We have updated the trailing-twelve-month (TTM) Core Earnings and GAAP Earnings for the NC 2000 and all sectors for 1Q24.

Results for Core Earnings and GAAP earnings are different again this quarter and raise red flags about the quality of reported earnings. These results underscore the more stable nature of Core Earnings. Because we remove unusual gains and losses, Core Earnings are not as volatile as GAAP Earnings.

This report is an abridged and free version of All Cap Index & Sectors: GAAP Vs. Core Update for 1Q24, one of our quarterly reports on fundamental market and sector trends.

The full version of the report analyzes Core Earnings[1][2] and GAAP earnings of the NC 2000 and each of its sectors (last version of this analysis is here) from 1998 to present. The full reports are available to Institutional members.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

GAAP Earnings Are Again Misleading in 1Q24

Our superior fundamental data protects investors from being misled by false trends in un-scrubbed GAAP Earnings. The recent move in GAAP Earnings, the first in this direction since 4Q22, supports our belief that pockets of quality stocks remain in the market while many stocks look very overvalued. Core Earnings for the S&P 500 in the TTM ended 1Q24 sit at record highs going back to 2004.

We’ve seen in the past that companies understate GAAP earnings in uncertain times (kitchen sink effect) to set up easy comps moving forward. This phenomenon occurred most recently from 1Q22 through 4Q22, when GAAP earnings significantly understated Core Earnings. Could companies be in the early stages of kitchen sink quarters again? We’ll be watching closely to see if the fall in GAAP earnings continues in 2Q24 while Core Earnings continue to rise. See Figure 1 in the full report.

GAAP Earnings Understate Core Earnings for Nearly Two-Thirds of the NC 2000 (by Market Cap)

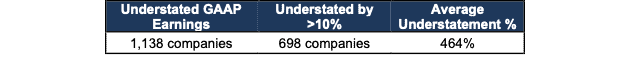

For the TTM ended 1Q24, 57% of the companies in the NC 2000 reported GAAP Earnings that are lower than Core Earnings.

When GAAP Earnings are lower than Core Earnings, they are understated by an average of 464%, per Figure 1.

Figure 1: NC 2000 GAAP Earnings Understated by 464% On Average

Sources: New Constructs, LLC and company filings.

We use Funds from Operations (FFO) for Real Estate companies rather than GAAP Earnings.

Key Details on Select NC 2000 Sectors

Seven of eleven sectors saw a QoQ rise in Core Earnings through the TTM ended 1Q24.

The Real Estate sector saw the largest QoQ improvement in Core Earnings.

The Technology sector generates the most Core Earnings. On the flip side, the Real Estate sector has the lowest Core Earnings.

Below we highlight the Industrials sector.

Sample Sector Analysis[3]: Industrials Sector

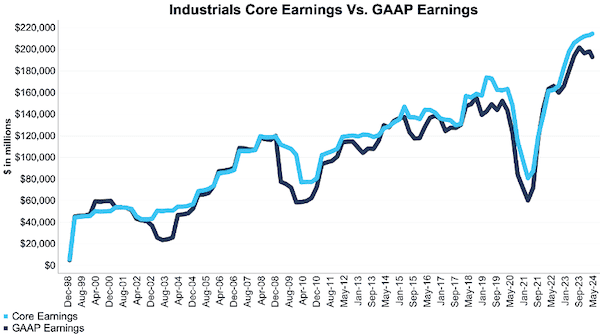

Figure 2 shows Core Earnings for the Industrials sector, at $214.4 billion, rose 1% QoQ in 1Q24, while GAAP earnings, at $193.0 billion, fell 3% over the same time.

Figure 2: Industrials Core Earnings Vs. GAAP: 1998 – 1Q24

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The May 16, 2024 measurement period incorporates the financial data from calendar 1Q24 10-Qs, as this is the earliest date for which all of the calendar 1Q24 10-Qs for the NC 2000 constituents were available.

This article was originally published on June 13, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

Appendix: Calculation Methodology

We derive the Core Earnings and GAAP Earnings metrics above by summing up the trailing-twelve-month individual NC 2000 constituent values for Core Earnings and GAAP Earnings in each sector for each measurement period. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

[1] Core Earnings enable investors to overcome the flaws in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan for The Journal of Financial Economics.

[2] Based on the latest audited financial data, which is the 1Q24 10-Q in most cases. Price data as of 5/16/24. QoQ analysis is based on the change since last quarter.

[3] The full version of this report provides analyses for all eleven sectors.