We closed ABC on June 22, 2023. A copy of the associated Position Close report is here.

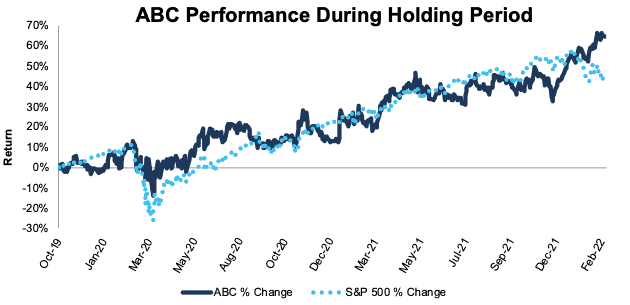

We made AmerisourceBergen Corp (ABC: $141/share) a Long Idea in October 2019. Since then, the stock has gained 64% while the S&P 500 is up just 41%. Even after its outperformance, the stock has 30%+ upside and could be worth at least $182/share today.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to pick this Long Idea.

ABC Has More Upside After Outperformance Based on:

- Being well-positioned to benefit from several trends that will drive long-term growth of pharmaceutical sales.

- Contracts with its two largest customers reduces customer-concentration risk.

- The acquisition of Alliance Healthcare will create more shareholder value.

- The company’s stock is priced as if profits will permanently fall 10% below TTM levels.

Figure 1: Long Idea Performance: From Date of Publication Through 2/22/2022

Sources: New Constructs, LLC

What’s Working

Long-term Trends Favor the Pharmaceutical Industry: Several favorable trends will drive continued demand for pharmaceuticals such as:

- Aging population: In the U.S., the number of individuals 65 and over is expected to exceed 65 million by 2025. Healthcare costs rise exponentially in individuals 65 and over.

- Industry R&D Spending Creates Demand: the large amount of industry spending in research and development (R&D) means the industry will continue to offer new products, thereby creating demand for AmerisourceBergen’s distribution services.

- Growing Access to Healthcare: The growing number of people covered by health insurance contributes to higher healthcare expenditures, including pharmaceuticals. The number of people in the U.S. covered with health insurance rose from 244 million in 2001 to 298 million in 2020.

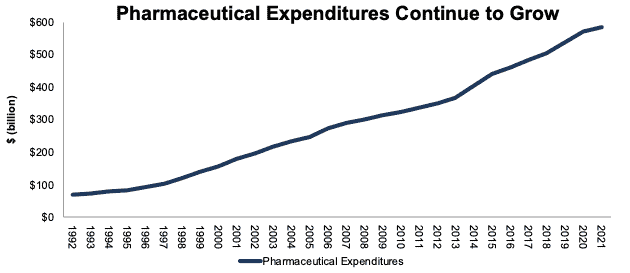

These long-term trends have pushed pharmaceutical expenditures higher for decades and are likely to do so going forward. Per Figure 2, pharmaceutical expenditures in the U.S. have steadily grown over the past 30 years, from $68 billion in 1992 to $585 billion in 2021, or 8% compounded annually. The relatively low-cost nature of pharmaceuticals compared to the cost of other healthcare treatments means insurance companies and governments are likely to place greater emphasis on drug therapies as they seek to lower healthcare costs. Pharmaceutical expenditures account for just ~10% of total healthcare costs.

Figure 2: 30-Years of U.S. Pharmaceutical Expenditures: 1992 – 2021

Sources: New Constructs, LLC and FRED

Long-term Contracts Reduce Business Risk: AmerisourceBergen extended distribution agreements in 2021 with its two largest customers, which accounted for 43% of the company’s fiscal 2021 revenue. The company will continue to distribute pharmaceuticals to Walgreens’ (WBA) through 2029 and Express Scripts, a subsidiary of Cigna (CI) through 2026. By extending these two significant customers’ contracts, AmerisourceBergen reduces the risk of large disruption to its Core Earnings, which have grown from $1.3 billion in fiscal 2017 to $1.8 billion over the trailing-twelve-months (TTM).

Acquisition Creates Value: AmerisourceBergen’s acquisition of Alliance Healthcare from Walgreen’s in fiscal 3Q21 broadens the company’s global network as it expands its footprint in Europe. The acquisition looks to already be creating shareholder value as well. The company’s economic earnings rose from $234 million in fiscal 4Q21 to $342 million in fiscal 1Q22. In fact, the company’s economic earnings in fiscal 1Q22 rose 34% year-over-year.

What’s Not Working

Pandemic Boost Will Fade: AmerisourceBergen played a key role in the distribution of vaccines and therapeutics during the pandemic. As COVID-19 becomes endemic to the population, demand for vaccines and therapeutics is likely to wane. However, increased expenditures in other areas of healthcare should offset the effects of declining demand for COVID vaccines and subsequent treatments.

Litigation Risk: The company is involved in large litigation regarding its role in the opioid crisis. Though the company believes it can reasonably estimate the cost of the litigation settlement – $6.7 billion, complications in the settlement process, or a higher settlement amount would not be favorable for the stock. As of its fiscal 1Q22 earnings release, 46 of 49 states, all 5 U.S. territories, and Washington D.C. had agreed to the proposed settlement involving AmerisourceBergen, Cardinal Health (CAH), and McKesson (MCK).

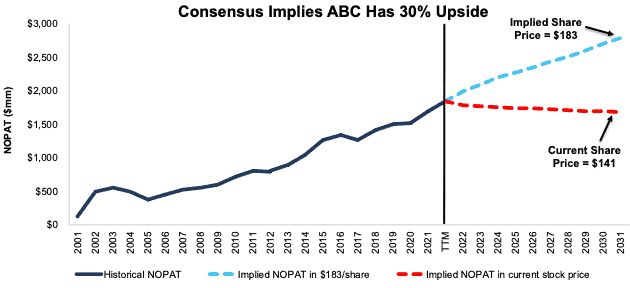

AmerisourceBergen Is Priced for Profits to Fall 10% Below TTM Levels

AmerisourceBergen’s price-to-economic book value (PEBV) ratio of 0.9 means the stock is priced for profits to fall, permanently, by 10% from TTM levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for AmerisourceBergen.

In the first scenario, we assume AmerisourceBergen’s:

- net operating profit after tax (NOPAT) margin stays at 0.8% (equal to TTM, vs. 10-year average of 0.9% TTM) from fiscal 2022 – 2031, and

- revenue falls by 1% (vs. fiscal 2022 – 2024 consensus CAGR of +7%) compounded annually from fiscal 2022 – 2031

In this scenario, AmerisourceBergen’s NOPAT falls by <1% compounded annually from fiscal 2022 – 2031 and the stock is worth $141/share today – equal to the current price. In this scenario, AmerisourceBergen’s NOPAT in fiscal 2031 is just $1.7 billion, or 9% below TTM levels.

AmerisourceBergen’s Shares Could Reach $183 or Higher

If we assume AmerisourceBergen’s:

- NOPAT margin stays at 0.8% from 2022 – 2031,

- revenue grows at a 7% (equal to consensus) CAGR from fiscal 2022 – 2024, and

- revenue grows by 3.5% compounded annually from fiscal 2025 – 2031, then

the stock is worth $183/share today – 30% above the current price. In this scenario, AmerisourceBergen’s NOPAT CAGR from fiscal 2022 – 2031 is just 5%. For comparison, AmerisourceBergen grew NOPAT by 8% compounded annually from fiscal 2011 to fiscal 2021. Should AmerisourceBergen grow NOPAT more in line with historical growth rates, the stock has even more upside.

Figure 3: AmerisourceBergen’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on February 23, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.