The U.S. GDP grew 3% in the second quarter of 2025, which exceeded expectations. However, tariff uncertainty clouds the headline growth figure. The majority of the improvement was driven by a large decline in imports, particularly after a record surge in imports in 1Q25.

One area that hasn’t slowed, regardless of the headlines or tariff polices: Artificial Intelligence. Companies are still investing billions in the space, each hoping to carve out their place in the trillion-dollar industry. NVIDIA (NVDA), often considered a measuring stick for broad AI, is up 30%+ year-to-date. Anthropic is reportedly raising $5 billion in a new round of funding that would value the company at $170 billion, up from $62 billion earlier this year.

With billions flowing into the industry and driving up valuations, there couldn’t possibly be any stocks in the AI space that still look cheap, right? Wrong.

Our latest Long Idea is a great example of the edge that our superior fundamental research provides. This company is an industry leader, benefits from AI tailwinds, has strong fundamentals, and its stock looks undervalued.

We originally made Photronics (PLAB: $21/share) a Long Idea in October 2023 and most recently reiterated our thesis in February 2024. While PLAB is down 16% over the last year, our thesis on this stock remains intact and upside potential remains strong.

PLAB offers favorable Risk/Reward based on the company’s:

- position to profit from AI-driven tailwinds,

- shifting revenue mix to higher value products,

- high profitability, and

- cheap stock valuation.

What’s Working

AI Is Driving Photomask Demand

As a leading photomask manufacturer, Photronics is well-positioned to profit from the photomask demand growth driven by advancements in each of these three key areas:

- chip technology – smaller integrated circuits require higher value photomasks,

- capacity expansions – more chips mean higher photomask demand, and

- consumer electronics – improved screens and more (advanced) chips drive photomask demand.

SEMI projects global semiconductor manufacturing capacity to grow 7% compounded annually from the end of 2024 through 2028.

Additionally, according to the Semiconductor Industry Association (SIA), global semiconductor sales grew 20% year-over-year in May 2025 and 3.5% month-over-month (MoM).

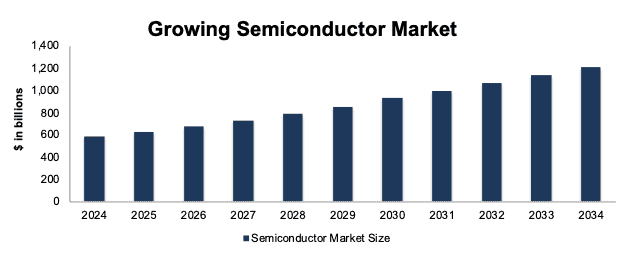

Longer-term, the global semiconductor market will grow 8% compounded annually from 2025 to 2034, according to Precedence Research. The long-term outlook for semiconductor demand indicates Photronics will have ample growth opportunities.

Figure 1: Global Semiconductor Market Size: 2024 – 2034

Sources: Precedence Research and New Constructs, LLC

Advanced chipmaking catered to the growing needs of AI applications is a key driver of the projected semiconductor market and capacity growth. AI chips require increased computational abilities, specialized processes, and specific energy needs. Advanced semiconductor technology demand is expected to remain strong, as AI (and its specific chips) gets integrated at a rising rate across many consumer electronics, from phones to computers, vehicles and smart devices (such as smart speakers).

Increasingly Positioned to Take Advantage of the AI Boom

Many technology companies are rushing to take advantage of growing AI demand, from producing the hardware to creating AI products. Photronics capitalizes on the AI boom across industries.

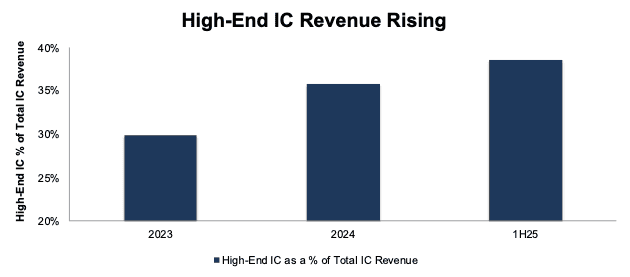

More specifically, Photronics produces two types of photomasks for integrated circuits (“IC”): high-end and mainstream. AI-driven technologies require the high-end photomasks (with IC nodes at 28 nanometers or smaller) and represent a key tailwind for Photronics’ growth.

These high-end products require more photomasks per design and generate higher average selling prices per mask set.

Historically, mainstream IC photomasks have, and continue to, make up a majority of the company’s IC photomask revenue mix.

However, Photronics has grown its high-end business from 30% of overall IC revenue in fiscal 2023 to 39% of IC revenue in the first half of fiscal 2025 (1H25). See Figure 2.

Figure 2: High-End IC Revenue as % of IC Revenue: Fiscal 2023 – 1H25

Sources: New Constructs, LLC and company filings

Geographic Footprint Minimizes Tariff Impact

Photronics operates 11 production facilities across Asia, the United States, and Europe. These facilities are located close to customers, which allow Photronics to more quickly collaborate and build products that meet its customer’s needs.

These locations also create a tariff advantage, especially after “Liberation Day”, when President Trump announced tariffs against individual countries.

On one hand, with three facilities in the United States, Photronics stands to benefit from the reshoring of semiconductor production. To maximize the benefit, Photronics is expanding its capacity and capabilities in the United States through strategic investments.

For those customers that aren’t reshoring production, Photronics allocates production across its facilities to ship “the majority of masks” directly to customers in the same region or country where the photomasks are produced, which mitigates the potential tariff costs for its customers.

In the company’s 2Q25 earnings call, management noted that the impact of tariffs on its supply chain “will have a negligible impact” to its financial results.

Quality Fundamentals

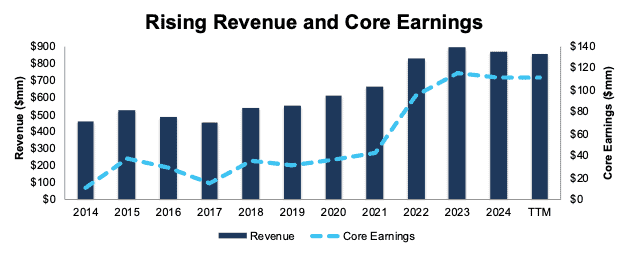

Apart from industry tailwinds and growing competitive advantages, Photronics has also grown revenue and Core Earnings, a superior metric of earnings, by 6% and 25% compounded annually since fiscal 2014, respectively. See Figure 3.

The company improved its net operating profit after-tax (NOPAT) margin from 5% in fiscal 2014 to 19% in the TTM while invested capital turns increased from 0.5 to 0.6 over the same time. Rising NOPAT margins and invested capital turns drive return on invested capital (ROIC) from 2% in fiscal 2014 to 12% in the TTM.

Additionally, the company’s NOPAT grew 21% compounded annually from $22 million in fiscal 2014 to $163 million in the TTM.

Figure 3: Photronics’ Revenue and Core Earnings Since Fiscal 2014

Sources: New Constructs, LLC and company filings

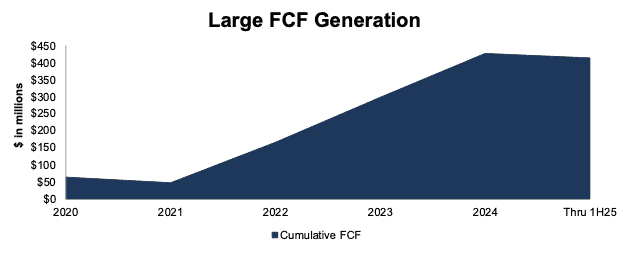

Strong Cash Flow Generation

We believe Photronics can continue to repurchase shares because of its large free cash flow (FCF). From fiscal 2020 through fiscal 2Q25, Photronics generated $415 million in FCF, which equals 37% of the company’s enterprise value.

Photronics’ $415 million in FCF since fiscal 2020 is more than enough to cover its $145 million in share repurchases.

Figure 4: Photronics’ Cumulative FCF: Fiscal 2020 – TTM

Sources: New Constructs, LLC and company filings

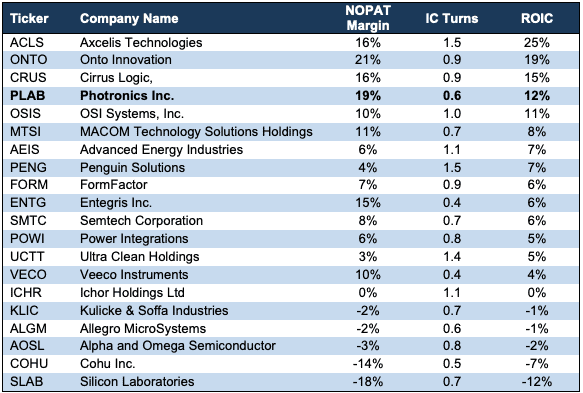

Industry Leading Profitability

Photronics, with its position as an industry leader, is also one of the most profitable companies in the industry.

Most of Photronics’ competitors are private or trade outside the United States. As a result, we compare the company’s profitability to the peers listed in its proxy statement.

Per Figure 5, Photronics has the second highest NOPAT margin and the fourth highest ROIC among its peers, which include Cirrus Logic (CRUS), FormFactor (FORM), Power Integrations (POWI), Entegris (ENTG), Kulicke & Soffa Industries (KLIC), and more.

Figure 5: Photronics’ Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings

Potential Repurchase Yield of 1.8%

Photronics currently doesn’t pay any dividends but does return capital to shareholders through share repurchases.

From September 2020 through October 2022, the company repurchased $68 million of shares. In August 2024, the company’s Board of Directors authorized an increase to the share repurchase program, which allows the company to repurchase up to $100 million of shares.

In the six-months ended May 4, 2025 (fiscal 1H25), the company repurchased $77 million (6% of market cap) of shares. As of May 4, 2025, $23 million of shares remained under the current authorization. Should the company repurchase shares at its fiscal 1H25 rate, it would exhaust the remaining authorization, which equals 1.8% of the current market cap.

Should the company’s Board authorize additional repurchases, the repurchase yield could be even higher.

What’s Not Working

Ongoing Tension with China Creates Uncertainty

Tariff uncertainty, especially about China, looms large for many international operators. In the first half of fiscal 2025, Photronics earned 27% of its revenue in China.

Investors are waiting for any announcement regarding an extension of the ongoing tariff pause between the U.S. and China. Without an extension, tariff rates will rise to Liberation Day highs and would likely impact trade between the two countries in a material way. Meanwhile, should President Trump extend the current pause, or sign a long-term deal, the uncertainty in the market would dissipate quickly.

However, as we mentioned earlier, we don’t expect tariffs to impact Photronics’ business in a material way, thanks to the company’s diversified geographic footprint.

Customer Concentration Risk

In fiscal 2024, Photronics generated 36% of its revenue from three customers. This concentration should not be a big concern, given that the semiconductor industry is very top heavy, but it is worth noting.

If any issues were to arise, either with a customer’s ability to operate or the relationship between the customer and Photronics, the impact could be material. Prudent investors should account for this risk when valuing PLAB.

The good news for investors is that Photronics’ stock price already implies a permanent drop in profits, as we’ll show below.

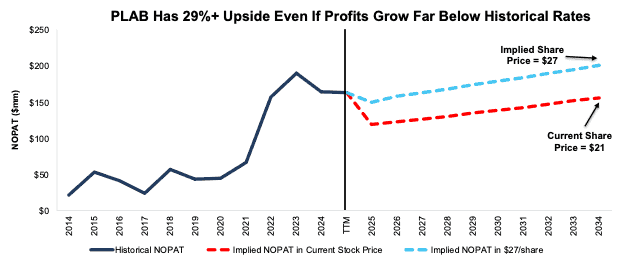

Current Price Implies Profit Permanently Declines by 20%

At its current price of $21/share, PLAB has a price-to-economic book value (PEBV) ratio of 0.8. This ratio means the market expects the company’s profits to permanently decline 20% from TTM levels. For context, Photronics has grown NOPAT by 27% compounded annually over the last five years and 21% compounded annually over the last decade.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for PLAB.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 13% (below five-year average of 15% and TTM NOPAT margin of 19%) through 2034, and

- revenue grows 3% a year through 2034 (compared to 8% CAGR over the last five years and 6% CAGR over the last decade) then

the stock would be worth $21/share today – equal to the current stock price. In this scenario, Photronics’ NOPAT would fall 1% compounded annually from 2025 – 2034, which is far below the company’s historical NOPAT growth rates. Contact us for the math behind this reverse DCF scenario.

Shares Could Go 29%+ Higher at Consensus Growth Rates

If we instead assume:

- NOPAT margin falls to 18% (below TTM NOPAT margin of 19%) through 2034,

- Revenue grows at consensus estimates in 2025 (-4%) and 2026 (6%), and

- revenue grows 3% a year through 2034 (compared to 8% CAGR over the last five years and 6% CAGR over the last decade) then

the stock would be worth $27/share today – a 29% upside to the current price. In this scenario, Photronics’ NOPAT would grow just 2% compounded annually through fiscal 2034, which would still be below the company’s historical growth rates dating back to 1998. Contact us for the math behind this reverse DCF scenario.

Should NOPAT grow closer to historical rates, the upside would be even larger.

Figure 6 compares Photronics’ historical NOPAT to the NOPAT implied in each of the above scenarios.

Figure 6: Photronics’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article was originally published on July 30, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.