This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

We make two historical adjustments to a company’s invested capital related to goodwill. The first deals with unrecorded goodwill.

Goodwill arises when one company pays more than the market price for another company. Prior to 2002, the recognition of goodwill (as well as the fair value of the assets acquired) could be avoided using the “pooling of interests method” of accounting for acquisitions or mergers. Under this method, only the book value of the assets of the company acquired is added to the books of the acquiring firm. There is no accounting record of the actual purchase price paid, which often exceeded the market value. Any premium paid for the company over its market value was “unrecorded” along with the fair market value of the assets acquired.

Firms liked this pooling method because it helped them keep EPS higher by avoiding goodwill amortization expenses. ROEs were higher too as only the book value of assets acquired got added to balance sheets.

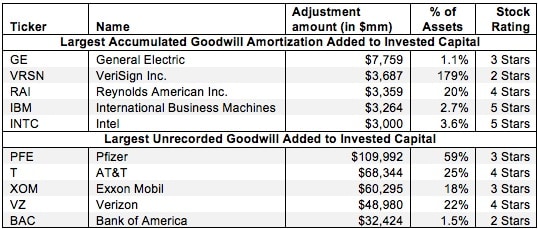

To reverse the discrepancy between the accounting for companies that used the pooling method instead of the purchase method of accounting, we add the difference between the purchase price of the acquisition and the book value of assets acquired to the invested capital of all companies that did pooling acquisitions.

The second historical goodwill adjustment we make to invested capital deals with accumulated goodwill amortization. Accumulated goodwill amortization is the gross amount of goodwill amortization that has been expensed over a company’s lifetime. Prior to the introduction of SFAS 142 in 2001, goodwill was amortized using straight-line depreciation. After SFAS 142, the system of goodwill impairment is used to value intangible assets and reduce their value via an annual test. Although goodwill amortization no longer takes place and the accumulated amount no longer changes, we add back accumulated goodwill amortization prior to SFAS 142 to a company’s invested capital calculation.

These adjustments ensure an apples-to-apples comparison between companies that recorded acquisitions under the pooling versus the purchase methods. They also provide a far more accurate measure of the amount of capital that has gone into businesses, which means a more accurate invested capital and ROIC.