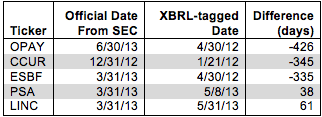

XBRL: Getting Better, But Work Left To Do

Back in 2013, we wrote about all the errors and issues we discovered when attempting to use XBRL data for our models. In the past couple years, XBRL has definitely come a long way in terms of improving the quality of the data, but there’s a lot of work left to do.

Sam McBride