Our Stock Pick of the Week Is…

The best stock picks have to meet certain criteria. The company must have strong fundamentals like rising profits and return on invested capital (ROIC). The company must also have a catalyst to continue growing. No one wants to buy a company that won’t grow into the future. Lastly, the best stocks are undervalued by the market. As we continue to analyze 2014 10-Ks we’re finding out just how over and undervalued companies are. In doing so, we’ve identified a company this week that meets the three criteria above. This company operates as a REIT, but doesn’t necessarily face the same issues many fear within this industry. This week’s stock pick of the week is Post Properties Inc. (PPS).

What is Post Properties?

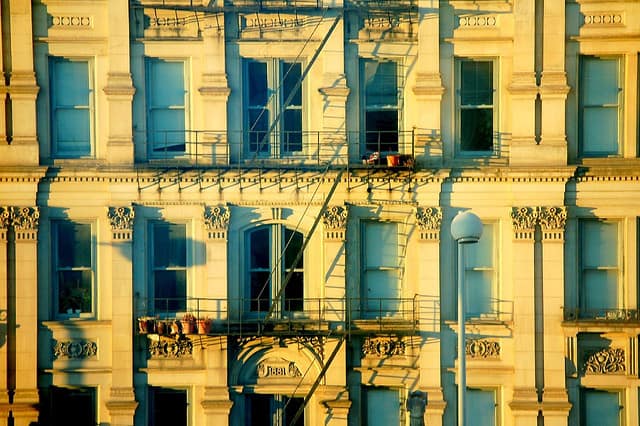

Post Properties, founded in 1971, owns and manages upscale multi-family apartment communities in a few markets around the United States. Post not only purchases apartment complexes but also oversees the construction and maintenance of new buildings, and manages the leasing and property management duties of each complex. The company is largely spread across four main areas, with the 29% of operations occurring in Atlanta, Georgia and 22% in Dallas, Texas.

Why Look at Post Today?

Post is operating at levels of profitability not seen in the past 16 years. In 2014, Post earned an after-tax operating profit (NOPAT) of almost $302 million, its highest ever in our model. Total revenues grew 4% year over year and the company’s NOPAT was up 80% over 2013’s profits. Profit growth over the long-term is just as impressive as NOPAT has grown by 5% compounded annually over the past decade and astounding 41% compounded annually since 2009. As renting has become more popular than owning, Post has positioned itself to benefit from this trend.

On top of growing its profits, Post is becoming increasingly more efficient with its core business. The company’s 2014 ROIC of 14% is the highest of the last 16 years, and is up from its ROIC of 2% only five years ago.

But Aren’t REITs Dangerous?

The big worry within the REIT sector concerns the probability of rising interest rates. This fear is focused more on the mortgage REIT side where companies make money off of interest rate spreads when purchasing mortgages. However, Post Properties is much different. Because Post actually buys, develops, and manages the real estate it holds, it derives its income from rental revenues, not from loan products. Rather than fearing interest rate hikes, Post Properties is more dependent on a strong economy, job creation, and consumers forgoing buying a home and choosing to rent. As the “millennial generation” continues to choose renting over buying, Post Properties, with its strategic locations, is poised to continue growing rental revenues.

These Adjustments Reveal Post’s Operating Profitability and Valuation

We make several key adjustments to the earnings and balance sheets of companies to uncover the recurring cash flows of each company’s core business and the value left for shareholders. We made the following major adjustments to Post’s earnings in 2014:

- Removed $63 million reported non-operating expenses included in operating earnings

- Removed $27 million in reported after-tax non-operating expenses included in operating earnings

The removal of these non-recurring items led Post’s 2014 NOPAT to be 43% higher than its reported net income. When considering Post’s valuation, we also add $11 million in off-balance sheet debt due to operating leases (1% of total debt) to Post’s total debt, bringing the company’s total debt to $938 million, or 38% of its market capitalization.

Post is a Deal at This Price

After removing the non-operating expenses highlighted above, we see that Post’s 2014 NOPAT was even more impressive than its GAAP net income. While net income increased by over 50% year over year, NOPAT was up 80% year over year.

Because of this understated profitability, Post is currently very undervalued. At its price of ~$56/share, Post has a price to economic book value (PEBV) ratio of just 0.7. This ratio implies that the market expects Post’s profits to permanently decline by 30%. This seems extremely pessimistic when considering Post has grown NOPAT by 40% compounded annually as of late. Such low expectations, coupled with the strong fundamentals above lead to Post receiving our Very Attractive rating.

If Post can grow NOPAT by just 3% compounded annually for the next 7 years, the company is worth $103/share — an 84% upside from current levels.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Jaybird (Flickr)

5 replies to "Renting Your Way to Growth with This Company"

$302 million NOPAT on $378 million Revenue seems too good to be true. $215 million in Net Income even sounds unreasonable. I haven’t read the 10-k, but I’m a little skeptical about this one

Would you send us a response to Bobby Cremin’s skeptical comments?

Arnold Braswell

Bobby,

Thanks for commenting. Post’s income in 2014 was boosted by a few major items.

First is the $188 million gain on the sale of real estate assets. This item is included in net income, which is part of the reason that Post’s net income this year is so high. We also include this gain on real estate sale in Post’s NOPAT, as it is an REIT.

Second is the ~$58 million that Post spent servicing its debt through interest payments and debt extinguishment. We remove these expenses as they are non-operating NOPAT is an unlevered measure of profit. These items, when removed, raise Post’s NOPAT even higher than its already high net income.

While Post’s almost 80% NOPAT margin in 2014 is certainly on the high side, the company has posted NOPAT margins of over 60% three other times since 2004. Those years, Post also recorded significant gains from the sale of its real estate assets.

In summary, while these kinds of margins are high for Post, they are by no means out of the ordinary.

Best,

André Rouillard, Investment Analyst

Thanks so much for the explanation on the adjustments to NOPAT Andre. I see how these kinds of margins can happen from time to time with real estate sales.

Do you ever “normalize” NOPAT in your analysis for situations like this? It seems with companies that have asset sales and other periodic “income” that it would make more sense so that margins, ROIC, yield and pretty much all the measures you use for business strength and value aren’t skewed by occasional blips like this.

The analysis “If Post can grow NOPAT by just 3% compounded annually for the next 7 years, the company is worth $103/share — an 84% upside from current levels.” seems a little oversimplified and dangerous since it is likely the margins and NOPAT are unsustainable at this level over a 7 year period.

Bobby, we do remove “blips” like this for almost every other company — the fact that Post is an REIT though led us to include this property sale in its NOPAT, as the company is in the business of buying, managing, and selling property.

You’re certainly right that we probably should have included some additional discussion on that example from our model you mentioned. In cases like these, our technical tools have a bit less ability to add value to our discussion.

Look at it this way: Even if we hadn’t included that income in Post’s NOPAT and its NOPAT was $187 million lower, the company still used that cash to pay down ~$200 million in debt. This lower debt raises Post’s economic book value in our model by roughly that same $200 million, so Post’s economic book value per share would be only slightly lower at around $80. Note that PPS’s current price is $57/share, so even without this extra income, Post is trading at a steep discount to its economic book value per share.