We closed this Long Idea on May 7, 2025. A copy of the associated Position Close report is here.

Political confrontations, tariffs, earnings releases, concerning GDP predictions, possibility of an inverted yield… we are in a volatile time to say the least. But, one question, no matter the news, always persists – how do you find good stocks right now?

The answer is, surprisingly, simple. It doesn’t matter if we are in a recessionary or a booming market, you have to do your diligence. Saying it is easier than doing it, which is why our clients love us. We do the best fundamental diligence in the world – as proven by Harvard Business School, MIT Sloan, and Ernst & Young – to help you make smarter investment decisions.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- consistent revenue and profit growth,

- domestic and international sales growth,

- rising market share,

- high customer satisfaction, and

- cheap stock valuation.

Quality Fundamentals

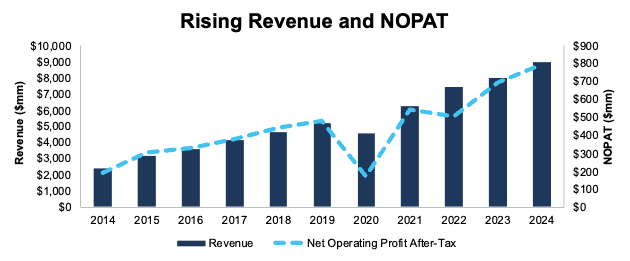

This company has grown revenue by 14% and net operating profit after-tax (NOPAT) by 15% compounded annually since 2014. See Figure 1.

The company improved its NOPAT margin from 8.1% in 2014 to 8.9% in 2024 while invested capital turns increased from 1.4 to 1.6 over the same time. Rising operational and capital efficiency drive return on invested capital (ROIC) from 11% in 2014 to 14% in 2024.

Additionally, the company’s Core Earnings rose 17% compounded annually from $141 million in 2014 to $654 million in 2024.

Figure 1: Revenue and NOPAT Since 2014

Sources: New Constructs, LLC and company filings

Strong Balance Sheet and Credit Rating to Weather Uncertainty

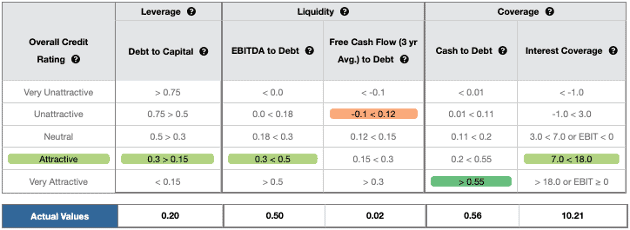

Per Figure 4, this company earns an Attractive overall Credit Rating and scores an Attractive-or-better rating in four of the five credit rating metrics.

Even if economic conditions deteriorate or tariffs hurt U.S. businesses more than expected, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 4: Credit Rating Details

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.