This report shows how well Utilities ETFs and mutual fund managers pick stocks. We juxtapose our Portfolio Management Rating on funds, which grades managers based on the quality of the stocks they choose, with the number of good stocks available in the sector. This analysis shows whether or not ETF providers and mutual fund managers deserve their fees.

For example, if a fund has a poor Portfolio Management Rating in a sector where there are lots of good stocks, that fund does not deserve the fees it charges, and investors are much better off putting money in a passively-managed fund or investing directly in the sector’s good stocks. On the other hand, if a fund has a good Portfolio Management Rating in a sector where there are lots of bad stocks, then investors should put money in that fund, assuming the fund’s costs are competitive.

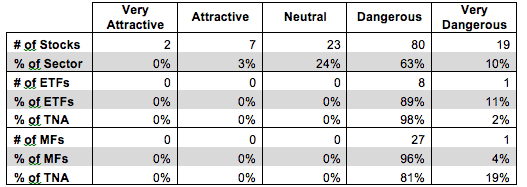

Figure 1 shows how many good stocks, according to our nationally-recognized ratings, are in the sector and their market cap. Next, it juxtaposes the Portfolio Management Ratings of the ETFs and mutual funds in the sector. We think investors can gain an advantage with our forward-looking fund ratings since past performance is not a reliable predictor of future returns.

Figure 1 shows that 9 out of the 131 stocks (only 3% of the market value) in Utilities ETFs and mutual funds get an Attractive-or-better rating.

The main takeaway from Figure 1 is that with so few quality stocks in the Utilities sector, the best one could hope for is that ETF providers and mutual fund mangers would at least allocate heavily to Neutral-rated stocks. Unfortunately, that is not the case.

Zero out of nine ETFs allocate enough to quality stocks to earn an Attractive-or-better Portfolio Management Rating. Mutual Fund managers have not fared much better. Zero out of 28 mutual funds allocate enough of their assets to quality stocks to earn an Attractive-or better Portfolio Management Rating. No ETF provider or mutual fund manger even earns a Neutral Portfolio Management rating. ETF providers and mutual fund managers need to do a better job to justify their fees.

With no quality funds available, 98% of investor assets in Utilities ETFs are invested in ETFs with Dangerous Portfolio Management Ratings. Investors are forced to allocate to the worst ETFs in the sector. The picture is worse for mutual fund investors as 19% of investor assets are allocated to mutual funds with Very Dangerous Portfolio Management Ratings.

Investors in this sector would be better served buying a basket of Attractive-or-better rated stocks rather than paying fees to funds with poor holdings.

Figure 1: Utilities Sector: Comparing Quality of Stock Picking to Quality of Stocks Available

Sources: New Constructs, LLC and company filings

ProShares Ultra Utilities ETF (UPW) has the highest Portfolio Management Rating of all Utilities ETFs and earns my Dangerous Portfolio Management Rating. American Century Quantitative Equity Utilities Fund (BULIX) has the highest Portfolio Management Rating of all Utilities mutual funds and earns my Dangerous Portfolio Management Rating.

First Trust Utilities AlphaDEX Fund ETF (FXU) has the lowest Portfolio Management Rating of all Utilities ETFs and earns my Very Dangerous Portfolio Management Rating. Hennessy Gas Utility Index Fund (GASFX) has the lowest Portfolio Management Rating of all Utilities mutual funds and earns my Very Dangerous Portfolio Management Rating.

Consolidated Edison (ED) is one of my favorite stocks held by Utilities ETFs and mutual funds and earns my Attractive rating. Over the last decade, Consolidated Edison has grown after tax profit (NOPAT) by 9% compounded annually. The company earned a return on invested capital (ROIC) of 5% in 2013, above the 4% average of the 79 Utilities companies I cover. Despite the consistent long-term profit growth generated by Consolidated Edison, the stock is undervalued. At its current price of ~$61/share, ED has a price to economic book value (PEBV) ratio of 0.9. This ratio implies the market expects Consolidated Edison’s NOPAT to permanently decline 10% over the life of the company. This expectation seems counterintuitive to the track record of Con Ed. Investors should capitalize on the opportunity to buy such a consistently profitable company while it remains undervalued.

Northwest Natural Gas Company (NWN) is one of my least favorite stocks held by Utilities ETFs and mutual funds and earns my Very Dangerous rating. Over the past seven years, Northwest’s NOPAT has declined by 1% compounded annually. Its ROIC has steadily declined every year since 2007 to a bottom-quintile 3% in 2013, below the average of all Utilities companies I cover. Northwest has also not generated positive economic earnings in any of the past 16 years. Despite this decline in profitability, NWN is valued as if it were a steadily growing company. To justify its current valuation of ~$44/share, Northwest must grow NOPAT by 5% compounded annually for the next 21 years. This expectation may not seem like much for most companies, but remember this is a utility company, and one with long-term declining profits. The market’s expectations do not coincide with the Northwest’s slow-growth reality.

Many ETF providers and mutual fund managers do a poor job identifying quality stocks. Their funds allocate heavily to overvalued stocks like Northwest Natural Gas and don’t hold high quality stocks such as Consolidated Edison. These funds are not worth owning at any cost.

The emphasis that traditional research places on low costs is a positive for investors, but low fees alone do not drive performance. Only good holdings can. Don’t fall prey to the index label myths. Even “passive” investors should be analyzing the holdings of their funds.

Our Best & Worst ETFs and Mutual Funds for the Utilities Sector report reveals our predictive ratings on the best and worst funds in the sector.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.