Earnings season is in full swing – with earnings from some of the biggest companies in the market this week. During this time, stocks can move in ways unrelated to the economics of the business, as emotion and algorithms get the best of traders and investors alike.

For discerning investors, this time can present opportunity. See a stock that soars on lackluster results? Perhaps, it could be time to take some gains.

See a stock that plummets while the strength of the business remains in tact? Perhaps, there’s a good entry point to invest in a strong business at a discounted price.

We leverage our proven-superior fundamental data to identify which stocks are being unfairly punished, or overly hyped by the market. Only by understanding the true cash flows of a business can investors know if a company’s stock price is justified.

This week’s Long Idea presents the perfect case study in irrational stock price movement. This stock is down ~7% over the past ~10 days, a drop that comes on the heels of the company missing consensus estimates when it reported earnings in late September. However, after parsing its latest 10-K, we see profits are as strong as ever and the company continues its streak of multi-decade profit growth. This unwarranted drop in share price could create a buying opportunity for those interested in paying less for a great business.

We believe this business, along with its strong corporate governance, deserves a premium stock valuation.

Our process for picking stocks is about as rigorous as it gets, and we’re proud to show our work. We’re not giving you the ticker for this pick, but we are happy to share large excerpts from the report.

The information below comes from the recent update on our thesis for this stock, available to Pro and Institutional members. And, you can buy the full report a la carte here.

This stock presents quality Risk/Reward based on the company’s:

- position to profit from consumers driving vehicles more and owning them longer,

- strong cash flows and history of industry-leading profit growth,

- quality corporate governance that ties executives’ interests with shareholders’ interests, and

- potential upside in the valuation of the stock.

What’s Working

Consumers Continue to Drive…

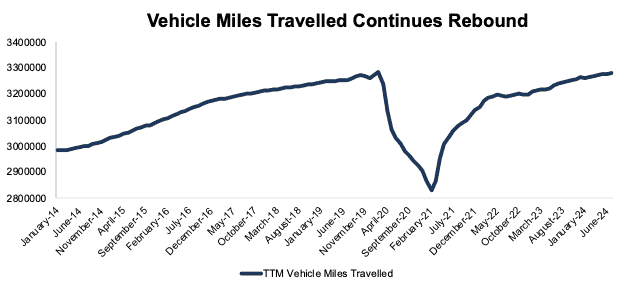

This company benefits from consumers driving their vehicles, and consumers are doing just that. Trailing twelve-month (TTM) vehicle miles travelled (VMT) reached 3.28 million in July 2024, which is up from 3.24 million and 3.19 million in July 2023 and July 2022 respectively. TTM VMT are now 16% above COVID-19 lows and are less than 1% below pre-COVID highs. See Figure 1.

The Federal Highway Administration projects light-duty VMT to grow by 0.4% per year through 2050.

Figure 1: U.S. Vehicle Miles Travelled: Jan 2014 – July 2024

Source: New Constructs, LLC & FRED.

…And Keep Their Vehicles Longer

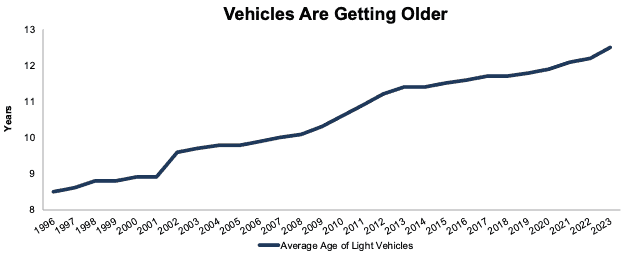

Consumers are not only driving more, but they’re also keeping their vehicles longer.

Per Figure 2, the average age of light vehicles on the road in the U.S. has increased from 8.5 years in 1996 to 12.5 years in 2023. This rising age of cars provides long-term demand that will continue to drive long-term growth in profits for this company.

Figure 2: Average Age of Light Vehicles in the U.S.: 1996 – 2023

Sources: New Constructs, LLC and Bureau of Transportation

Multi-Decade Track Record of Profit Growth

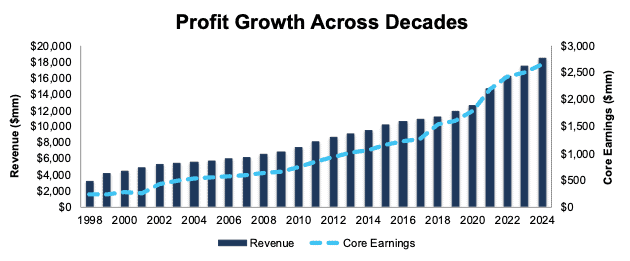

This company has proven the strength of its business model across multiple decades. The company has grown revenue year-over-year (YoY) in each of the past 26 years. The company has grown Core Earnings YoY in 25 of the past 26 years, with the only YoY decline coming back in 2001.

The company has grown revenue 7% compounded annually and Core Earnings 10% compounded annually over both the past decade and since 1998. See Figure 3.

The company has improved net operating profit after-tax (NOPAT) margin from 12.9% in 2014 to 16.9% in fiscal 2024 and ROIC from 24.7% to 26.5% over the same time.

Figure 3: Revenue and Core Earnings: Fiscal 1998 – Fiscal 2024

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.