Starting with Model Portfolio Performance Through 3Q20, we updated the risk-free rate we use to benchmark the performance of the market-neutral long/short strategies based on our Most Attractive & Most Dangerous Stocks Model Portfolios. Going forward, the risk-free rate is based on the 5-year zero-coupon U.S. Treasury rate.

Prior to this update, we used the 3-Month T-Bill as the risk-free rate to benchmark performance of these portfolios.

We also use the 5-year zero-coupon U.S. Treasury rate as the risk-free rate in our Company Valuation Models.

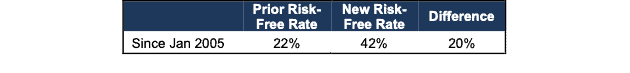

Below, we show how much the switch to the new rate raises the performance of our risk-free benchmark.

First, the cumulative return of the new risk-free rate since 2005 is ~42% through 2Q20, compared to ~22% with the prior rate. See Figure 1.

Figure 1: Cumulative Risk-Free Rate Return: Comparing Prior vs. New Rate

Sources: New Constructs, LLC and company filings.

Note: Gain/Decline performance analysis excludes transaction costs, dividends and rebates.

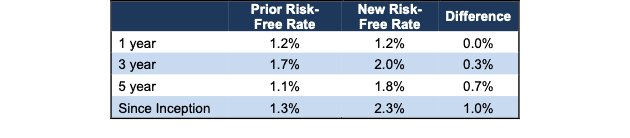

Next, we compare the annualized rates of return for the prior and new risk-free rates across multiple time frames. See Figure 2.

Figure 2: Annualized Risk-Free Rate Returns: Comparing Prior vs. New Rate

Sources: New Constructs, LLC and company filings.

Note: Gain/Decline performance analysis excludes transaction costs, dividends and rebates. Inception date is January 2005.

This article originally published on November 10, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.