It’s rare to find a company that benefits society and investors. Our ability to screen the entire U.S. stock market for the best and worst stocks based on criteria proven to generate alpha makes us uniquely qualified to find such rare companies.

Our Long Idea is a company that has consistently grown profits for over a decade, in good and bad times.

Even though the company’s stock has significantly outperformed the S&P 500 year-to-date, it remains undervalued and continues to provide strong upside potential.

We previously made HCA Healthcare Inc (HCA: $472/share) a Long Idea in December 2018, and have reiterated our bullish view on the stock multiple times since. See all our reports on HCA Healthcare here.

After a strong third quarter, in which the company beat top and bottom-line estimates and raised guidance for the full fiscal year, HCA is up 48% since our last update published in February 2025.

Since our original report, HCA has strongly outperformed as a Long Idea by 91%, rising 246% while the S&P is up 155%.

Even after significantly outperforming, the stock remains undervalued, in large part due to HCA Healthcare’s growing profits and cash flows. Our thesis for HCA Healthcare remains firmly intact, and its stock continues to provide strong upside potential.

HCA offers favorable Risk/Reward based on the company’s:

- position to provide care to an aging population,

- rising admissions and occupancy rates,

- increasing hospital and bed counts,

- leading market share, cash flow and profitability, and

- cheap stock price that implies profits will never grow again from current levels.

What’s Working

As the largest healthcare system in the U.S., with over 190 hospitals and 2,400 ambulatory sites, the company is well-positioned to continue growing profits as the population gets older.

We recently highlighted in our Long Idea report on Universal Health Services (UHS) that two key trends will drive the growth of healthcare systems in the U.S.

1) The Aging U.S. Population

The U.S. population age 65 and older increased 3.1% year-over-year (YoY) in 2024, while the population under the age of 18 decreased by 0.2% YoY. While children still outnumber adults in the U.S., the gap is narrowing. The share of the population age 65 and older has increased from 12% in 2004 to 18% in 2024, while the share of children declined from 25% to 22%.

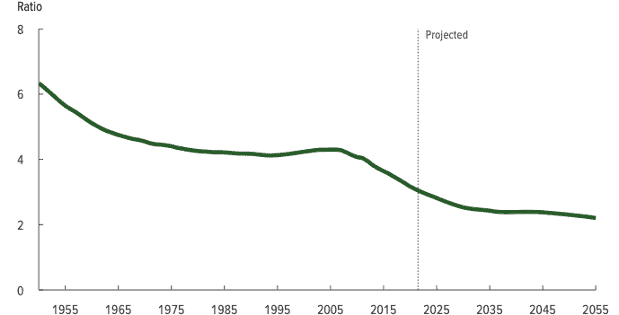

This trend will persist. The Congressional Budget Office projects the ratio of people ages 25-64 to people ages 65+ to decline from 2.8 to 1 in 2025 to 2.2 to 1 by 2055. Figure 1 illustrates how this ratio has steadily declined since the 1950s.

The Census Bureau expects the oldest of the U.S. population, the centenarian (ages 100 and older) population, to quadruple from 2024 to 2054.

America’s senior population is rising while its youth population is shrinking.

Figure 1: The Ratio of 25-64 Year Olds to 65+ Year Olds: 1950 Through 2055

Sources: Congressional Budget Office

2) Healthcare Spending Increases with Age

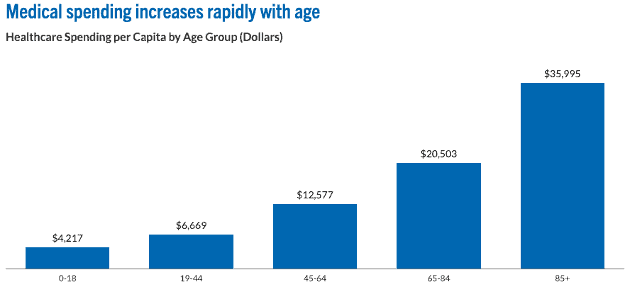

The link between aging and rising healthcare spending is strong: older patients generally require more medical services and spend more on such services.

Accordingly, the latest Centers for Medicare & Medicaid services (CMS.gov) data shows that the per capita spending of a person aged 85 or older is 8.5x higher than the spending of a child aged 18 or under. For those aged 65-84, healthcare spending is 4.9x higher than those aged <18. See Figure 2.

Figure 2: Healthcare Spending Per Person by Age Group in the U.S.

Sources: Peter G. Peterson Foundation and CMS.gov

Acute Care Services Play a Key Role

General, acute care hospitals typically provide a full range of services to accommodate multiple medical specialties, such as internal medicine, general surgery, cardiology, oncology, neurosurgery, orthopedics and obstetrics, as well as diagnostic and emergency services.

Age, inevitably, brings a wide range of health problems, and older patients will increasingly rely on the comprehensive services and treatments available at acute care hospitals, which drives demand for acute care hospitals and services over the next decade.

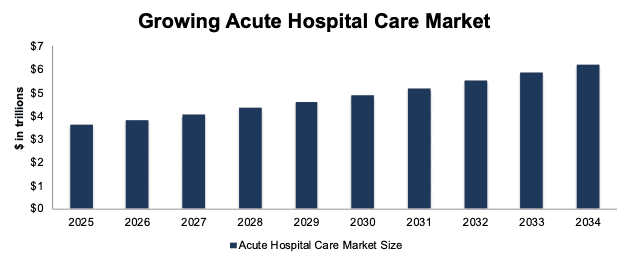

Precedence Research forecasts the global acute hospital care market to grow from $3.6 trillion in 2025 to $6.2 trillion in 2034, or 6% compounded annually. See Figure 3.

Figure 3: Acute Hospital Care Market Forecast: 2025 Through 2034

Sources: Precedence Research

Well-Positioned to Serve the Population

HCA Healthcare’s portfolio is heavily focused on its general, acute care hospitals. At the end of 2024, of the 190 hospitals under its control, 180 were general, acute care hospitals, 6 were behavioral care hospitals, and 4 were rehabilitation hospitals.

HCA Healthcare’s focus on general acute care services positions it to meet the growing healthcare needs, as evidenced by the growth in admissions and occupancy rates.

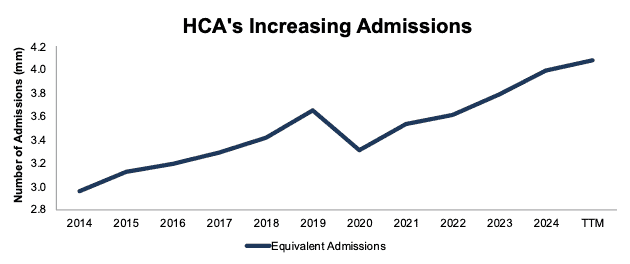

HCA Healthcare’s equivalent admissions, which provide a general measure of combined inpatient and outpatient volume, rose 3% compounded annually from 3.0 million in 2014 to 4.1 million in the TTM ended 3Q25. See Figure 4.

Similarly, the company’s occupancy rate, which is the percentage of hospital beds in service that are occupied by patients, increased from 55% in 2014 to 74% in the first nine months of 2025.

Figure 4: HCA Healthcare’s Equivalent Admissions: 2014 – TTM ended 3Q25

Sources: New Constructs, LLC and company filings

Capacity Expansion Supports Growth

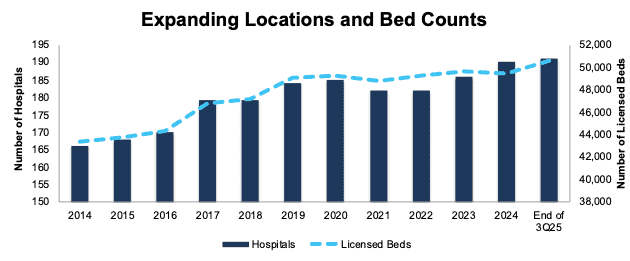

HCA Healthcare has consistently grown its hospital and bed count for over a decade, which allows the company to provide services to a larger population and treat more patients at one time. This expansion also helps HCA Healthcare maintain its position as the largest healthcare system in the U.S., both by hospital count and licensed bed count.

The company has grown its hospital count from 166 in 2014 to 191 at the end of 3Q25, while it increased its licensed bed count from over 43,000 to over 50,500 over the same time.

Figure 5: HCA Healthcare’s Hospital and Licensed Bed Count: 2014 – End of 3Q25

Sources: New Constructs, LLC and company filings

Expansion Continues

HCA Healthcare already has new hospital and facility plans in place to continue the expansion noted above. Recent projects include:

- a new 68-bed hospital in Clarksville Tennessee,

- a project to turn the Florida Gainesville emergency room into a full-service 90-bed hospital,

- an expansion to the Good Samaritan Hospital in San Jose California which will add 234 beds,

- an expansion to the Florida Palms West Hospital which will add 42 beds,

- an expansion to the Florida West Marion Hospital which added 40 beds,

- a new freestanding emergency room in Ocala Florida which will add 36 beds, and

- more committed projects taking place over the next few years.

Proven Quality Fundamentals

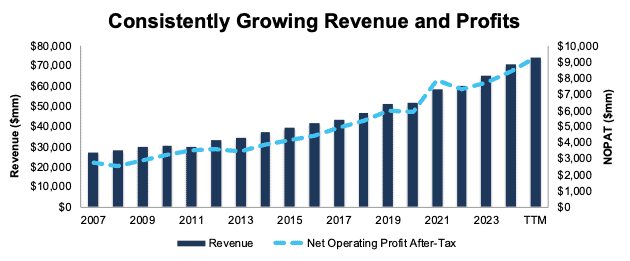

HCA Healthcare operates in an industry with growth tailwinds throughout all economic cycles. Management has successfully converted such steady and rising demand into revenue and profit growth across the years.

The company has grown revenue and net operating profit after-tax (NOPAT) by 6% and 7% compounded annually since 2007, respectively. See Figure 6.

Additionally, the company’s Core Earnings grew 14% compounded annually from $598 million in 2007 to $6.5 billion in the TTM ended 3Q25.

More recently, HCA Healthcare improved its NOPAT margin from 11.6% in 2019 to 12.5% in the TTM, while its invested capital turns increased from 1.4 to 1.5 over the same time. Rising NOPAT margin and invested capital turns drive the company’s return on invested capital (ROIC) from 16% in 2019 to 19% in the TTM.

Figure 6: HCA Healthcare’s Revenue and NOPAT: 2007 – TTM ended 3Q25

Sources: New Constructs, LLC and company filings

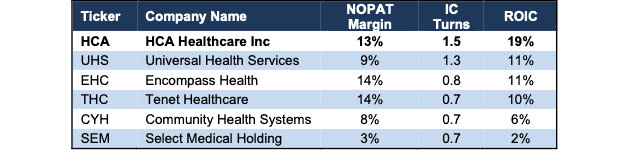

Industry Leader Through and Through

HCA Healthcare is not only the largest healthcare system in the U.S. by revenue and hospital count, but also the most profitable one by ROIC. In other words, through high operational and capital efficiency, HCA Healthcare leads in both scale and profitability.

Per Figure 7, HCA Healthcare’s ROIC and invested capital turns are higher than all other healthcare system companies, which include fellow Long Idea Universal Health Services (UHS), Encompass Health (EHC), Tenet Healthcare (THC), Community Health Systems (CYH), and Select Medical Holding (SEM).

Figure 7: HCA Healthcare’s Profitability Vs. Peers: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

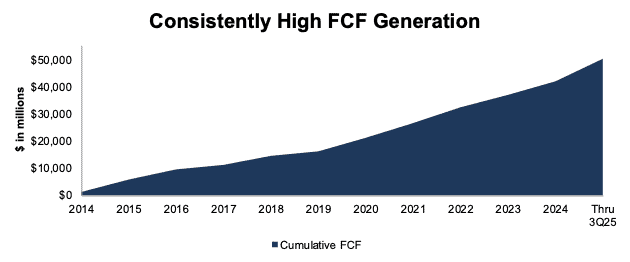

Significant Cash Flow Generation

HCA Healthcare has consistently generated large cash flows for over a decade. The company’s hasn’t recorded a negative free cash flow (FCF) in any fiscal year in our model, which dates to 2008.

The company generated a cumulative $50.4 billion (25% of enterprise value) in FCF from 2014 through 3Q25. See Figure 5. Over the TTM alone, HCA Healthcare generated $10.5 billion in FCF.

Figure 8: HCA Healthcare’s Cumulative Free Cash Flow Since 2014

Sources: New Constructs, LLC and company filings

Potential for 3.7%+ Yield

Since 2018, HCA Healthcare has paid $4.3 billion (4% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.35/share in 1Q18 to $0.72/share in 4Q25. The company’s current dividend, when annualized, provides a 0.6% yield.

HCA also returns capital to shareholders through share repurchases. From 2018 through 3Q25, the company repurchased $35.6 billion (34% of market cap) of shares. In the first nine months of 2025 alone, the company repurchased $7.5 billion of shares.

In January 2025, HCA Healthcare’s board of directors authorized a new $10 billion share repurchase program. As of September 30, 2025, HCA Healthcare has $3.3 billion of shares remaining under its existing repurchase authorization.

Should the company repurchase shares at its TTM repurchase rate, it would deplete its remaining repurchase authorization, which equals 3.1% of the current market cap.

When combined, the dividend and share repurchase yield could reach 3.7%.

It’s worth noting that HCA Healthcare is repurchasing slightly more shares than its FCF would allow. Since 2018, the company has repurchased shares and paid dividends worth $39.9 billion. Over the same time, the company generated $39.4 billion in FCF.

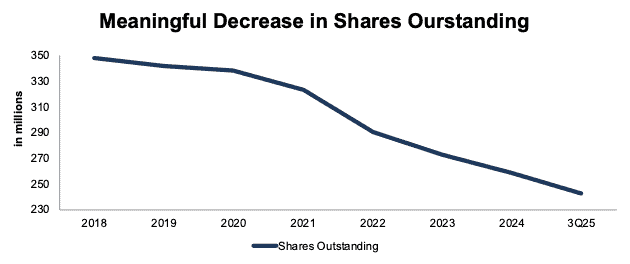

Shares Outstanding on the Decline

HCA Healthcare’s repurchases have meaningfully reduced its shares outstanding from 347 million in 2018 to 243 million at the end of 3Q25. See Figure 9.

We like companies that choose to return capital to shareholders instead of spending it on costly acquisitions or executive bonuses that rarely drive shareholder value creation. Companies that sport strong enough cash flows to consistently lower their shares outstanding, like HCA Healthcare, offer excellent value.

Figure 9: HCA Healthcare’s Shares Outstanding: 2018 – 3Q25

Sources: New Constructs, LLC and company filings

What’s Not Working

Labor Costs Will Remain a Challenge Across the Industry

The shortage of healthcare workers has been a concern across the healthcare industry over the last couple of years. McKinsey projects the global healthcare worker shortage to reach 10 million by 2030.

In the U.S., the American Hospital Association (AHA) projects a nurse assistant shortage of 73,000 and a critical health care worker shortage of 100,000 by 2028, despite projections for a slight registered nurse surplus over the same time.

With ongoing shortages, the labor costs remain a challenge for the entire healthcare industry. However, the most profitable companies, namely HCA Healthcare and Universal Health Services, have proven their ability to effectively manage costs while maintaining profit growth.

HCA Healthcare’s salaries and benefits expense as a percentage of revenue fell from 46% in 2020 to 44% in the TTM ending 3Q25.

Even if the labor costs were to rise again, any deterioration in HCA Healthcare’s profit margin is already priced into its current stock price, as we’ll show below.

Current Price Implies No Profit Growth

At its current price of $472/share, HCA’s price-to-economic book value (PEBV) ratio is 1.0. This ratio means the market expects the company’s NOPAT to never grow from TTM levels. Such an expectation looks overly pessimistic given that the company has grown NOPAT by 8% compounded annually over both the past five and ten years.

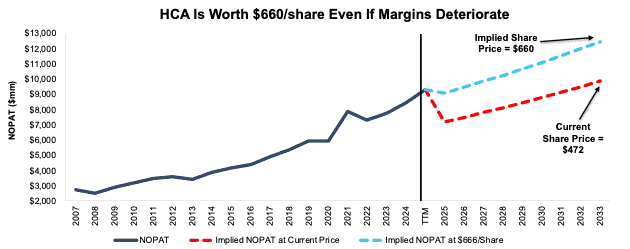

Below, we use our reverse discounted cash flow (DCF) model to quantify the cash flow expectations for different stock price scenarios for HCA.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 9.5% (below TTM margin of 12.5% and 10-year average of 11.6%) from 2025 to 2034,

- revenue grows at consensus estimates in 2025 (7%) and 2026 (5%), and

- revenue grows 4% (below 5- and 10-year CAGR of 7%) each year thereafter through 2034, then

the stock would be worth $475/share today – nearly equal to the current stock price. In this scenario, HCA Healthcare’s NOPAT would grow just 2% compounded annually from 2025 – 2034. For reference, the company has grown NOPAT 7% compounded annually since 2007 (earliest data available). Contact us for the math behind this reverse DCF scenario.

Shares Could Go 40%+ Higher at Consensus Growth

If we instead assume HCA Healthcare’s:

- NOPAT margin immediately falls to 12.0% (still below TTM margin of 12.5%) through 2034,

- revenue grows at consensus estimates in 2025 (7%) and 2026 (5%), and

- revenue grows 4% (below 5- and 10-year CAGR of 7%) each year thereafter through 2034, then

the stock would be worth $660/share today – a 40% upside to the current price. In this scenario, HCA Healthcare’s NOPAT would grow just 4% compounded annually through 2034. Contact us for the math behind this reverse DCF scenario. Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside.

Figure 10 compares HCA Healthcare’s implied future NOPAT in these scenarios to its historical NOPAT.

Figure 10: HCA’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

This article was originally published on November 5, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.