One of the biggest losers from the Mag 7 this earnings season is Nvidia (NVDA). We called the top for NVDA back in August 2024 and are not surprised to see it fall precipitously after reporting excellent earnings. The narrative that valuation does not matter is being disproved before our very eyes – along with many other false narratives that have plagued our society. If you’ve been following our reports on the company’s stock, you would know that the recent drop in price is still not nearly enough to make the stock attractive.

NVDA is not alone. Crowded trades and overvalued stocks are everywhere. Good stocks are harder and harder to find as the market was hitting new highs. Accordingly, we see opportunity in market pull backs. We see a golden era for stocks over the next couple of years as markets exorcise more false narratives (remember NFTs…haha) and embrace fundamentals again.

Meanwhile, our proven-superior research continues to give you an edge in finding good stocks. We work harder and smarter with our Robo-Analyst AI to scour the markets and the data to identify the stocks, ETFs and mutual funds with the best risk/reward. Our track record proves our research works. The only question is when, not if, you want to raise your game and enjoy the benefits of our research like our other clients.

We previously made HCA Healthcare Inc (HCA: $320/share) a Long Idea in June 2020, and have reiterated our bullish view on the stock many times. See all our reports on HCA Healthcare here. Since our original report, HCA has outperformed as a Long Idea by 137%, rising 224% while the S&P is up 87%. Even after outpacing the overall market, HCA Healthcare remains a strong business and Very Attractive stock.

HCA offers favorable Risk/Reward based on the company’s:

- consistent top- and bottom-line growth,

- growing patient and hospital numbers,

- strong position as the industry leader,

- high dividend and share repurchase yields on shares, and

- cheap stock valuation.

What’s Working

Consistently Growing Fundamentals

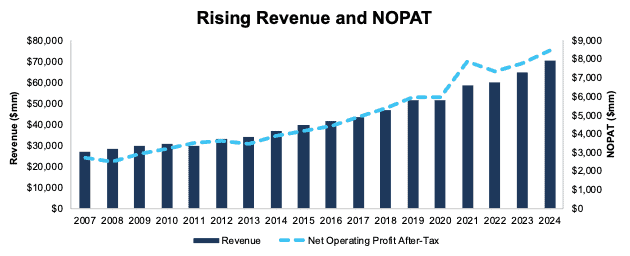

HCA Healthcare has steadily grown its top- and bottom-line since 2007.

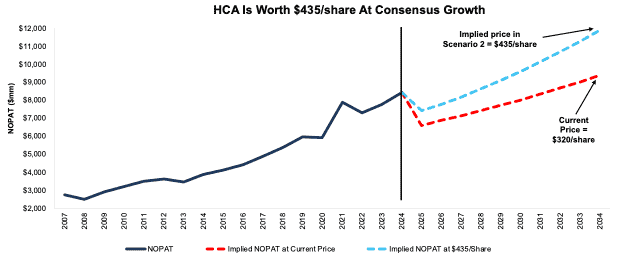

HCA Healthcare has grown revenue by 6% and net operating profit after-tax (NOPAT) by 8% compounded annually since 2007. See Figure 1. The company has improved its NOPAT margin from 10.2% in 2007 to 11.9% in 2024 while increasing invested capital turns from 1.32 to 1.48 over the same time. Rising operational and capital efficiency drive return on invested capital (ROIC) from 13% in 2007 to 18% in 2024.

Figure 1: HCA Healthcare’s Revenue and NOPAT Since 2007

Sources: New Constructs, LLC and company filings

Patient Admissions and Hospital Locations on the Rise

Year-over-year (YoY) in 2024, HCA Healthcare’s:

- same facility revenue increased 7.9%

- same facility admissions increased 4.9%

- same facility inpatient surgical volumes increased 2.2%

- same facility emergency room visits increased 4.9%

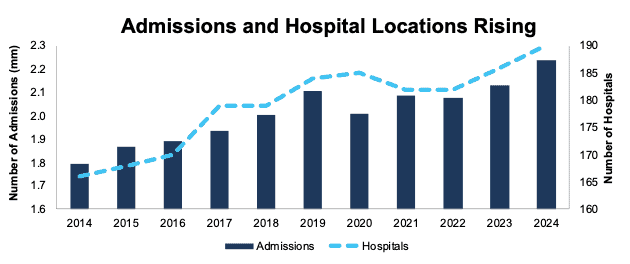

Longer-term, the company has grown its admissions (general measure of inpatient volume) YoY in 8 out of the last 10 years.

HCA Healthcare’s total admissions grew from 1.8 million in 2014 to 2.2 million in 2024, or 2% compounded annually. Over the same time, the company has expanded the number of hospitals it operates from 166 to 190. See Figure 2.

Figure 2: HCA Healthcare’s Number of Admissions and Hospitals: 2014 – 2024

Sources: New Constructs, LLC and company filings

Medical Spending Tailwinds

Hospital operators, such as HCA Healthcare, benefit from consistent, and long-term, tailwinds of an aging population and rising healthcare costs.

In 2022, 17% of the U.S population was 65 years or older. That percentage is expected to increase to 22% by 2040. The population of those aged 85+ is also expected to double from 2022 to 2040.

As populations age, healthcare spending increases. In fact, per capita healthcare spending for those aged 65-84 is 1.6x higher than those aged 45-64 and 3.1x higher than those aged 19-44.

Rising spend from an aging population drives projections for continued growth in hospital spending. According to the Peterson KFF Health System Tracker, the annual hospital spending is expected to grow:

- 4.8% in 2025

- 4.6% in 2026

- 5.9% in 2027

- 5.7% in 2028

- 5.8% in 2029

- 5.4% in 2030

- 5.3% in 2031

- 5.4% in 2032

With its industry leading position and superior profitability (more on that below), HCA Healthcare is well-positioned to capitalize on steady growth in healthcare spending for years to come.

Attractive Dividend and Repurchase Yield

Since 2018, HCA Healthcare has paid $3.8 billion (5% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.35/share in February 2018 to $0.72/share in March 2025. The company’s current dividend, when annualized, provides a 0.8% yield.

HCA also returns capital to shareholders through share repurchases. From 2018 through 2024, the company repurchased $28.1 billion (34% of market cap) of shares. $16.9 billion of this repurchase activity occurred from 2022-2024.

In January 2025, HCA Healthcare’s board of directors authorized a new $10 billion share repurchase program. Management noted in the 4Q24 earnings call that they “anticipate completing a significant portion in 2025.”

Should the company repurchase shares at its 2024 rate, it would repurchase $6.0 billion of shares in 2025, which equals 7.3% of the current market cap. When combined, the dividend and share repurchase yield could reach 8.1%.

Long Track Record of Quality Cash Flow Generation

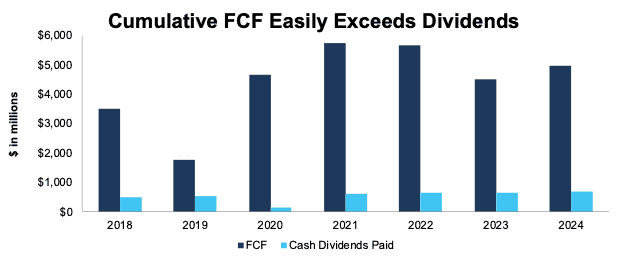

HCA generates enough free cash flow (FCF) to cover both its share repurchases and regular dividend payments. From 2018 to 2024, HCA generated $30.9 billion in FCF while paying $3.8 billion in dividends and $28.1 billion in repurchases, for total capital return of $31.9 billion. We like companies that choose to return so much capital to shareholders instead of spending it on executive bonuses or acquisitions. See Figure 3.

Figure 3: HCA Healthcare’s Free Cash Flow Vs. Cash Dividends Paid: 2018 Through 2024

Sources: New Constructs, LLC and company filings

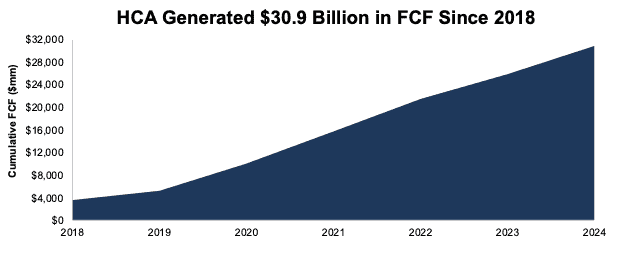

HCA Healthcare has generated positive free cash flow (FCF) in every year of our model on an annual basis. On a quarterly basis, the company has generated positive FCF in 46 of the past 52 quarters. Since 2018, HCA Healthcare generated $30.9 billion (23% of enterprise value) in FCF. See Figure 4.

Figure 4: HCA Healthcare’s Cumulative FCF Since 2018

Sources: New Constructs, LLC and company filings

Proven Industry Leader

HCA Healthcare was the most profitable healthcare company amongst its peers when we originally wrote our Long Idea report, and it remains #1 today. It is also the largest hospital operator by revenue and number of locations.

HCA Healthcare’s ROIC and invested capital turns are higher than all peers, while the company’s NOPAT margin surpasses all but one of its publicly traded competitors. Competitors in this analysis include Encompass Health (EHC), Tenet Healthcare (THC), Universal Health Services (UHS), and more, per Figure 5.

Figure 5: HCA Healthcare’s Profitability Vs. Peers: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

What’s Not Working

Skilled Labor Is Hard to Come by in Healthcare

Skilled labor in the healthcare industry remains in short supply. Job satisfaction for Registered Nurses (RN) and Advanced Practice Registered Nurses (APRN) remains low since COVID-19 due to increased levels of stress and excessive work hours. Many nurses also left the workforce after Covid. Worse yet, a significant segment of the nursing workforce is nearing retirement age, while too few new nurses are entering the workforce.

According to the American Association of Colleges of Nursing (AACN), nursing enrollment is not growing fast enough to meet the projected demand for RN and APRN services. Hiring enough labor continues to be a headwind for the whole healthcare industry, including HCA. However, the company is taking steps to recruit and retain quality employees. In the 4Q24 earnings call, management noted that employee engagement is “at an all-time high”, which has allowed the company to “reduce turnover and improve the capabilities of our facilities with having continuity and staffing…” Furthermore, the company continues to hire nurses from Galen College, one of the largest nursing schools in the U.S., in which HCA Healthcare acquired a majority stake in 2020.

Unknown Costs of Tariffs

The cost of goods is rising, and the potential for newly administered tariffs to drive costs even higher remains a risk for many companies. In the 4Q24 earnings call, HCA Healthcare management noted that they’ve been working on tariff mitigation strategies for years to manage the cost of supplies needed to operate its hospitals. Importantly, management noted that in 2025, 70% of its supplies are already contracted with firm pricing, which could help mitigate any increased supply cost when and if mass tariffs are enacted.

Importantly, HCA Healthcare is already priced as if tariffs and labor costs will hurt the business and result in deteriorating profitability. Management’s ability to mitigate these challenges creates increased upside in shares, as we’ll show below.

Shares Are Pricing in Zero Growth

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for HCA. At its current price, HCA’s price-to-economic book value (PEBV) ratio is 1.0, which means the market expects its NOPAT to never grow from current levels. For context, HCA has grown its NOPAT by 8% compounded annually since 2014 and 7% compounded annually since 2007.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 9% (equal to lowest ever NOPAT margin vs.12% in 2024 and average of the past five years) through 2034, and

- revenue grows at 4% a year through 2034 (compared to 7% compounded annually in the last five and ten years) then

the stock is worth $319/share today – nearly equal to the current stock price. For reference, the revenue growth in this scenario would be below consensus expectations of 5.7% growth in 2025 and 5.1% growth in 2026. In this scenario, HCA’s NOPAT grows just 1% compounded annually from 2025 – 2034, which is well below historical growth rates.

Shares Could Go 36%+ Higher at Consensus Growth Rates

If we instead assume:

- NOPAT margin immediately falls to 10% through 2034,

- revenue grows at consensus rates in 2025 (5.7%), 2026 (5.1%), and 2027 (5.3%), and

- revenue grows at 2027 consensus rate (5.5%) each year thereafter through 2034, then

the stock is worth $435/share today – a 36% upside to the current price. In this scenario, HCA’s NOPAT would grow 4% compounded annually from 2025 to 2034. Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside.

Figure 6: HCA Healthcare’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article was originally published on February 27, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.