Most public companies should benefit from the new tax law, which lowers the corporate tax rate from 35% to 21%. Analysts expect the S&P 500 to see a profit boost ranging from 7% to more than 10%. Optimism over the impact of the new tax law has helped the S&P 500 to a 6% gain in January.

Some companies will benefit more than others. Some of the biggest winners will be companies with large deferred tax liabilities (DTLs). These are companies that have deferred paying taxes by reducing taxable income in the past with a variety of accounting techniques such as accelerated depreciation, non-deductible intangibles, or holding international profits overseas. Companies that have used these methods record DTLs on their balance sheets to account for the higher taxes they expect to pay in the future.

These companies get an extra bonus from a corporate tax cut, since it applies not only to their regular taxes but also to the deferred taxes they were obligated to pay. Many companies will see their balance sheets improve significantly in the coming months as they decrease the value of their DTLs now that the lower corporate rate is coming into effect.

Identifying DTLs: Not as Easy as It Sounds

It sounds easy to just look for companies with large DTLs, but that process does not really work. Some companies don’t disclose DTLs on their balance sheet and only show them in the footnotes. Others might report DTLs on the balance sheet but also have offsetting deferred tax assets in the notes. Our machine learning Robo-Analyst technology helps us parse thousands of 10-Ks and 10-Qs to identify the true net deferred tax liabilities.

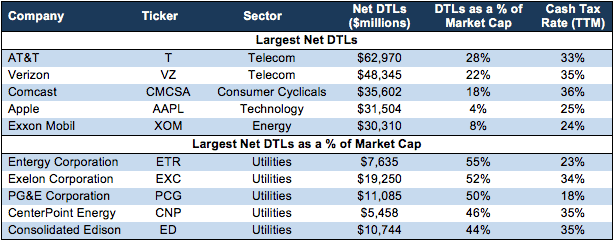

Figure 1 shows the five S&P 500 companies with the largest net DTLs as of their latest 10-K or 10-Q, and the five with the largest net DTLs as a percent of market cap.

Figure 1: Companies with the Largest Net Deferred Tax Liabilities

Sources: New Constructs, LLC and company filings

The Telecom sector stands out as the largest total winner. AT&T (T) and Verizon (VZ) have the largest DTLs by dollar value. Comcast (CMCSA), in third, is classified as consumer cyclicals but invests heavily in telecom infrastructure.

Verizon has already announced a one-time gain of $16.8 billion on the remeasurement of its DTLs, while Comcast recorded a $12.7 billion gain. We will update our models on these companies once they file their 10-Ks in February.

In addition to their large DTLs, these three companies also pay close to the full 35% statutory tax rate, so they should get the full benefits of the tax cut. Verizon expects a $3.5-$4 billion benefit to operating cash flow in 2018.

The final two companies, Apple (AAPL) and Exxon (XOM) should experience a smaller benefit as both already pay well below the 35% tax rate. However, Apple will certainly benefit from the ability to repatriate most of its cash at a lower rate.

Utilities Sector Is a Clear Winner

The bottom half of Figure 1 shows that the Utilities sector should get the largest relative boost from the new tax law. The top five companies in terms of DTLs as a percent of market cap are all Utilities companies.

So far, the Utilities sector has not participated in the stock market rally prompted by the passage of the tax law. Utilities are heavily regulated and will mostly be forced to pass on the tax break to ratepayers, so these companies won’t be getting an immediate boost to profitability.

However, Figure 1 shows how the Utilities sector may still benefit in a way that the market might not fully appreciate. The decrease in their DTLs will shore up their balance sheets and allow them to take on more debt to invest in key areas like power grid improvements and renewable energy generation. These investments won’t necessarily show up in the bottom line right away, but they could deliver a significant long-term boost to profits.

As an added benefit, regulated utilities are exempt from a provision in the tax law that places a cap on the tax deductibility of interest expense. These firms can borrow without having to worry about the tax ramifications.

We still rate the Utilities sector as Unattractive, and only three Utilities stocks earn our Attractive-or-better rating, but the new tax law does give a tangible benefit to the sector that the market doesn’t seem to be factoring in to its valuation.

This article originally published on January 31, 2018.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Gotcredit.com (Flickr)