Rarely do we find multiple stocks in the same industry that we consider compelling Long Ideas.

Rarely doesn’t mean never, and this week, we’ve done just that. Through our forensic Robo-Analyst AI analysis of 3,300+ stocks, we’ve identified a cluster of great stocks in the Consumer Cyclicals sector. Despite the overall sector earning a Neutral rating, we’re featuring a Very Attractive-rated ETF within the sector.

Each of these companies operates in the same industry, which is a subset of the Consumer Cyclicals sector.

We’re not giving you the tickers from this report, but we are happy to share our hard work because we want you to see how good our research is. Always let us know how we can provide more value to you.

We hope you enjoy this excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

A Very Attractive ETF With Quality Holdings

This ETF gives investors exposure to this highly profitable industry without the need to buy individual stocks or allocate to the entire Consumer Cyclicals sector or overall market, both of which are not as highly rated.

Our analysis of the ETF and the S&P 500, as measured by State Street SPDR S&P 500 ETF Trust (SPY), reveals that the ETF allocates more capital to profitable companies with cheaper valuations.

Per Figure 1 in the full report, the ETF allocates 53% of its assets to Attractive-or-better rated stocks compared to just 8% for SPY. On the flip side, the ETF allocates just 12% of its assets to Unattractive-or-worse rated stocks compared to 58% for SPY.

This ETF Is Better than the Consumer Cyclicals Sector, Too

This ETF’s index tracking avoids many of the Unattractive-or-worse rated stocks within the Consumer Cyclicals sector.

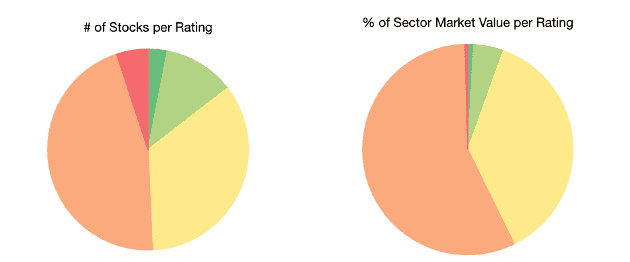

Per Figure 3, 85% of the 453 stocks in the Consumer Cyclicals sector earn a Neutral-or-worse rating. These stocks make up 94% of the market cap in the entire Consumer Cyclicals Sector.

50% of stocks earn an Unattractive-or-worse rating and make up 57% of the market cap in the sector.

As noted in the report, just 12% of this ETF’s assets are in stocks with Unattractive-or-worse ratings.

Figure 3: Consumer Cyclicals Sector Stock Rating Distribution

Sources: New Constructs, LLC and company filings

On the flip side, just 15% of the stocks in the overall Consumer Cyclicals sector, which make up just 6% of the sector’s market cap, earn an Attractive-or-better rating. Meanwhile, this ETF allocates 53% of its assets to Attractive-or-better rated stocks.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this pick to outperform.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.