From Underdog to Contender

From Underdog to Contender

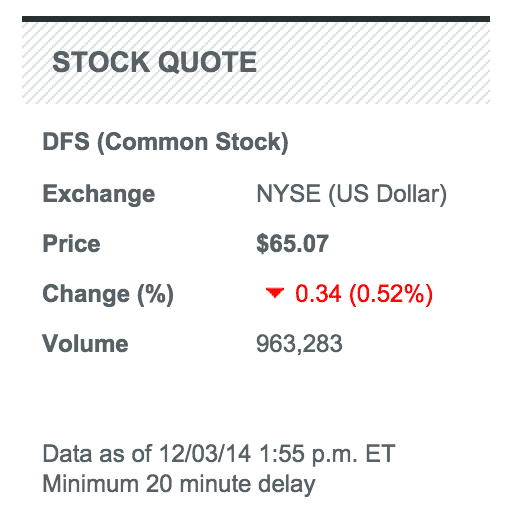

When it comes to credit card companies, Discover Financial Services (DFS: $65/share) is the new kid on the block.

First issued by Sears in 1985, the Discover Card has quietly risen to become one of the most popular credit cards in the United States, with over 50 million cards in circulation. Discover Financial is now a fully-fledged financial services company, offering banking and loan services in addition to its credit cards.

Discover Financial Services Looks Good on Paper

Since going public in 2007, Discover Financial Services (DFS) has been hitting all of the right notes. While 2007 was hardly the perfect time to dive into the financial services industry, Discover has increased its after-tax profit (NOPAT) from $953 million in 2007 to $2.4 billion in 2013 at a rate of 16% compounded annually.

Discover’s (DFS) return on invested capital (ROIC) has increased from 14% in 2007 to 19% last year. Discover’s current ROIC is in line with those of the most profitable consumer finance companies we cover, behind only American Express’ (AXP) 21% and Visa’s (V) 23%. Discover also generates outstanding free cash flow, with over $1.4 billion in cash generated in 2013.

…And in the Real World

Part of Discover Financial Service’s success is due to its outstanding customer service (just like American Express). This year, Discover ranked first in J.D. Power’s customer satisfaction survey for credit card companies, tied with American Express. It is Discover’s outstanding customer service that has allowed it to take market share from competitors and more than double its credit card loan receivables from $22 billion in 2007 to $54 billion in the most recent quarter.

One of Discover’s biggest drawbacks used to be the limited number of locations accepting its cards. However, it was announced in August of this year that the number of merchants accepting Discover was up 24% over 2009. Other data indicates that Discover is now accepted at over 90% of locations that accept MasterCard and Visa.

2015 Poised to be a Big Year

The near future looks bright for Discover for two reasons:

- The increasing possibility of rising interest rates means increased loan income

- Customer service recognition and increased acceptance will continue to drive strong credit card growth

The Reason DFS is the Best Credit Card Company for Your Portfolio

Despite the several parallels we have drawn with American Express, Discover is actually the best credit card stock — and one of the best companies — for your portfolio. The reason? Discover’s attractive valuation.

At its current price of ~$65/share, Discover has a price to economic book value (PEBV) ratio of just 1.2. This ratio implies that the market expects Discover’s NOPAT to grow by only 20% for the remaining life of the company. This expectation seems rather low given that Discover has nearly grown at that rate annually since 2007. For perspective, the similarly profitable American Express has a PEBV of over 1.6 and Visa has a PEBV of 2.2.

Discover has slowly taken market share from its competition while simultaneously expanding into the consumer banking business. It has consistently beat Wall Street’s revenue growth estimates for the past two years.

If we assume that Discover can grow NOPAT by just 6% for the next 13 years, far below its historic level of 16%, the stock is worth $80/share, a 23% upside. We expect the market to raise its expectations in line with this scenario as it becomes more and more apparent that Discover is beating its competition both on the income statement and in consumer’s wallets.

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.