Broadband HOLDRS (BDH) is our top pick for telecom sector ETFs. We also rate the investment merit of the top-3 telecom sector ETFs.

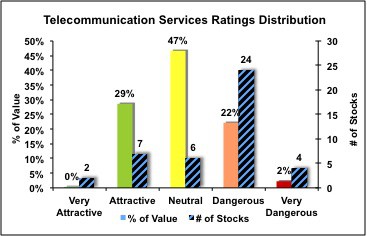

Per our first-quarter-2011 review of U.S. Equity Sector ETFs, the telecom sector is one of five sectors that gets our “neutral” rating. Figure 2 shows how the telecom sector’s stocks and the market value attributed to them stack up under the microscope of our stock rating system. The telecom sector has only 9 stocks that we rate attractive-or-better. And the sector only has 30 stocks that we rank dangerous-or-worse. Some good stocks in the telecom sector to buy individually or as part of an ETF are Vonage (VG) and Verizon (VZ). Some stocks to avoid, sell or short in the telelcom sector are Frontier Communications Corp (FTR) and MetroPCS Communications (PCS).

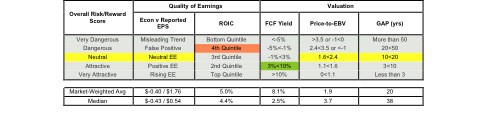

Figure 1: Telecom Sector – Capital Allocation & Holdings by Risk/Reward Rating

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

The telecom sector has 24% of its value in dangerous-or-worse-rated stocks compared to 29% of its value in attractive-or-better-rated stocks. Nearly half of the sector’s stocks get our “neutral” rating, which causes the telecom sector to earn our neutral overall risk/reward rating.

The key takeaway here is that the telecom sector offers both good and poor investment opportunities. The investment value of each ETF is derived from its constituents, so ETFs that overweight attractive-or-better-rated stocks, like BDH, are great investment opportunities while ETFs that overweight neutral-or-worse-rated stocks should be avoided.

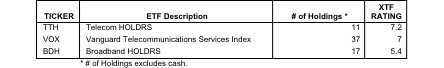

When analyzing the telecom sector ETFs, we started by identifying those ETFs with acceptable structural integrity as measured by XTF, an ETF research firm. We chose the 6 ETFs whose XTF rating was above the sector average XTF rating.

Figure 2: Telecom ETFs With Acceptable Structural Integrity

Figure 2 shows clearly that not all telecom ETFs are made the same. Different ETFs have meaningfully different numbers of holdings and, therefore, different allocations to holdings. Given the differences in holdings and allocations, these ETFs will likely perform quite differently.

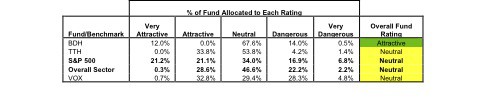

After determining the structural integrity, we analyzed the investment merit of each ETF based on how it allocated value to each stock it held. Figure 3 shows how the 6 telecom sector ETFs stack up versus each other and the overall sector based on their overall risk/reward ratings and the allocation of their holdings by rating.

Figure 3: Investment Merit Based on Holdings and Allocations

Attractive ETFs:

BDH earns an Attractive Overall Risk/Reward rating and therefore, is the only Telecom ETF we recommend.

Neutral ETFs:

TTH and VOX allocate the value of their fund in a way that earns them a Neutral Overall Risk/Reward rating. We recommend investors buy the Very Attractive and Attractive stocks in this sector before buying any of the Telecom ETFs except BDH. Contact us for the full list of the 9 Telecom companies that earn an Attractive-or-better Overall Risk/Reward rating. Figure 3 contrasts the differences in investment merit between BDH, VOX, and the overall sector.

Dangerous ETFs:

This report does not include any Dangerous-or-worse-rated ETFs.

Benchmark Comparisons

Sector Benchmark

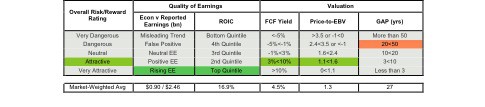

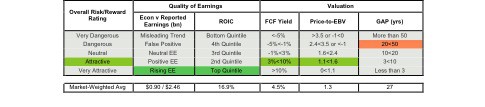

BDH outperforms the overall Telecom sector in quality-of-earnings ratings. BDH earns a Very Attractive Economic vs. Reported Earnings rating because its Economic Earnings are positive and rising. BDH has an ROIC of 16.9%, earning it a Very Attractive rating, compared to the sector’s Dangerous-rated ROIC of 5%.

The Telecom sector outperforms BDH in valuation ratings. The sector has a FCF Yield of 8.1%, earning it an Attractive rating, and a GAP of 20 years compared to BDH’s FCF Yield of 4.5% and GAP of 27 years.

Figure 4: BDH – Risk/Reward Rating

Figure 5: Telecom Sector – Risk/Reward Rating

BDH more effectively allocates capital than the overall Telecom sector. Per Figure 3 above, BDH allocates 12% of its value to Very Attractive-rated stocks while the sector only allocates 0.3%. BDH also only allocates 0.5% of its value toward Very Dangerous-rated stocks compared to the sector’s Very Dangerous weighting of 2.2%.

For explanation and details behind our risk/reward rating system, see one of our Company Valuation reports, which are available for free here.

Market Benchmark

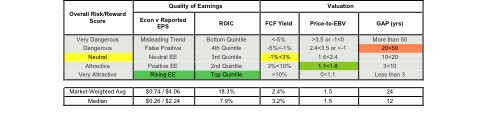

BDH and the S&P 500 have comparable quality-of-earnings rating. BDH and the S&P 500 both earn Very Attractive ratings for Economic vs. Reported Earnings and ROIC.

BDH and the S&P 500 also have comparable valuation ratings. BDH and the S&P have the same Price-to-EBV and GAP rating but BDH’s FCF Yield of 4.5% earns it an Attractive rating compared to the S&P 500’s Neutral-rated FCF Yield of 2.4%.

Figure 6: BDH – Risk/Reward Rating

Figure 7: S&P 500 – Risk/Reward Rating

BDH more effectively allocates capital than the S&P 500. Per Figure 3 above, it may appear that the S&P does a better job of allocating capital since it allocates 42.3% of its value to Attractive-or-better-rated stocks compared to BDH’s 12% weighting. However, BDH’s 12% is allocated to companies with substantially more attractive investment opportunities. BDH also only allocates 14.5% of its value to Dangerous-or-worse-rated stocks while the S&P 500 allocates 23.7%.

Methodology

This report offers recommendations on Telecom sector ETFs and benchmarks for (1) investors considering buying Telecom sector ETFs and for (2) comparing individual ETFs to the Telecom sector and the S&P 500. Our analysis is based on aggregating results from our models on each of the companies included in every ETF and the overall sector (43 companies) based on data as of April 20th, 2011. We aggregate results for the ETFs in the same way the ETFs are designed. Our goal is to empower investors to analyze ETFs in the same way they analyze individual stocks.

To make an informed ETF investment, investors must consider:

1) The structural integrity of the ETF and its ability to fulfill its stated objective. We use XTF, an ETF research firm, to find the top 3 ETFs with the best structural integrity rating.

2) The quality of the ETF’s holdings. We determine and ETF’s quality using our overall risk/reward rating system.

Given the success of our Rating system for individual stocks, we believe its application to groups of stocks (i.e. ETFs and funds) helps investors make more informed ETF and mutual fund buying decisions. Barron’s regularly features our unique ETF research. The first article is “The Danger Within”.

2 replies to "Some Good In Telecom Sector ETFs"

[…] Some Good In Telecom Sector ETFs – Hidden Gems and Red Flags in … Tweet This […]

[…] Go here to see the original: Some Good In Telecom Sector ETFs – Hidden Gems and Red Flags in … […]