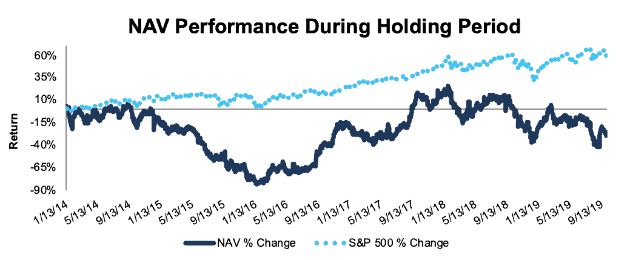

Navistar International (NAV) – Closing Short Position – down 30% vs. S&P up 59%

Navistar International (NAV: $27/share) was originally selected as a Danger Zone Idea on 1/13/14. At the time of the initial report, the stock received an Unattractive rating. Our short thesis pointed out the firm’s declining market share, accounting red flags, and expensive valuation.

During the nearly 6-year holding period, NAV outperformed as a short position, declining 30% compared to a 59% gain for the S&P 500.

Since our original report, NAV has bounced around, falling as low as $6/share in early 2016 and rising as high as $47/share in early 2018. Recently, the company’s fundamentals have shown signs of improvement, and its return on invested capital (ROIC) has continued to improve (from 6% in 2016 to 17% TTM). NAV has grown revenue year-over-year in each of the past two years, and its improved profitability, combined with its cheaper valuation, means the stock no longer presents the same risk/reward. We believe it is time to take the gains and close this short position.

Figure 1: NAV vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on October 3, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.