This report shows how well style ETFs and mutual fund managers pick stocks. We juxtapose our portfolio management rating on funds, which grades managers based on the quality of the stocks they choose, with the number of good stocks available in the style. This analysis shows whether or not ETF providers and mutual fund managers deserve their fees.

For example, if a fund has a poor portfolio management rating, that fund does not deserve the fees it charges and investors are much better off putting money in a passively-managed fund or investing directly in good stocks. On the other hand, if a fund has a good portfolio management rating, then investors should put money in that fund, assuming the fund’s costs are competitive.

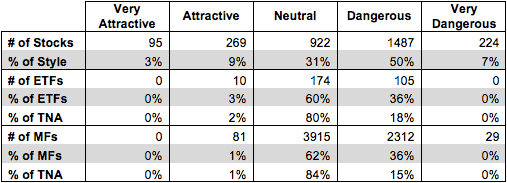

Figure 1 compares the number of good stocks to the number of good funds. 364 out of the 2997 stocks (over 27% of the market value) held in style ETFs and mutual funds get an Attractive-or-better rating.

Only 3% (10 out of 289) of ETFs allocate enough to quality stocks to earn an Attractive-or-better portfolio management rating. Mutual fund managers have not fared any better. Only 1% (81 out of 6337) of mutual funds allocate enough of their assets to quality stocks to earn an Attractive-or better portfolio management rating. ETF providers and mutual fund managers need to do a better job to justify their fees.

Figure 1: Comparing Quality of Stock Picking to Quality of Stocks Available

Sources: New Constructs, LLC and company filings

Arrow QVM Equity Factor ETF (QVM) has the highest portfolio management rating of all style ETFs and earns our Attractive portfolio management rating. Pear Tree Quality Fund (QGIAX) has the highest portfolio management rating of all style mutual funds and earns our Attractive portfolio management rating.

iShares Russell Microcap Index Fund ETF (IWC) has the lowest portfolio management rating of all style ETFs and earns our Dangerous portfolio management rating. Aston River Road Independent Value Fund (ARVIX) has the lowest portfolio management rating of all style mutual funds and earns our Very Dangerous portfolio management rating.

Oracle Corporation (ORCL) is one of our favorite stocks held by QGIAX and earns our Very Attractive rating. Over the last decade, Oracle has grown after tax profit (NOPAT) by 17% compounded annually. In addition, the company also earns a 29% return on invested capital (ROIC), placing Oracle in the top quintile of all companies we cover. Despite this consistent growth generated by Oracle, the stock remains undervalued. At its current price of ~$44/share, ORCL has a price to economic book value (PEBV) ratio of 1.3. This ratio implies that the market expects Oracle’s NOPAT to grow by only 30% over its remaining corporate life. This expectation seems extremely pessimistic considering the company has grown NOPAT by 17% a year for the last decade. Investors should look into this fundamentally strong company while it remains undervalued.

Gramercy Property Trust, Inc. (GPT) is one of our least favorite holdings of IWC and earns our Very Dangerous rating. Since 2008, Gramercy’s NOPAT has declined by 91% compounded annually. In the same time span, the company’s ROIC has dropped sharply, from 8% to its current 1%, ranking in the bottom quintile of all companies we cover. Gramercy has been unable to achieve neither positive economic earnings nor positive free cash flow in the past three years. The company remains overvalued, however, despite its eroding foundation. To justify its current price of ~$25/share, Gramercy would need to grow NOPAT by 17% compounded annually for the next 27 years. The chance that Gramercy will be able to generate profits at such levels for 27 years is highly unlikely given its past struggles.

Our Style Ratings for ETFs & Mutual Funds reveal our predictive ratings on the best and worst funds in each style.

Disclosure: David Trainer owns ORCL. David Trainer and Max Lee receive no compensation to write about any specific stock, style, or theme.

Photo Credit: Nathan McCoy (Flickr)