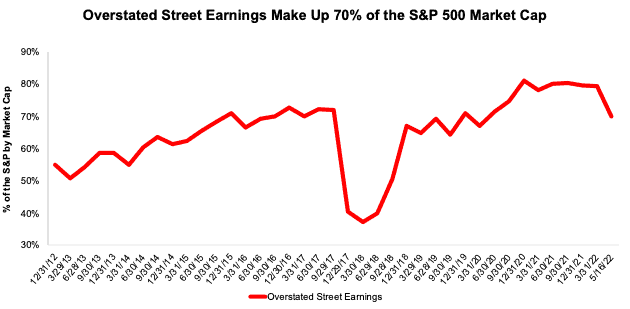

Wall Street analysts are too bullish on second quarter earnings expectations for most S&P 500 companies. Although down from record highs set in recent quarters, the percent of S&P 500 companies whose Street EPS exceed our Core EPS remains high at 70%.

This report shows:

- the frequency and magnitude of overstated Street Earnings[1] in the S&P 500

- five S&P 500 companies with overstated Street estimates likely to miss 2Q22 earnings

Get our report on the S&P 500 companies more likely to beat 2Q22 Street EPS estimates here.

Street Overstates EPS for 333 S&P 500 Companies

333 companies with overstated Street Earnings make up 70% of the market cap of the S&P 500 through 5/16/22, which is down from 79% through the close of 2021, measured on a rolling four quarter basis.

The drop from the prior TTM period is driven largely by the decline in Street Earnings for Microsoft (MSFT) and NVIDIA Corporation’s (NVDA). Combined, these two firms make up 7% of the S&P 500 market cap on 5/16/22. For comparison, in calendar 2021, 336 companies had overstated Street Earnings.

Figure 1: Overstated Street Earnings as % of Market Cap: 2012 through 5/16/22

Sources: New Constructs, LLC and company filings.

On average, Street Earnings overstate Core Earnings[2] by 19% per company in 1Q22. See Figure 2. For over a third of S&P 500 companies, Street Earnings overstate Core Earnings by >10%.

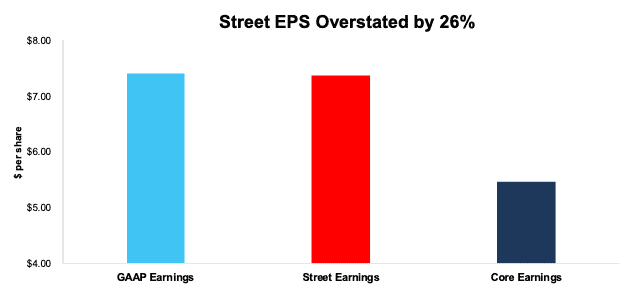

Figure 2: Street Earnings Overstated by 19% on Average in TTM Through 1Q22[3]

Sources: New Constructs, LLC and company filings.

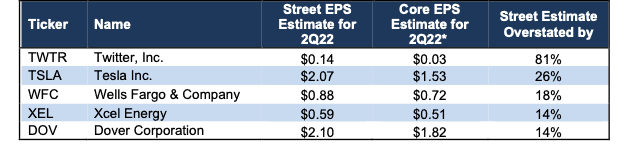

Five S&P 500 Companies Likely to Miss 2Q22 Earnings

Figure 3 shows five S&P 500 companies likely to miss calendar 2Q22 earnings because their Street EPS estimates as overstated. Below we detail the hidden and reported unusual items that caused Street Distortion and overstated Street Earnings in the TTM ended 1Q22 for Twitter (TWTR) and Tesla (TSLA), the former currently in acquisition discussions with Elon Musk, the latter run by Elon Musk.

Figure 3: Five S&P 500 Companies Likely to Miss 2Q22 EPS Estimates

Sources: New Constructs, LLC, company filings, and Zacks

*Assumes Street Distortion as a percent of Core EPS is same for 2Q22 EPS as for TTM ended 1Q22.

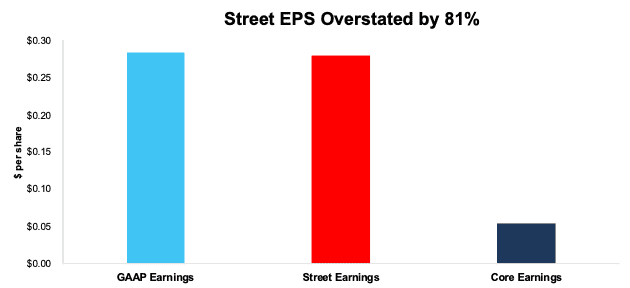

Twitter Inc: The Street Overstates Earnings for 2Q22 by $0.11/share

The Street’s 2Q22 EPS estimate of $0.14/share for Twitter is overstated by $0.11/share due, at least in part, to the inclusion of gains on Twitter’s sale of its MoPub business in January 2022 in historical Street EPS. Based on how much the Street EPS estimate exceeds our Core EPS of $0.03/share, we consider Twitter as one of the S&P 500 companies most likely to miss Wall Street’s expectations. Twitter’s Earnings Distortion Score is Miss and its Stock Rating is Very Unattractive.

However, it’s important to note that Twitter missing earnings may not impact the stock as much as others, given it is trading more on acquisition prospects rather than fundamentals.

Unusual gains, which we detail below, materially increased Twitters TTM 1Q22 Street and GAAP earnings to make profits look better than Core EPS. Once all unusual items are adjusted for, we find that Twitter’s TTM 1Q22 Core EPS are $0.05/share, which is worse than TTM 1Q22 Street and GAAP EPS of $0.28/share.

Figure 4: Comparing Twitter’s GAAP, Street, and Core Earnings: TTM Through 1Q22

Sources: New Constructs, LLC and company filings.

Below, we detail the differences between Core Earnings and GAAP Earnings so readers can audit our research. We would be happy to reconcile our Core Earnings with Street Earnings but cannot because we do not have the details on how analysts calculate their Street Earnings.

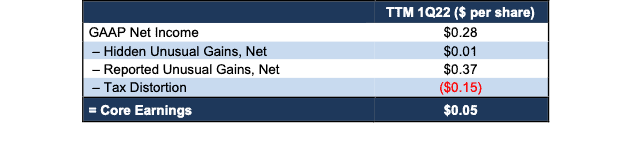

Figure 5 details the differences between Twitter’s Core Earnings and GAAP Earnings.

Figure 5: Twitter’s GAAP Earnings to Core Earnings Reconciliation: TTM Through 1Q22

Sources: New Constructs, LLC and company filings.

More details:

Total Earnings Distortion of $0.23/share, which equals $182 million, is comprised of the following:

Hidden Unusual Gains, Net = $0.01/per share, which equals $7 million and is comprised of

- $7 million in sublease income in the TTM period based on $10 million in sublease income in the 2021 10-K

Reported Unusual Gains, Net = $0.37/per share, which equals $295 million and is comprised of

- $970 million gain on sale of asset group in 1Q22 stemming from Twitter’s sale of its MoPub business to AppLovin Corporation

- $91 million in other income in the TTM period based on

- -$6.5 million in expense in 1Q22

- $20.8 million in income in 4Q21

- $20.6 million in income in 3Q21

- $55.7 million in income in 2Q21

- $766 million in litigation settlement expenses in the TTM period based on a $766 million settlement in 3Q21

Tax Distortion = -$0.15/per share, which equals -$121 million

The similarities between Street Earnings and GAAP Earnings for Twitter indicates that Street Earnings miss many of the unusual items in GAAP Earnings and that Core Earnings include a more comprehensive set of unusual items when calculating Twitter’s true profitability.

Tesla Inc.: The Street Overstates Earnings for 2Q22 by $0.54/share

The Street’s 2Q22 EPS estimate of $2.07/share for Tesla is overstated by $0.54/share largely due to automotive regulatory credits included in historical Street EPS.

Based on how much the Street EPS estimate exceeds our Core EPS estimate of $1.53/share, we consider Tesla as one of the S&P 500 companies most likely to miss Wall Street analyst’s expectations in its 2Q22 earnings report. Tesla’s Earnings Distortion Score is Strong Miss. See all our research on Tesla here.

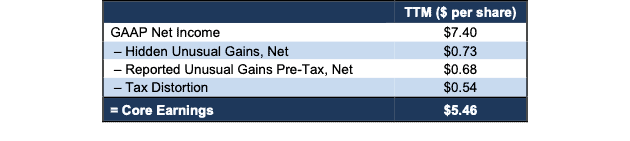

Unusual gains, which we detail below, materially increased Tesla’s TTM 1Q22 Street and GAAP earnings and make profits look better than Core EPS. When we adjust for all unusual items, we find that Tesla’s TTM 1Q22 Core EPS are $5.46/share, which is worse than TTM 1Q22 Street EPS of $7.37/share and GAAP EPS of $7.40/share.

Figure 6: Comparing Tesla’s GAAP, Street, and Core Earnings: TTM Through 1Q22

Sources: New Constructs, LLC and company filings.

Below, we detail the differences between Core Earnings and GAAP Earnings so readers can audit our research. We would be happy to reconcile our Core Earnings with Street Earnings but cannot because we do not have the details on how analysts calculate their Street Earnings.

Figure 7 details the differences between Tesla’s Core Earnings and GAAP Earnings.

Figure 7: Tesla GAAP Earnings to Core Earnings Reconciliation: TTM Through 1Q22

Sources: New Constructs, LLC and company filings.

More details:

Total Earnings Distortion of $1.94/share, which equals $2.2 billion, is comprised of the following:

Hidden Unusual Gains, Net = $0.73/per share, which equals $823 million and is comprised of

- $947 million in automotive regulatory credits in the TTM period based on

- $314 million in 4Q21

- $279 million in 3Q21

- $354 million in 2Q21

- -$124 million in inventory and purchase commitment write-downs in the TTM period based on

- -$33 million in 1Q22

- -$12 million in 4Q21

- -$40 million in 3Q21

- -$39 million in 2Q21

Reported Unusual Gains Pre-Tax, Net = $0.68/per share, which equals $768 million and is comprised of

- $679 million in automotive regulatory credits in the TTM period based on

- $679 million in 1Q22[4]

- $163 million in other income in the TTM period based on

- $56 million income in 1Q22

- $68 million income in 4Q21

- -$6 million expense in 3Q21

- $45 million income in 2Q21

- -$74 million in restructuring and other expense in the TTM period based on

- -$51 million in 3Q21

- -$23 million in 2Q21

Tax Distortion = $0.54/per share, which equals $611 million

Given the similarities between Street Earnings and GAAP Earnings for Tesla, our research shows Street and GAAP earnings both fail to capture unusual items in the footnotes and those reported directly on Tesla’s income statement and therefore give a misleading picture of the firm’s profitability.

This article originally published on July 5, 2022.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Brian Pellegrini receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Street Earnings refer to Zacks Earnings, which are reported to be adjusted to remove non-recurring items using standardized assumptions from the sell-side.

[2] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[3] Average overstated % is calculated as Street Distortion, which is the difference between Street Earnings and Core Earnings.

[4] We treat the automotive regulatory credits as reported items in 1Q22 because they are reported directly on the income statement. In prior quarters, we treat the credits as hidden items as they were disclosed in a table separate from the income statement that disaggregates Tesla’s revenue by source.