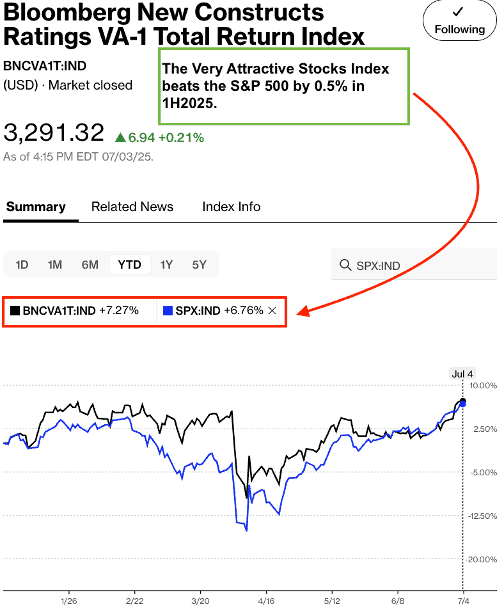

Our Very Attractive Stocks Index, aka the Bloomberg New Constructs Ratings VA-1 Index (you can look it up under this ticker: BNCVA1T:IND), has outperformed the S&P 500 by 68% over the last 5 years. In the first half of 2025, it also outperformed rising 7.3% compared to the S&P 500 rising 6.8%.

This outperformance highlights how our superior Stock Ratings produce novel alpha. We use those same Stock Ratings to determine our ETF and mutual fund ratings. After all, a fund is only as good as the stocks it holds.

We think it’s only logical to evaluate a fund based on research and ratings of each of its holdings. This bottoms-up approach is more forward-looking than alternative fund ratings, like Morningstar. Given the outperformance of the Very Attractive Stocks Index and our stock picking awards, we think our bottoms-up fund research merits your attention. We provide ratings on 7,600+ ETFs and mutual funds.

We recently published our quarterly Best and Worst ETFs and Mutual Funds reports that rank the 11 sectors and 12 investment styles. These reports provide a bottom-up assessment of the fundamental risk/reward in each sector or style based upon the stocks in those sectors and styles.

Our ETF and mutual fund ratings are based on the aggregation of our ratings for the stocks held by each fund. This week, we’re bringing a Very Attractive mutual fund in the top-ranked Style to your attention.

After rigorous analysis of our database of 7,600+ ETFs and mutual funds, we found a mutual fund that successfully picks stocks with strong fundamentals and cheap valuations while charging below-average fees. Fidelity Value Discovery Fund (FVDFX) is this week’s Long Idea.

Backwards Looking Research Underrates this Fund

Morningstar gives both share classes of the Fidelity Value Discovery Fund a 2-Star (backward-looking) rating. Instead of looking at past performance, we analyze funds based on their holdings. When viewed through our Predictive Risk/Reward Fund Rating methodology, both share classes earn a Very Attractive rating. See Figure 1.

Figure 1: Fidelity Value Discovery Fund Ratings

Sources: New Constructs, LLC and Morningstar

Higher quality holdings and lower average costs mean Fidelity Value Discovery Fund is more likely to outperform moving forward, which is something traditional fund research can’t tell you.

How Our Forward-Looking Research Reveals a Very Attractive Fund

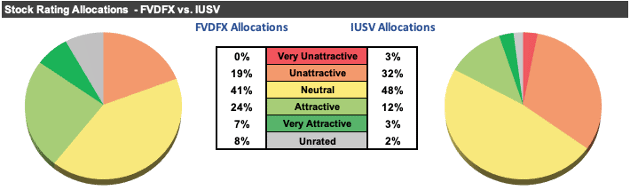

Our analysis of its holdings reveals the fund allocates more to high-quality stocks, i.e. profitable companies with undervalued stock prices, than its benchmark, iShares Core S&P U.S. Value ETF (IUSV). See Figure 2.

We leverage our Robo-Analyst technology[1] to assess a mutual fund’s portfolio quality by analyzing the fund’s individual stock holdings.

Through this rigorous analysis, we find that FVDFX allocates 31% of its assets to Attractive-or-better rated stocks compared to just 15% for IUSV. On the flip side, FVDFX allocates just 19% of its assets to Unattractive-or-worse rated stocks compared to 35% for IUSV.

Figure 2: FVDFX Holdings Vs. IUSV Holdings

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

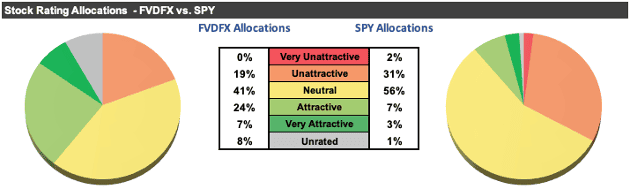

Per Figure 3, our holdings analysis also reveals FVDFX’s portfolio is of much higher quality than the S&P 500 as represented by State Street SPDR S&P 500 ETF Trust (SPY). SPY earns our Attractive rating, but only 10% of SPY’s portfolio is allocated to stocks rated Attractive-or-better and 33% is allocated to stocks rated Unattractive-or-worse.

Figure 3: FVDFX Holdings Vs. SPY Holdings

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

Fund Managers Focus on Valuation

FVDFX’s investment strategy aims to identify stocks that are undervalued in the marketplace in relation to factors such as assets, sales, earnings, growth potential, cash flow, or in relation to securities of other companies in the same industry. Fidelity notes that these types of stocks are often referred to as “value stocks.”

The fund’s prospectus specifically notes that the fund looks for companies “experiencing positive fundamental change”, which could include:

- a new management team or product launch,

- a significant cost-cutting initiative,

- a merger or acquisition,

- a reduction in industry capacity that would lead to improved pricing,

- companies whose earnings potential has increased or is expected to increase more than generally perceived, and

- companies that have enjoyed recent market popularity, but which appear to have temporarily fallen out of favor for reasons considered short-term or non-recurring.

When analyzing value, the fund uses “traditional and other measures” including earnings relative to enterprise value. Enterprise value represents the value of the firm to all stakeholders and is the denominator in our calculation of 2-year average free cash flow yield.

We would love more details or calculations behind the fund’s “bottom-up” fundamental analysis, but without them, we can only judge the methodology by its results, or the stocks the fund allocates too.

Given the fund’s superior asset allocation (compared to its benchmark and the SPY), it’s clear the investment strategy successfully finds stocks that provide quality risk/reward, as we’ll detail below.

Quality Stocks Drive Very Attractive Risk/Reward Rating

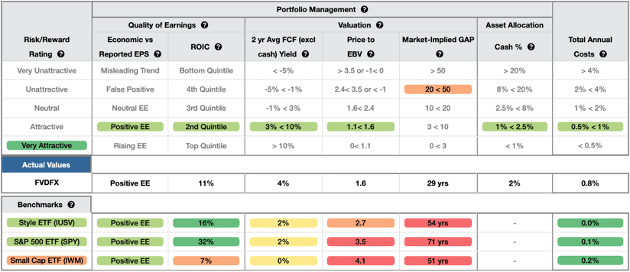

Figure 4 shows our detailed rating for FVDFX, which includes each of the criteria we use to rate all mutual funds under coverage. These criteria are the same for our Stock Rating Methodology, because the performance of a mutual fund’s holdings drives the performance of the mutual fund after fees. Figure 4 also compares FVDFX’s rating with those of IUSV, SPY and IWM.

Figure 4: Fidelity Value Discovery Fund Breakdown

Sources: New Constructs, LLC and company filings

FVDFX’s holdings are superior or equal to IUSV and SPY in four out five of the criteria that make up our Portfolio Management rating. Specifically:

- FVDFX’s holdings generate positive economic earnings, same as IUSV and SPY.

- FVDFX’s free cash flow (FCF) yield of 4% is higher than IUSV and SPY’s at 2%.

- The price-to-economic book value (PEBV) ratio for FVDFX’s holdings is 1.6, which is much lower than IUSV’s at 2.7 and SPY’s at 3.5.

- Our discounted cash flow analysis reveals an average market-implied growth appreciation period (GAP) of just 29 years for FVDFX’s holdings compared to 54 years for IUSV and 71 years for SPY.

The takeaway?

FVDFX allocates to profitable businesses, as measured by the 11% ROIC of its holdings, which trade at prices that are much cheaper than the stocks held in the benchmark.

Strong profitability + cheap valuation = quality risk/reward.

A Closer Look at Holdings Reveals More Positives

Of the 108 FVDFX’s holdings in our coverage universe, 10 are also open Long Ideas of ours. These 10 stocks make up nearly 12% of FVDFX’s portfolio.

Also, of the 108 holdings under coverage:

- 98% have a positive ROIC,

- 83% have a positive 2-year average free cash flow yield,

- 81% have a positive PEBV ratio of 2.7 (equal to benchmark) or less, and

- 71% have a GAP of 54 years (equal to benchmark) or less.

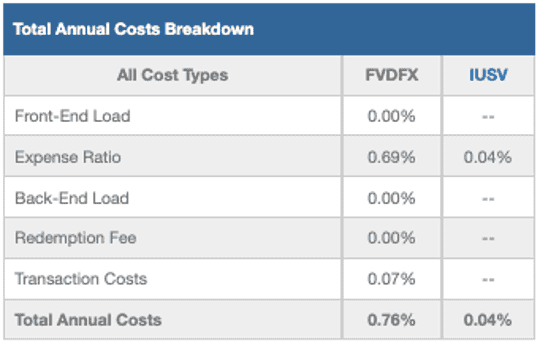

Quality Stock Selection at Below Average Cost

FVDFX’s 0.76% total annual costs (TAC) are below the 1.50% simple average and 1.10% asset-weighted average of the 914 other All Cap Value mutual funds under coverage. Figure 5 shows our breakdown of FVDFX’s total annual costs, which is available for all 7,600+ mutual funds and ETFs under coverage.

Figure 5: FVDFX’s Total Annual Costs Breakdown

Sources: New Constructs, LLC and company filings

The Importance of Holdings Based Fund Analysis

We offer clients in-depth reports for all the 7,600+ ETFs and mutual funds under coverage. Click below for a free copy of our standard mutual fund report on FVDFX.

Smart fund (or ETF) investing means analyzing each of the holdings of a fund. Simply buying an ETF or mutual fund based on past performance does not necessarily lead to outperformance. Only thorough holdings-based research can help determine if a fund’s methodology leads managers to pick high-quality or low-quality stocks.

Most investors don’t realize they can access superior fundamental research that enables them to overcome inaccuracies, omissions, and biases in legacy fundamental research and data. Our Robo-Analyst technology analyzes the holdings of all 1,081 ETFs and mutual funds in the All Cap Value style and ~7,600+ ETFs and mutual funds under coverage to avoid “the danger within”.

Build A Better Fund: Use our DIY ETF Tool

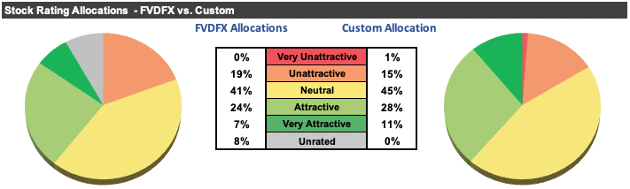

As we show in The Paradigm Shift to DIY ETFs, new technologies enable investors to create their own fund without any fees while also enabling better, more sophisticated weighting methodologies. For example, if we reallocate the fund’s capital to the companies with the best ROICs, our customized fund allocates:

- 39% of assets to Attractive-or-better rated stocks (compared to 31% for FVDFX)

- 16% of assets to Unattractive-or-worse rated stocks (compared to 19% for FVDFX)

Compare the quality of stock allocation in as-is FVDFX vs. our customed version of FVDFX in Figure 6.

Figure 6: FVDFX Vs. Custom Fund Allocations

Sources: New Constructs, LLC and company filings

Note that our DIY ETF tool allows clients to pick and weight portfolio holdings based on multiple proprietary metrics, such as Core Earnings, Economic Earnings, Free Cash Flow, Net Operating Profit After Tax and more.

Check Out the Indices Based on New Constructs Research

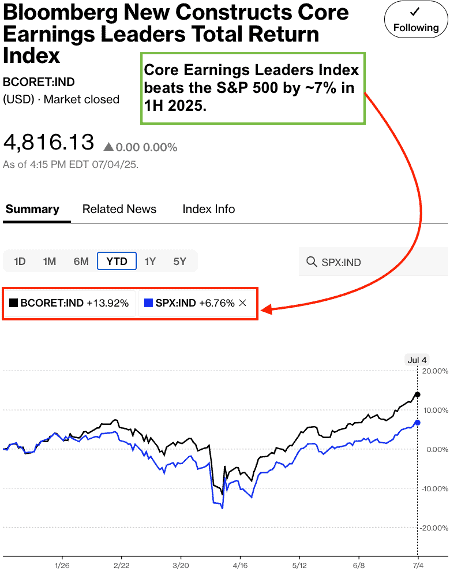

While we’re writing about creating your own fund, we should highlight the indices we’ve developed with Bloomberg’s Index Licensing Group. All three outperformed the S&P 500 in 1H25. See Figures 7-9.

- Bloomberg New Constructs Core Earnings Leaders Index (ticker: BCORET:IND)

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND)

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

The Bloomberg New Constructs Core Earnings Leaders Index beat the S&P 500 by over 7% in 1H25. Our Index (ticker: BCORET:IND) was up 13.9% while the S&P 500 was up 6.8%. That’s pretty good! See Figure 7 for details.

Figure 7: Bloomberg New Constructs Core Earnings Leaders Index Outperforms the S&P 500 in 1H25

Sources: Bloomberg as of July 4, 2025

Note: Past performance is no guarantee of future results.

The “Very Attractive Stocks” Index beat the S&P 500 by over 0.5% in 1H25. Bloomberg’s official name for the index is Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND). Figure 8 shows it was up 7.3% while the S&P 500 was up 6.8%.

Figure 8: Very Attractive-Rated Stocks Strongly Outperform the S&P 500 in 1H25

Sources: Bloomberg as of July 4, 2025

Note: Past performance is no guarantee of future results.

Our “Core-Earnings Weighted S&P 500” Index beat the S&P 500 by over 0.3% in 1H25. Bloomberg’s official name for the index is Bloomberg New Constructs 500 Total Return Index (ticker: BNCVAT1T:IND). Figure 9 shows it was up 7.1% while the S&P 500 was up 6.8%.

Figure 9: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500 in 1H25

Sources: Bloomberg as of July 4, 2025

Note: Past performance is no guarantee of future results.

This article was originally published on July 16, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] Our Robo-Analyst technology provides superior fundamental data, as proven in The Journal of Financial Economics, and a novel source of alpha.