Barron’s Features My Analysis on DAL’s Abnormal Pension Accounting

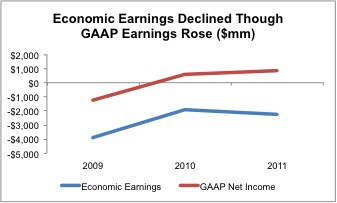

In his weekly column, The Trader, Vito Racanelli features my in-depth work on the funky accounting Delta Airlines' (DAL) uses to mask $26 billion on off-balance sheet liabilities.

Mr. Racanelli agrees

David Trainer, Founder & CEO