AI is an increasingly popular topic in the investment industry – for good reason. From its ability (or lack thereof) to facilitate investment research or pick winning stocks, the potential applications are broad.

Like it or not, it’s clear that AI is going to change the investment industry in a big way. It started, mostly with hype, years ago, but we are seeing more and more progress with each passing day.

Some of the largest asset managers have already incorporated AI into their active ETFs. BlackRock (BLK), the largest asset manager in the world, provides an early case study.

BlackRock first integrated AI/machine learning into active ETFs back in 2018 with the suite of ETFs under the “iShares Evolved” brand. This product line consisted of seven new funds which would pick holdings in industries based on machine learning and natural language processing.

While the concept seemed promising, the results were not. Five of the seven funds were liquidated in 2022. Of the remaining 2 ETFs, only one has outperformed the S&P 500 since inception. Perhaps unsurprisingly, the outperforming ETF, now named iShares U.S. Tech Independence Focused ETF (IETC), focused on the high-flying tech sector.

Why the lack of success?

It’s the Data

As our readers know, AI doesn’t perform well if it is fed poor training data. Whenever AI is involved, especially in a complex field like investing, the quality of the training data is the single most important factor to its success. Keep in mind that AI learns from its training data. It doesn’t know if its training data is wrong. It trusts it blindly.

Unfortunately for users, current large language models (LLMs) fail miserably at understanding the meaning and nuances of financial data in filings because they have been trained using low quality financial data. Any stock picking or investment research system built on these models is using bad data, and we all know the timeless saying about models: garbage in – garbage out. If the financial models used to train the AI can’t generate alpha, AI isn’t going to do any better. AI isn’t a magic bullet. It cannot fix the data on which it is built. It’s a tool to replicate the work that human analysts do, but at scale. In fact, AI may often perform worse than humans because it lacks so much of the context on which its human counterparts (often unconsciously) rely.

If big asset managers like BlackRock, Franklin Templeton (BEN), Invesco (IVZ), and others can’t find high-quality data to drive their AI solutions, we believe their stocks will face downward pressure.

The only way for asset managers to differentiate their funds and hope to outperform the market more consistently is to leverage superior data to drive superior research. Otherwise, their only real differentiator is distribution, an advantage that has long been exhausted, as detailed in this paper.

Small Language Models to the Rescue

There’s no better proof that the quality of training data is paramount to AI’s success than the mounting evidence that small language models (SLM) significantly outperform LLMs.

The problem with LLMs is that they tend to rely heavily on the open internet for training, which is a data source filled with noise and inaccuracies. Traditional asset managers would never train human analysts by directing them to learn about investing by only reading the internet. Why anyone is training their AI analysts this way is unclear. As a result, these LLMs handle a broad range of general tasks reasonably well, but their performance declines sharply when faced with more sophisticated tasks.

In contrast, SLMs focus on a narrower and more specific domain, which enables human experts to ensure the data is accurate and properly organized and that the rules about how to use the data produce reliable results.

For example, the SLM created by New Constructs powers market-beating stock picking. We’re able to empirically prove the accuracy and reliability of our SLM because it is based on:

- Publicly available data in financial filings,

- Systematically gathering data into a clear ontology that supports sophisticated research, and

- Metrics and signals whose accuracy can be measured objectively by stock market performance.

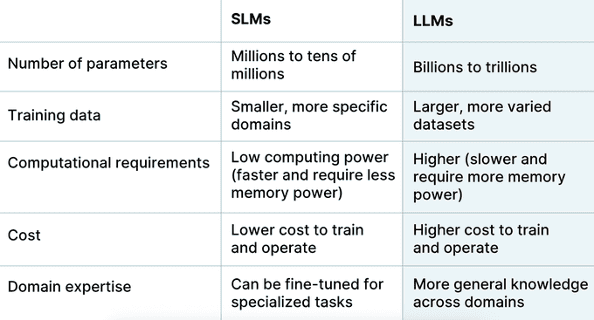

We think the advantages of SLMs over LLMs are intuitive. Rather than trying to boil the ocean like LLMs, they narrow the scope to a small enough domain where human experts can truly curate a pristine dataset on which clear instructions can be built to produce truly reliable and human-expert level insights. See Figure 1 for a basic comparison of SLMs and LLMs.

Figure 1: Comparing Small Language Models (SLMs) and Large Language Models (LLMs)

Sources: Tweet: BREAKING: NVIDIA just exposed the dirty secret about LLMs.

Want proof of the advantage of our SLMs over all the other LLMs for investing in the market? See below.

Proof Is in Performance: See the Indices Based on New Constructs’ SLM-Driven AI

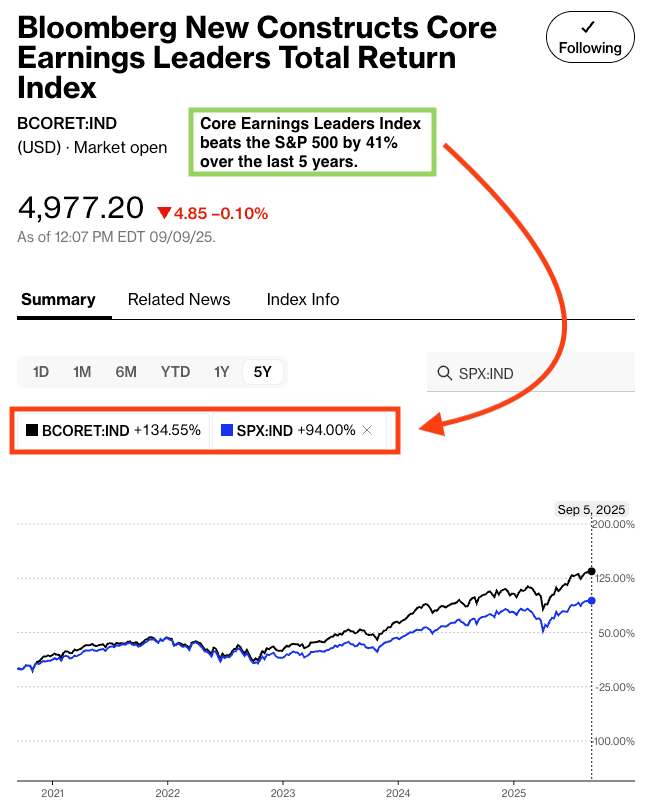

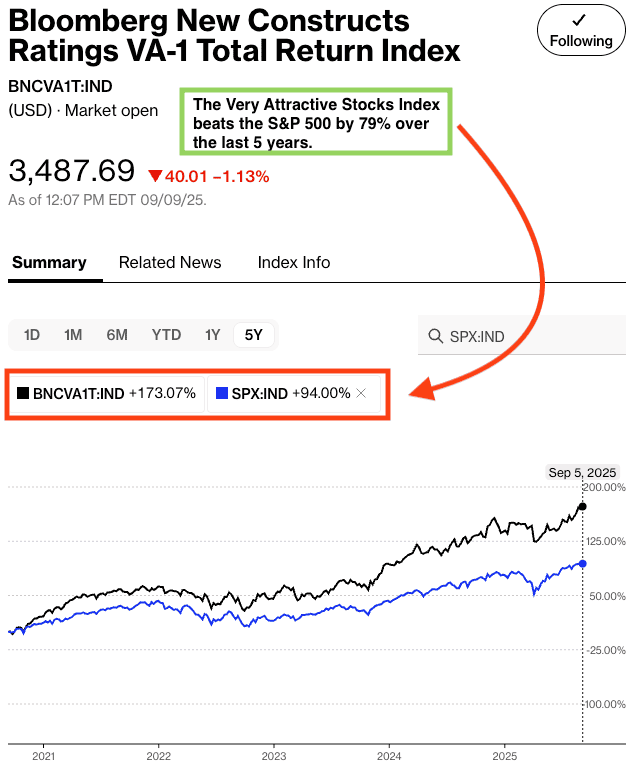

To showcase how our SLM AI generates winning signals, we highlight the indices we’ve developed with Bloomberg’s Index Licensing Group below. All three are outperforming the S&P 500 over the past five years. See Figures 2-4.

- Bloomberg New Constructs Core Earnings Leaders Index (ticker: BCORET:IND)

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND)

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

The Bloomberg New Constructs Core Earnings Leaders Index, which allocates based on Earnings Capture and Core Earnings, beat the S&P 500 by over 41% over the past five years. The Index (ticker: BCORET:IND) was up 135% while the S&P 500 was up 94%.

Figure 2: Bloomberg New Constructs Core Earnings Leaders Index Outperforms S&P 500: Last 5 Years

Sources: Bloomberg as of September 5, 2025

Note: Past performance is no guarantee of future results.

The “Very Attractive Stocks” Index, which allocates to stocks that get a Very Attractive rating by our AI Agent for Investing, beat the S&P 500 by 79% over the last five years. Bloomberg’s official name for the index is Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND). Figure 4 shows it was up 173% while the S&P 500 was up 94%.

Figure 3: Very Attractive-Rated Stocks Strongly Outperform the S&P 500: Last Five Years

Sources: Bloomberg as of September 5, 2025

Note: Past performance is no guarantee of future results.

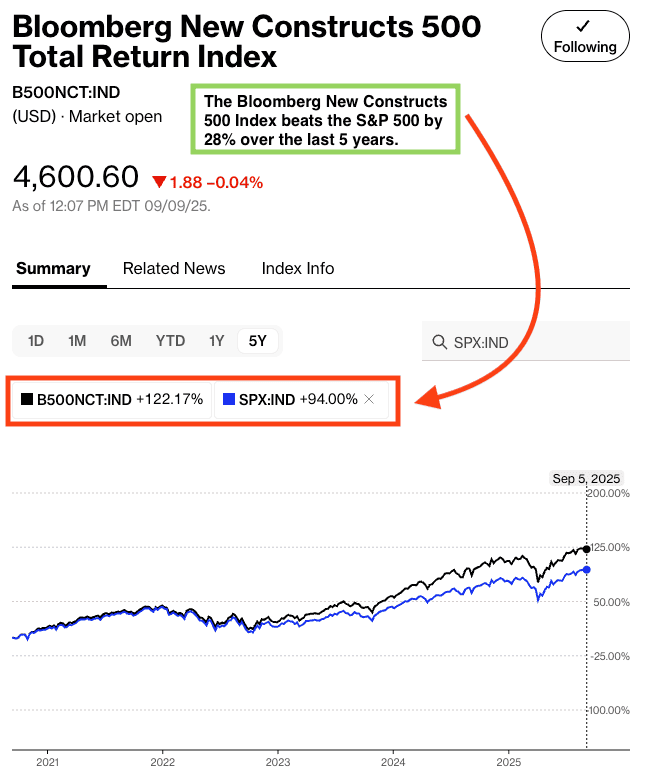

Our “Core-Earnings Weighted S&P 500” Index, which weights the largest 500 U.S. companies by Core Earnings instead of market cap, beat the S&P 500 by 28% over the past five years. Bloomberg’s official name for the index is Bloomberg New Constructs 500 Total Return Index (ticker: B500NCT:IND). Figure 5 shows it was up 122% while the S&P 500 was up 94%.

Figure 4: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500: Last Five Years

Sources: Bloomberg as of September 5, 2025

Note: Past performance is no guarantee of future results.

Note that these indices are not available to the public. The only way to build strategies that achieve this kind of outperformance based on superior fundamental data is to be a New Constructs member.

This article was originally published on September 19, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.