We closed this Long Idea on September 11, 2025. A copy of the associated Position Close report is here.

As the MOMO, YOLO, and BTFD days sink deeper into the past, we remind investors to focus on fundamentals. Fundamental research might seem boring, but it is the only way to find companies that generate real profits and have stocks that carry less risk. Boring investments can be very rewarding.

Johnson & Johnson (JNJ: $185/share) is one of this week’s Long Ideas. The other Long Idea is CarMax (KMX: $88/share), which we cover in a separate report here.

Fundamentals Are as Important as Now as Ever

In the midst of economic uncertainty and market volatility, investors should make sure – now more than ever – their portfolios are filled with companies that generate Core Earnings and trade at cheap valuations.

After years of pouring easy money into popular growth companies, the market is no longer tolerating bottom-line losses no matter how strong the top-line growth.

Investors should focus on companies with the following characteristics, regardless of the economic outlook:

- consistent Core Earnings growth

- high return on invested capital (ROIC) compared to peers

- rising economic earnings

- strong free cash flow (FCF)

- low price-to-economic book value (PEBV)

JNJ Outperformed Pharmaceuticals ETF by 33%

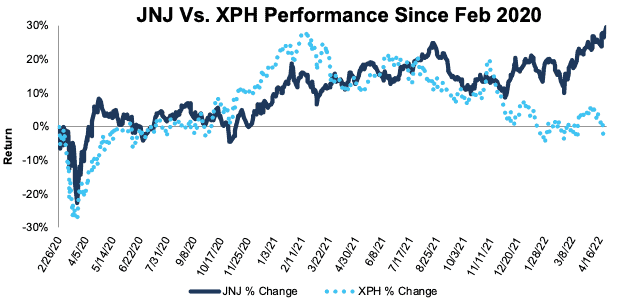

We made Johnson & Johnson a Long Idea on February 26, 2020 and since then JNJ is up 30% compared to a 3% decline for pharmaceutical-focused SPDR S&P Pharmaceuticals ETF (XPH).

Figure 1: Price Performance: JNJ Vs. XPH Since 2/26/20

Sources: New Constructs, LLC and company filings

History of Strong Core Earnings Growth

Johnson & Johnson’s scale and diversified business greatly reduce the risk generally involved when investing in pharmaceutical stocks heavily dependent on a handful of products and clinical trials. Since 1998 (earliest date of our model), Johnson & Johnson has generated positive Core Earnings each year and Core Earnings have grown 8% compounded annually over the same time.

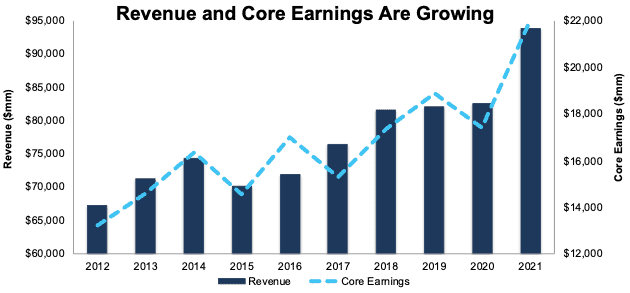

Per Figure 2, over the past decade, Johnson & Johnson’s Core Earnings rose from $13.2 billion in 2012 to $22.0 billion in 2021.

Figure 2: Johnson & Johnson’s Revenue and Core Earnings Since 2012

Sources: New Constructs, LLC and company filings

Johnson & Johnson Generates Strong FCF

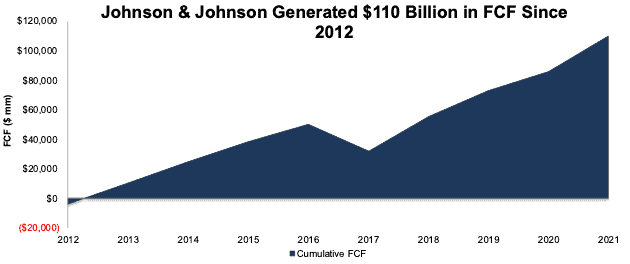

Johnson & Johnson generates significant FCF, which is a critical in the pharmaceutical industry given the need to front massive research and development costs. In 2021, Johnson & Johnson’s research and development expense rose 20% year-over-year (YoY) to $14.7 billion. Over the past decade, Johnson & Johnson generated $110.1 billion (23% of market cap) in FCF. The company’s current FCF yield of 5% dwarfs the 1% FCF yield of SPDR S&P Pharmaceuticals ETF and the 2% FCF yield of the S&P 500, as measured by the State Street SPDR S&P 500 ETF (SPY).

Figure 3: Johnson & Johnson’s Cumulative FCF Since 2012

Sources: New Constructs, LLC and company filings

Economic Earnings Are Amongst the Best

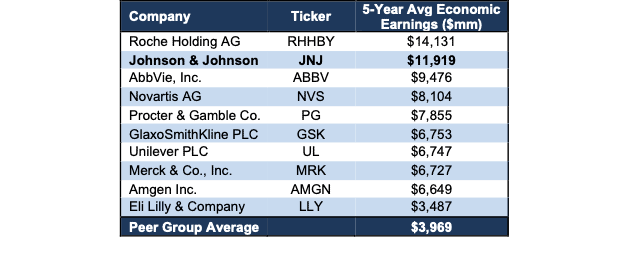

Johnson & Johnson’s ROIC of 15% is higher than XPH’s ROIC of 11%. The company’s high ROIC contributes to its strong economic earnings. Over the past five years, Johnson & Johnson generated more economic earnings than 20 of 21 publicly traded pharmaceutical, medical device, and consumer health companies in its peer group[1].

Per Figure 4, Johnson & Johnson’s five-year average economic earnings are second only to Roche Holding (RHHBY) and are nearly three times higher than the peer group average.

Figure 4: Johnson & Johnson’s Economic Earnings Vs. Peers: Five-Year Average

Sources: New Constructs, LLC and company filings

Spinoff Creates a More Focused and Profitable Company

In November of 2021, Johnson & Johnson announced plans to spin off its consumer health segment, which raised concerns that the company will become overly concentrated in the remaining lines of business. We view the risk from the increase in business concentration as more than offset by the benefits of focusing resources on where its competitive advantages – and profits - are greatest. Consumer health accounted for 16% of total revenue in 2021, but just 6% of total income before tax. After the segments separate, Johnson & Johnson expects pharmaceutical sales to account for ~65% of total revenue compared to 56% in 2021.

While the company’s reported earnings before tax rose from $17.7 billion in 2017 to $22.8 billion in 2021, earnings before tax from the consumer health segment fell from $2.5 billion to $1.3 billion over the same time. By separating the consumer health segment from the rest of the business, Johnson & Johnson hopes to become even more profitable over the long run.

After the separation, Johnson & Johnson will remain a highly diversified business. The company’s pharmaceutical and medical devices segments are focused on ten different therapeutic and product areas, the largest of which, Oncology, accounts for just ~19% of total revenue.

Long-term Tailwinds Will Drive Pharmaceutical Demand

Favorable demographic and health insurance coverage trends will drive continued demand for pharmaceuticals over the long run. The population in the U.S. is aging, and that trend will drive increased healthcare expenditures, including pharmaceuticals, for individuals 65 and over. In the U.S., the number of individuals 65 and over is expected to grow from 54 million in 2020 to 65 million by 2025.

Additionally, the growing number of people covered by health insurance contributes to higher healthcare expenditures. The number of people in the U.S. with health insurance rose from 244 million in 2001 to ~301 million in 2021 and is expected to reach ~319 million[2] in 2030.

A Strong Performer in Multiple Environments

Though threats of government price controls pressure Johnson & Johnson’s stock, the company has proven to profitably operate in a variety of political environments. After Medicare Part D went into effect on January 1, 2006, Johnson & Johnson received $615 million of revenue from the plan while improving its NOPAT margin improved from 19% in 2005 to 20% in 2007.

Since the Affordable Care Act was passed into law in 2010, Johnson & Johnson’s NOPAT margins rose from 21% in 2009 to 23% in 2021 as the company’s NOPAT grew 67%. Even if more governmental healthcare policies are enacted, it is not a given that they would negatively impact Johnson & Johnson’s profits.

JNJ Has 32%+ Upside If Consensus Is Correct

Johnson & Johnson’s PEBV ratio of 0.9 means the stock is priced for profits to permanently fall 10% below 2021 levels. Such an assumption seems overly pessimistic, given the company grew NOPAT by 5% compounded annually over the past decade.

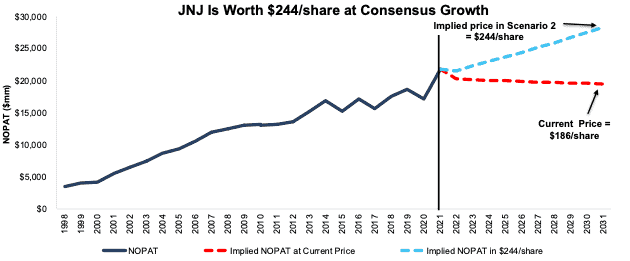

Below we use our reverse discounted cash flow (DCF) model to analyze two future cash flow scenarios and highlight the upside potential in Johnson & Johnson’s current stock price.

DCF Scenario 1: to Justify the Current Stock Price of $186/share.

If we assume Johnson & Johnson’s:

- NOPAT margin falls to 21.7% (five-year average vs. 23.2% in 2021) in 2022 – 2031 and

- revenue falls by 0.2% (vs. 2022 – 2024 consensus estimate CAGR of +3%) compounded annually from 2022 – 2031, then

the stock is worth $185/share today – equal to the current stock price. In this scenario, Johnson & Johnson earns $19.5 billion in NOPAT in 2031, which is 10% below its 2021 NOPAT.

DCF Scenario 2: Shares Are Worth $244+

If we assume Johnson & Johnson’s:

- NOPAT margin falls to 22.3% (three-year average) from 2022 – 2031, and

- revenue grows at a 3% CAGR from 2022 – 2031 (equal to consensus estimate CAGR from 2022 – 2024), then

the stock is worth $244/share today – a 32% upside to the current price. In this scenario, Johnson & Johnson’s NOPAT grows just 3% compounded annually for the next decade. For reference, Johnson & Johnson grew NOPAT at a 5% CAGR from 2011 – 2021. Should Johnson & Johnson’s NOPAT grow in line with historical growth rates, then the stock has even more upside.

Figure 5 compares Johnson & Johnson’s historical NOPAT to its implied NOPAT in each of the above DCF scenarios.

Figure 5: Johnson & Johnson’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on April 27, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] AbbVie, Inc. (ABBV), Amgen Inc. (AMGN), AstraZeneca (AZN), Boston Scientific Corp (BSX), Bristol Myers Squibb Company (BMY), Colgate-Palmolive Company (CL), Eli Lilly & Company (LLY), GlaxoSmithKline PLC (GSK), Intuitive Surgical, Inc. (ISRG), Medtronic Plc (MDT), Merck & Co. (MRK), Novartis AG (NVS), Pfizer Inc. (PFE), Procter & Gamble Co. (PG), Roche Holding AG (RHHBY), Sanofi S.A. (SNY), Smith & Nephew PLC (SNN), Stryker Corporation (SYK), The Cooper Companies, Inc. (COO), Unilever PLC (UL), and Zimmer Biomet Holdings, Inc. (ZBH).

[2] Derived from the Centers for Medicare & Medicaid Services (CMS) forecasted 2030 insured rate of 89.8% and the Census Bureau’s 2030 population projection of 355 million.