Investors should focus on the core, recurring operating profitability of the business when valuing stocks. Otherwise, they risk getting fooled by one-time, non-operating expenses or income that artificially and temporarily distort reported earnings. Often, one-time items are easy to find because they are clearly labeled as such on income statements. However, many times they are not easy to find because they are hidden inside normal, operating line items like “Cost of sales” on income statements. The only way to find these hidden one-time items is to scour the Management Discussion & Analysis (MD&A) and the Financial Footnotes in 10-K filings.

Most investors will be surprised to learn that we found over 13,000 one-time items buried in normal line items in the MD&A and Footnotes of 10-K filings from 1998 thru 2/15/2011. And don’t think for a second that these one-time items are not material. During the last reported fiscal year, companies concealed over $41 billion in one-time items.

This research proves that there is no substitute to analyzing the MD&A and Financial Footnotes of 10-K filings if investors want to know the true profitability and value of a company.

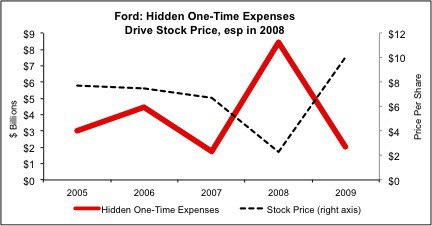

Some companies have concealed more than others. For example, since 2005, Ford has buried at least $1.7 billion annually of one-time charges within operating line items on its income statement. In 2008 alone, the company buried over $8.5 billion of one-time charges in line items like “Cost of sales”. These charges cause Ford’s reported earnings to understate, meaningfully, F’s normal operating profitability, and slam F’s stock to multi-year lows. Figure 1 suggests that investors placed too much importance on the $8.5 billion in one-time charges that sank Ford’s earnings in 2008 as the company’s stock price sank to a little over $2 per share. In the following years, once investors realized the normal profitability of the business was much better than indicated by 2008 GAAP earnings, the stock soared back to over $15 per share. Case studies in our free report on Hidden Items (request access to this report via research@newconstructs.com) show how to find and rectify these accounting distortions.

Figure 1: F – Hidden One-Time Charges vs Stock Price Over Time

The problem is that official (GAAP) accounting rules allow companies to obfuscate their true operating earnings. For example, SFAS 144 states that companies that impair long-lived assets that are still used in the business must include the impairment charge above both the “income from continuing operations” line and the “income from operations” line on the income statement. This broad rule enables companies to hide long-lived asset impairments in operating earnings.

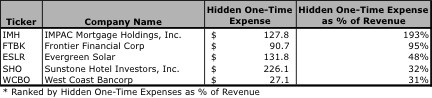

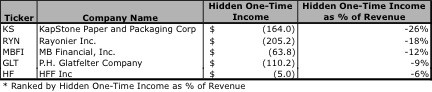

And companies do take advantage of SFAS 144 and other similar accounting loopholes. Figures 2 and 3 show lists of the companies with among the most hidden expenses and income in the last fiscal year (note: data in this article is updated as of 2/16/2011 and does not reflect new 10-K filings since then). For a list of the top 50 offenders in each category, buy our Premium report (request access to this report via research@newconstructs.com).

Figure 2: Samples of Big Hidden Expenses

Figure 3: Samples of Big Hidden Income

The key take-away is that investors should focus on the core, recurring operating profitability of the business when valuing stocks. Otherwise, they risk getting fooled by hidden expenses or gains that artificially decrease or increase reported earnings.

We understand this advice is not easy to follow. One-time items are hard to find. Companies often only report one-time items in the MD&A and/or the Financial Footnotes. One has to read carefully the MD&A and Financial Footnotes of every annual report in order to find the one-time items. Sorry, there is simply no way around it, which is why we built our proprietary research platform. This platform enables us to unearth key data and make smarter investment decisions by plumbing the depths of over 50,000 annual reports. In our experience analyzing the MD&A and Financial Footnotes of over 50,000 filings, we found that companies use a multitude of different names for one-time items within operating line items.

Below is a list of common names for one-time items concealed within operating line items.

- Long-lived asset impairments

- Non-recurring write-down of inventory

- Gain on sale of assets

- Loss on sale of assets

- Buy the premium report for names of more hidden items.

The point above and the case studies in our free report provide further evidence that there are no shortcuts to analyzing the MD&A and Financial Footnotes of 10-K filings if investors want to know the true profitability of a company. Per our article, “XBRL: Digital Needles In the Digital Haystack”, XBRL does not address many of the intricacies of how companies report information in the MD&A and Financial Footnotes.

In addition to our previously released Red Flag Reports on hidden debt from off-balance sheet operating leases and management failures related to asset write-downs, be on the lookout for more Red Flag Reports from New Constructs. Future reports will focus on the following accounting distortions:

- Over/Under – Funded Pensions

- Reserves

- Discontinued Operations

- Excess Cash

- Unconsolidated Subsidiaries

- Accumulated Other Comprehensive Income

See our Corporate Disclosure Transgressions (request access to this report via research@newconstructs.com) report that we submitted to the SEC and the Senate Banking Committee for more examples of Red Flags.

4 replies to "Red Flag Report: Hidden Expenses/Income: What You Don’t Know Can Cost You"

[…] is also used as on of the Case Studies in our latest Red Flag research: “Hidden One-Time Items Distort Earnings”. For example, since 2005, Ford has buried at least $1.7 billion annually of one-time […]

[…] $15 per share. To see our case study on how to find and compensate for hidden items for Ford, click here. Source: New Constructs, LLC. and company filings. Data as of […]

[…] For more details on how accounting earnings are misleading, see “What You Don’t Know About a Company’s Earnings Can Cost You”. […]

[…] financial data in the footnotes, Agenda magazine features New Construct’s research on Hidden Items to alert directors, especially those on audit committees, of the dangers of earnings […]