Earnings season and economic news got you feeling flipped upside down? NASDAQ’s website shows 108 companies reported earnings on 1/29/25 and another 119 on 1/30/25. Throw in the latest GDP data and the Fed’s newly cautious approach to rate cuts moving forward, and it’s enough datapoints to make your head spin.

Looking for ideas you can trust during earnings season? We’ve got you covered.

We cut through the cheerleading and hype from the media and Wall Street. We dig past the headiness with the first and best AI for investing. Our proven-superior Stock Ratings find undervalued gems even in a market filled with overvalued stocks.

We work harder and smarter than all the other research firms, and we’d like the opportunity to prove it to you by sharing some free stock research on this week’s Long Idea.

There are not many good stocks left in the market these days. Did you know less than 4% of our coverage universe gets a Very Attractive Rating? Only ~9% more get an Attractive Rating.

This week’s Long Idea is one of those few. We first made D.R. Horton (DHI: $144/share) a Long Idea in April 2020 and most recently reiterated our thesis on the stock in January 2024. See all reports on DHI here. Since our original report, the stock is up 242% while the S&P 500 is up 111%.

Our thesis highlighted D.R. Horton’s long track record of profit growth, healthy balance sheet, top-tier profitability and return on invested capital (ROIC), and its leadership in affordable homes. Today, our thesis remains intact, and the stock remains undervalued.

DHI offers favorable Risk/Reward based on the company’s:

- market share leadership,

- diversified offerings,

- top-tier profitability, and

- cheap stock valuation.

What’s Working

Still the Industry Leader

The housing industry, despite the ongoing deficit of available homes and, in particular, affordable homes has recently been dogged by consumer’s hesitance to purchase, in large part due to high interest rates and inflation.

However, as the largest homebuilder in the U.S. for the last 23 years, D.R. Horton is able to leverage its diverse product offerings, coupled with incentives and lower home sale prices, to continue to grow its market share.

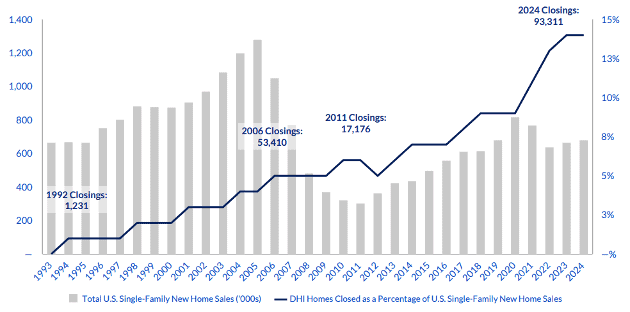

In 2024, the company closed more than 93,000 homes, compared to just under 91,000 in 2023 and just under 18,000 in 2011.

Figure 1: D.R. Horton’s Rising Market Share: 1993 – 2024

Sources: New Constructs, LLC and company filings

As of the end of 2024, D.R. Horton builds approximately one out of seven new single-family homes in the U.S.

The company ranks as the largest homebuilder in five of the top seven U.S. housing markets and in 61 of the 125 markets in which it operates. As the clear industry leader, D.R. Horton is well-positioned to benefit should rates decline and affordability rise.

Scale and Profitability

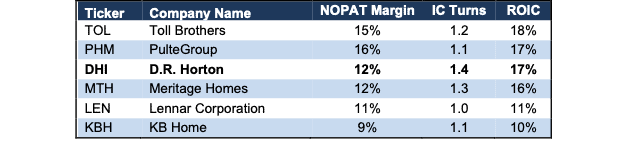

D.R. Horton also operates one of the most efficient companies in the homebuilder industry. It combines both scale and profitability.

Over the trailing twelve months (TTM), the company is tied for the second highest return on invested capital (ROIC) compared to its publicly-traded peers. To achieve such an ROIC, D.R. Horton is particularly efficient with its balance sheet, as it has the highest invested capital turns of its peer group, which includes PulteGroup (PHM), Meritage Homes (MTH), Toll Brothers (TOL), Lennar (LEN), and KB Home (KBH), as shown in Figure 2.

Figure 2: D.R. Horton’s Profitability Vs. Peers – TTM

Sources: New Constructs, LLC and company filings

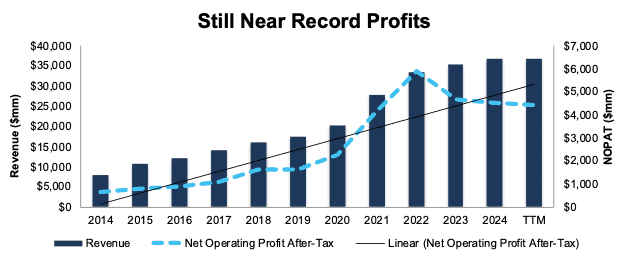

Profits Remain Strong

D.R. Horton has grown revenue and net operating profit after-tax (NOPAT) by 16% and 21% compounded annually, respectively, since fiscal 2014. The company’s NOPAT margin improved from 8% in fiscal 2014 to 12% in the trailing-twelve-months (TTM), while invested capital turns increased from 1.1 to 1.4 over the same time. Rising NOPAT margins and invested capital turns drive the company’s ROIC from 9% in fiscal 2014 to 17% in the TTM. See Figure 3. Even though NOPAT has fallen after a record 2022, D.R. Horton’s TTM NOPAT is still higher than any annual period in company history outside of fiscal 2022-2024.

Figure 3: D.R. Horton’s Revenue and NOPAT: Fiscal 2014 – TTM

Sources: New Constructs, LLC and company filings

Attractive Dividend and Repurchase Yield

Since fiscal 2018, D.R. Horton has paid $2.1 billion (5% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.13/share in February 2018 to $0.40/share in February 2025. The company’s current dividend, when annualized, provides a 1.1% yield.

While D.R. Horton has consistently increased its dividend, the bulk of capital returned to shareholders comes through share repurchases. From fiscal 2018 through fiscal 1Q25, the company repurchased $7.0 billion (15% of market cap) worth of shares. It would appear management believes the stock is cheap at current levels, as $5.2 billion of these repurchases have occurred since fiscal 2022. In fiscal 1Q25, the company repurchased $1.1 billion, which is up from $377 million in fiscal 1Q24. On the 1Q25 earnings call, management noted that “as our stock price declined during the quarter, we accelerated some of our planned share repurchases.”

In July 2024, D.R. Horton’s Board of Directors authorized a $4 billion share repurchase program with no expiration date. As of December 2024, there are $2.5 billion remaining under the current authorization. Management noted on the 1Q25 earnings call that it expects to repurchase $2.6 and $2.8 billion in 2025. Netting out the $1.1 billion repurchased in 1Q25, this statement implies the company will repurchase and additional $1.6 billion (based on the midpoint repurchase estimate) in 2025. A $1.6 billion repurchase is 3.5% of the current market cap, and when combined with the dividend yield, could provide investors a 4.6% yield on shares.

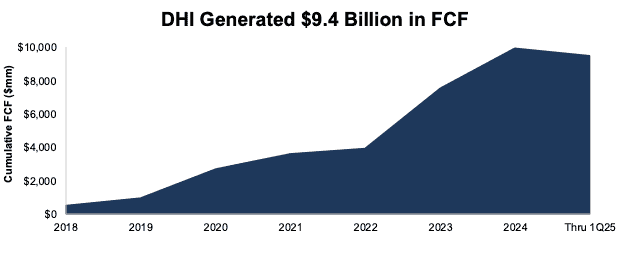

Strong Cash Flow Generation

Best of all, D.R. Horton’s free cash flow (FCF) easily exceeds its regular dividend payments. From fiscal 2018 through fiscal 1Q25, the company has generated $9.4 billion in FCF while paying $2.1 billion in dividends. Combined, the company has repurchased shares and paid dividends worth $9.1 billion over the same time.

D.R. Horton has generated a cumulative $9.4 billion in free cash flow (FCF), which equals 21% of its enterprise value. The company’s large and rising FCF shows the company’s ability to grow while running one of the most profitable businesses in the industry even when margins are being pressured.

Figure 4: D.R. Horton’s FCF: Fiscal 2018 – Fiscal 1Q25

Sources: New Constructs, LLC and company filings

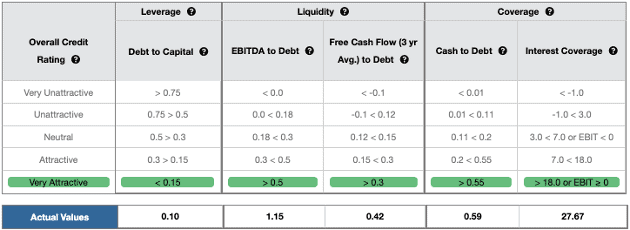

Strong Balance Sheet and Credit Rating

One of the reasons D.R. Horton can maintain its industry leading position throughout economic cycles is its strong balance sheet. D.R. Horton earns a Very Attractive Overall Credit Rating, and all five criteria that drive our Credit Ratings also score Very Attractive . Even if economic conditions deteriorate, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 5: D.R. Horton’s Credit Rating Details

Sources: New Constructs, LLC and company filings

What’s Not Working

Margins Continue to Be Squeezed

D.R. Horton continued to use incentives and lower home sale prices to attract buyers in 2024, as persistently high interest rates make home affordability more difficult. While these actions spur higher demand and address affordability, they also impact the company’s margins. The company’s reported annual home sales gross margin has fallen from 27% in fiscal 1Q22 to 23% in fiscal 1Q25. NOPAT margins follow a similar trend.

Going forward, management says “incentive costs are expected to increase further on homes closed over the next few months so we expect our home sales gross margin to be lower in the second quarter compared to the first quarter”, so margin pressure will not abate in the near-term.

Labor Uncertainty Persists

The construction industry is well-known as one of the largest employers of undocumented workers. It remains to be seen how President Trump’s focus on illegal immigration and ongoing deportations will impact the construction sector as a whole, and D.R. Horton’s management is taking a cautious approach. At the moment, management notes that they’re “seeing good access” to the labor they need and that they don’t expect to “see much inflation in either [labor or parts] over the next 12 months.” Management further notes that they’ve had to handle shifting immigration in the past and would expect any impact to be more regional rather than “sweeping across our entire footprint.”

Shares Have More Upside

The good news for investors is that D.R. Horton doesn’t need to improve margins for its stock to hold potential upside. At its current price, D.R. Horton’s price-to-economic book value (PEBV) ratio is 1.0, which means the market expects its NOPAT to never grow from current levels.

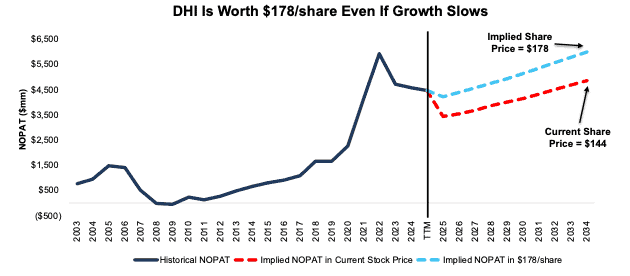

Below, we use our reverse discounted cash flow (DCF) model to quantify the cash flow expectations for different stock price scenarios for D.R. Horton.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin falls to 9% (versus 13% average over the past five years and 12% over the TTM) through fiscal 2034, and

- revenue grows 4% compounded annually through fiscal 2034 (compared to 16% compounded annually over the last decade and 6% compounded annually over the last two decades), then

the stock would be worth $144/share today – nearly equal to the current stock price. In this scenario, D.R. Horton’s NOPAT grows just 1% compounded annually through fiscal 2034. For reference, D.R. Horton has grown NOPAT by 21% compounded annually over the past 10 years and 8% compounded annually over the past two decades.

Shares Could Go 24%+ Higher

Even if we assume:

- NOPAT margin falls to 11% (below 12% in the TTM) from fiscal 2025 – fiscal 2034 and

- revenue grows at 4% (compared to consensus estimates of 7% in 2025 & 2026 and 5% in 2027) a year through fiscal 2034, then

the stock would be worth $178/share today – a 24% upside to the current price.

In this scenario, D.R. Horton’ NOPAT grows just 3% compounded annually through fiscal 2034. Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside. See Figure 6.

Figure 6: D.R. Horton’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article was originally published on January 30, 2025.

Disclosure: David Trainer owns DHI. David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.