INTC

Large Cap Blend Style

The Large Cap Blend style ranks first out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report.

David Trainer, Founder & CEO

Update: Intel Earnings

In my most recent article, I said that modest growth over the next 15 years makes Intel worth ~$41 share today, and this earnings report strengthens my belief in that fair value estimate.

David Trainer, Founder & CEO

Recovering PC Market Makes Intel Still A Buy

INTC is still a good stock for a value investor, but it’s not as great as it was eight months ago.

David Trainer, Founder & CEO

10 Wonderful Companies That Are Bad Stocks

Sometimes, a great company can actually be a risky stock when it gets significantly overvalued.

David Trainer, Founder & CEO

Cheap Funds Dupe Investors – 1Q2014

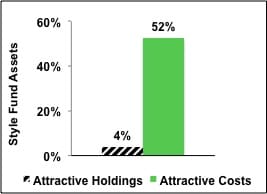

Investors are good at picking cheap funds. We want them to be better at picking funds with good stocks. Both are required to maximize success. 1Q14

David Trainer, Founder & CEO

Buy Intel and Profit From Market Fear

Almost every investor knows Warren Buffet’s famous advice, “Be fearful when others are greedy and greedy when others are fearful.” Now is the perfect time to get greedy with INTC.

David Trainer, Founder & CEO

Best & Worst ETFs and Mutual Funds: Large Cap Blend Style

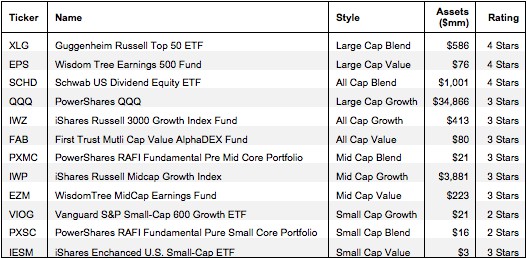

The Large Cap Blend style ranks first out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 33 ETFs and 908 mutual funds in the Large Cap Blend style as of October 17, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

David Trainer, Founder & CEO

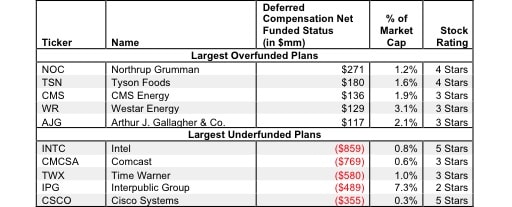

Deferred Compensation Assets and Liabilities – Valuation Adjustment

The net amount of deferred compensation is included in shareholder value. If a company has a net liability, future cash flows will be diverted to pay for that obligation. If a company has a net asset, then any future increases in the obligation will not need to be met with new contributions from the company. Instead, the company can return that cash to shareholders.

David Trainer, Founder & CEO

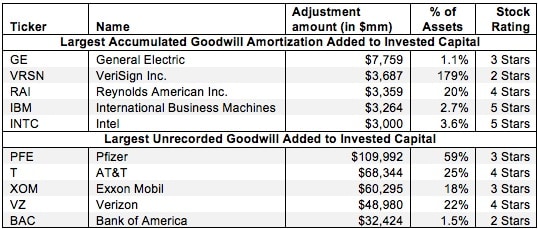

Accumulated Goodwill Amortization & Unrecorded Goodwill – NOPAT Adjustment

Understanding NOPAT Adjustments - Accumulated Goodwill Amortization and Unrecorded Goodwill

David Trainer, Founder & CEO

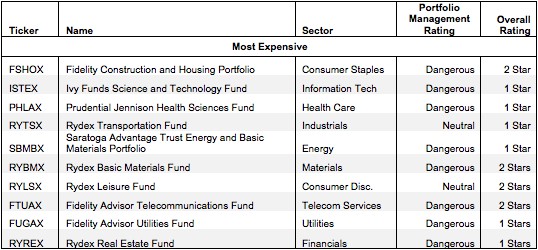

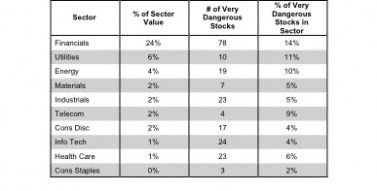

How To Avoid the Worst Sector Mutual Funds

Picking from the multitude of sector mutual funds is a daunting task. In any given sector there may be as many as 229 different mutual funds, and there are at least 631 mutual funds across all sectors.

David Trainer, Founder & CEO

How To Find the Best Style ETFs: May 2013

Finding the best ETFs is an increasingly difficult task in a world with so many to choose from. May 2013.

David Trainer, Founder & CEO

How To Find the Best Sector ETFs: March 2013

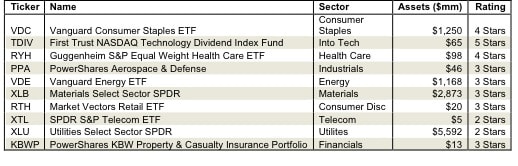

With so many ETFs out there, investors cannot simply look at ETF labels. They need in-depth research of the ETFs holdings and costs. New Constructs offers this kind of research.

David Trainer, Founder & CEO

Top Stock Picks: 2011 In Review

Everyone wants diligence. Few will ever turn it down. The problem is that diligence is expensive. New Constructs makes diligence cost-effective.

David Trainer, Founder & CEO

footnoted.org vs New Constructs = Hype vs Substance

When I ran across the recent article "270,033 pages later, a chance to catch our breath…", I could not help but admire footnoted.org's marketing moxy.

The article provides a count of the number of pages of 10-K filings that have poured in during the real earnings season. It also highlight a couple of the largest filings. At first glance, it is easy for one to assume that all of the 270,033 pages were also analyzed.

David Trainer, Founder & CEO

The Real Earnings Season Begins Now

Nearly all of the investing world ignores 10-K season. 10-Ks contain the most important financial information that companies provide all year.

David Trainer, Founder & CEO

Low Fund Fees Snare Investors

Investors are good at picking funds with low costs. They are not good at picking funds with good stocks. Both are required to maximize opportunity for success.

David Trainer, Founder & CEO

Sector Roadmap For Best and Worst Funds

For those investors interested in rigorous research, I offer my roadmap to the best stocks and funds in the market by sector. The full sector roadmap is here.

David Trainer, Founder & CEO

Buy Intel: A Stock For All Seasons

In an increasingly challenging market, Intel [s: INTC] is one of the safest investments with compelling upside potential. That’s right, investors get to have their cake and eat it too – at least for now.

David Trainer, Founder & CEO

ETFs vs Mutual Funds: The Winner Is…

The radically higher number of US equity mutual funds (4,700+) versus ETFs (380+) is not indicative of better stock selection from active management. On the contrary, the vast majority of actively-managed funds do not justify the higher fees they charge. They do not, in terms of stock selection and expected returns, add value versus passively managed benchmarks.

David Trainer, Founder & CEO