Where does the market go from here?

The Fed left interest rates unchanged and continued their “wait-and-see” approach for another month. Of note, they continued to project the expectation for two rate cuts this year. What many investors thought could be a catalyst for the next market move, turned into a whole lot of nothing.

We believe the market is getting more efficient. As FOMO and MOMO take a backseat, fundamentals reclaim the driver’s seat. And, there’s no better market for diligent investors than one where capital gets allocated to companies who actually deserve it.

How do you know which companies deserve capital? Fundamentals, and we provide the best fundamental research in the world. Our Robo-Analyst technology enables us to gather more data and produce superior financial metrics and stock ratings. Speaking of stock ratings, the Bloomberg index that holds only our Very Attractive-Rated Stocks (ticker: BNCVA1T:IND) is up strongly in a down market. From January 1st to March 19th, the index, officially named the “Bloomberg New Constructs Ratings VA-1Index”, is up 4.2% while with S&P 500 is down 3.5%.

Figure 1: Bloomberg New Constructs Ratings VA-1 Index Beats S&P 500 By 7.75% YTD Thru March 19

Sources: New Constructs, LLC and Bloomberg

So, if you’re looking for the highest quality fundamental investment ideas, I think it’s safe to say that our Very Attractive-rated stocks are a good place to start. Note that we just did a special training on how our Stock Ratings can help you thrive in a volatile market.

Our Exec Comp Aligned with ROIC Model Portfolio starts with Attractive-or-better rated stocks and goes a step further. It only includes companies with executive compensation plans aligned with return on invested capital (ROIC) (or similar variants). As David Trainer, our CEO, said many times in this special training, the Exec Comp Aligned with ROIC Model Portfolio provides you with stocks you can trust the most.

Companies with high quality corporate governance are worth more than those with low quality corporate governance. I think the companies that incentivize their managers to create shareholder by tying pay to ROIC have the best corporate governance in the world.

We are proud to offer the Exec Comp Aligned with ROIC Model Portfolio, and we are excited to give you a free stock pick from this Model Portfolio.

The goal behind sharing these free features with you is to deliver insight into the uniquely high value-add of our research. We want you to know how hard we work and how we do research, so you know how reliable research looks and how real AI and machine learning work.

We update this Model Portfolio monthly, and March’s Exec Comp Aligned with ROIC Model Portfolio was updated and published for clients on March 14, 2025.

Free Stock Feature for March: PulteGroup Inc. (PHM: $105/share)

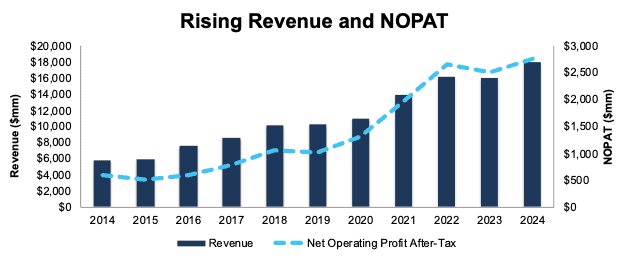

PulteGroup has grown revenue and net operating profit after tax (NOPAT) by 12% and 17% compounded annually, respectively, since 2014. The company’s NOPAT margin improved from 10% in 2014 to 15% in 2024. Invested capital turns rose from 0.8 to 1.1 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 8% in 2014 to 17% in 2024.

Figure 2: PulteGroup’s Revenue & NOPAT: 2014 – 2024

Sources: New Constructs, LLC and company filings

Executive Compensation Properly Aligns Incentives

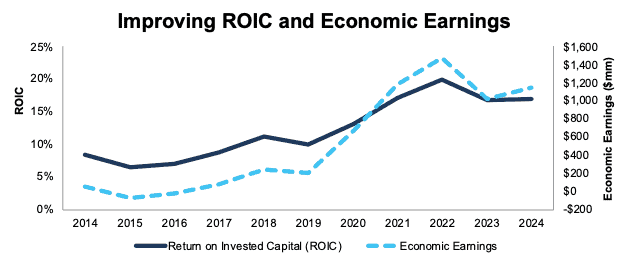

PulteGroup’s executive compensation plan aligns the interests of executives and shareholders by tying one-third of its long-term equity incentive compensation to ROIC, according to the company’s proxy statement.

The company’s inclusion of ROIC as a performance goal has helped create shareholder value by driving higher ROIC and economic earnings. When we calculate ROIC using our superior fundamental data, we find that PulteGroup’s ROIC has increased from 8% in 2014 to 17% in 2024. Economic earnings rose from $54 million to $1.1 billion over the same time.

Figure 3: PulteGroup’s ROIC & Economic Earnings: 2014 – 2024

Sources: New Constructs, LLC and company filings

PHM Has Further Upside

At its current price of $105/share, PHM has a price-to-economic book value (PEBV) ratio of 0.8. This ratio means the market expects PulteGroup’s NOPAT to permanently fall 20% from current levels. This expectation seems overly pessimistic for a company that has grown NOPAT 22% and 17% compounded annually since 2019 and 2014, respectively.

Even if PulteGroup’s

- NOPAT margin falls to 13% (below five-year average NOPAT margin of 15%) and

- revenue grows 3% (below to five-year and ten-year compound revenue growth of 12%) compounded annually through 2034 then,

the stock would be worth $137/share today – a 30% upside. Contact us for the math behind this reverse DCF scenario. In this scenario, PulteGroup’s NOPAT would grow just 1% compounded annually from 2025 through 2034.

Should the company grow NOPAT more in line with historical growth rates, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in PulteGroup’s 10-K:

Income Statement: we made over $500 million in adjustments with a net effect of removing over $300 million in non-operating income. Professional members can see all adjustments made to PulteGroup’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made just under $8 billion in adjustments to calculate invested capital with a net increase of under $4 billion. One of the most notable adjustments was several million in asset write downs. Professional members can see all adjustments made to PulteGroup’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made just under $2 billion in adjustments with a net increase of just under $700 million to shareholder value. The most notable adjustment to shareholder value was excess cash. Professional members can see all adjustments to PulteGroup’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on March 21, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.