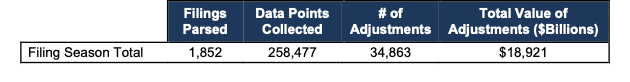

During the Real Earnings Season (February 14 – March 10), our Robo-Analyst[1] analyzed 1,852 10-K and 10-Q filings and collected 258,477 data points. This data led to 34,862 Core Earnings, balance sheet, and valuation adjustments with a combined dollar value of $18.9 trillion. The adjustments were applied as follows:

- 14,161 income statement adjustments with a total value of $1.2 trillion

- 13,798 balance sheet adjustments with a total value of $8.1 trillion

- 6,904 valuation adjustments with a total value of $9.6 trillion

Figure 1: Filing Season 2023 in Numbers

Sources: New Constructs, LLC and company filings.

This Filing Season Finds report highlights some of the most interesting footnote disclosures from 2023 Filing Season. See all other Filing Season highlights here.

- How non-operating items make Black Knight (BKI) look more profitable than it is and

- material disclosures in the 10-Ks of Exxon Mobil (XOM)

- 19 companies that report material weaknesses in internal controls and more.

Filing Season Finds reports are now available only to Pro and Institutional members. Since 2005, we’ve reported how traditional earnings measures are unreliable due to accounting loopholes that allow companies to manage earnings. Our Core Earnings[2] excludes unusual gains and losses to provide a more reliable earnings measure shown to provide a new source of alpha.