This week’ stock pick comes from an industry we’ve long been fans of: insurance. Insurance can not only be purchased on almost any item of value, but it also provides great value to consumers in the event of an unexpected disaster. Due to the continuous demand for insurance products, we want to find the best of the best in this industry when it comes to profitability, and The Chubb Corporation (CB) is one of the best. For this reason, CB makes our Most Attractive stocks list for December.

Impressive Company History

The Chubb Corporation has a track record that few other insurance companies can best. As a property and casualty insurer, Chubb derives its income through the 1. policies it writes and 2. its investment income. Chubb has grown after-tax profit (NOPAT) by 6% compounded annually over the past five years.

In 3Q14 alone, the company grew total revenues by 5%, personal insurance premiums by 6%, commercial insurance premiums by 4%, and specialty insurance premiums by 5% over 3Q13. Chubb is continuing to build on its revenue growth over the last five years.

While continually growing revenues and profits, Chubb has become more efficient in using the money being spent in the business. In 2013, Chubb’s return on invested capital (ROIC) was 16%, up from 11% in 2011. High ROIC companies yield high investment returns and Chubb increasing its ROIC is a great sign for investors. Over the past four years alone, Chubb has generated nearly $7 billion in free cash flow (FCF).

Quality Management Team Looking Ahead

Chubb’s management has also been very shareholder friendly and has increased its dividend every year since 1987. In January of 2014, the company authorized a $1.5 billion share repurchase program. At the end of 3Q14, the company had repurchased over $1.2 billion. When management is repurchasing stock it can be a sign that they agree the company is undervalued.

Another positive for the company, aside from providing a product with constant demand, is the potential for greater investment returns going forward. In the case of rising interest rates, Chubb will likely benefit from the increased yield of its bond investments.

Potential for Problems

As with any insurer, it must be noted that any unexpected natural disaster could greatly affect revenue and profit growth. Chubb has navigated the insurance landscape for many years, and we feel confident that in the event of any disaster, Chubb is well positioned to handle the shock.

Unrealized Potential

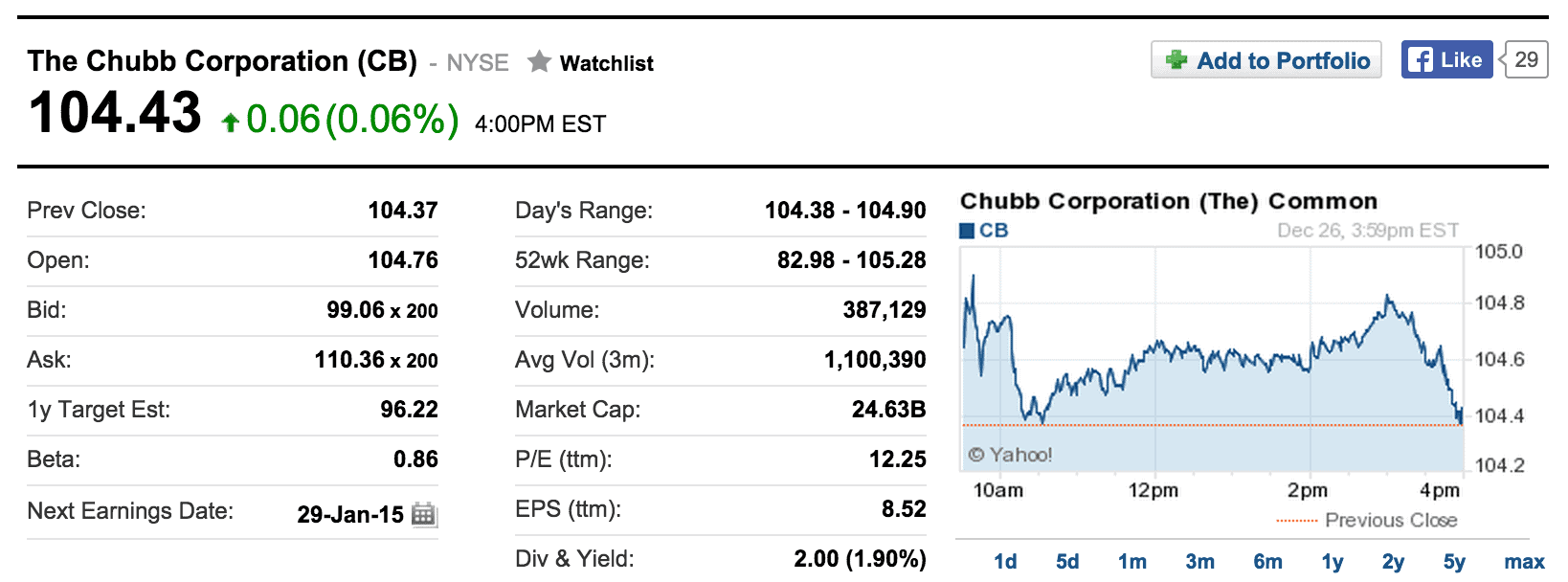

Even though Chubb’s stock price is up over 20% since its February lows this year, the market is just beginning to recognize the true value of this company. At its current price of ~$103/share, CB has a price to economic book value (PEBV) ratio of 0.8. This ratio implies the market expects Chubb’s NOPAT to permanently decline by 20%. Based on everything we’ve touched on above, this expectation is beyond pessimistic for Chubb.

If we give Chubb credit for only 2% NOPAT growth (less than half its five year average) for the next 10 years, the stock is worth $138/share today –– a 34% upside. Even in a situation that assumes growth below what Chubb is currently achieving, the company has significant upside. It only gets better if Chubb can grow NOPAT at current rates.

If Chubb can grow NOPAT by 5% compounded annually for the next 10 years, the stock is worth $158/share today –– a 53% upside. Strong fundamentals, an attractive industry, and a depressed valuation make Chubb Corporation our stock pick of the week.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.