Our proven-superior research[1] earned us #1 rankings – again – on SumZero for August 2025.

For 50 consecutive months since May 2021, our stock picks have ranked #1 in multiple categories. 50 consecutive months of superior stock picking is no small feat, especially across so many categories:

- #1 in Consumer Discretionary

- #1 in Industrials

- #2 in Consumer Staples

- #7 in Micro Cap

- #9 in Healthcare

Our SumZero stock picks come from our Focus List Stocks: Long and Focus List Stocks: Short Model Portfolios, which feature our best stock picks.

From January 2021 through 2Q25, the Focus List Stocks: Long Model Portfolio has outperformed the S&P 500[2] by 10%, and the Focus List Stocks: Short Model Portfolio has outperformed shorting the S&P 500 by 37%.

Get the latest Focus List Stocks: Long here and Short here.

Professional members get updates to the Focus Lists in real time and get our research before syndication to SumZero and other platforms.

SumZero is an exclusive buy-side community with over 16,000 pre-screened professional portfolio managers that compete for these rankings.

Figure 1: Performance of Select Long Ideas on SumZero – Through 8/6/25*

| Company | Ticker | Publish Date | Outperformance Vs. S&P 500 |

| AutoZone Inc. | AZO | 11/4/20 | 170% |

| HCA Healthcare | HCA | 6/22/20 | 169% |

| D.R. Horton | DHI | 4/27/20 | 145% |

| JPMorgan Chase | JPM | 5/21/20 | 108% |

| Allison Transmission | ALSN | 6/15/20 | 29% |

Sources: New Constructs, LLC

*Performance on a price return basis, exclusive of dividends.

Figure 2: Performance of Select Danger Zone Picks on SumZero – Through 8/6/25*

| Company | Ticker | Publish Date | Outperformance as a Short Vs. S&P 500 |

| Eventbrite | EB | 9/24/18 | 211% |

| Lyft Inc. | LYFT | 3/12/19 | 208% |

| Peloton Interactive | PTON | 9/21/20 | 184% |

| Beyond Meat | BYND | 9/2/20 | 181% |

| AMC Entertainment | AMC | 4/12/21 | 150% |

Sources: New Constructs, LLC

*Performance on a price return basis, exclusive of dividends.

Check Out the Indices Based on New Constructs Research

While we’re writing about how our superior fundamental research finds winning stocks, we should highlight the indices we’ve developed with Bloomberg’s Index Licensing Group. All three are outperforming the S&P 500 over the past five years. See Figures 3-5.

- Bloomberg New Constructs Core Earnings Leaders Index (ticker: BCORET:IND)

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND)

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

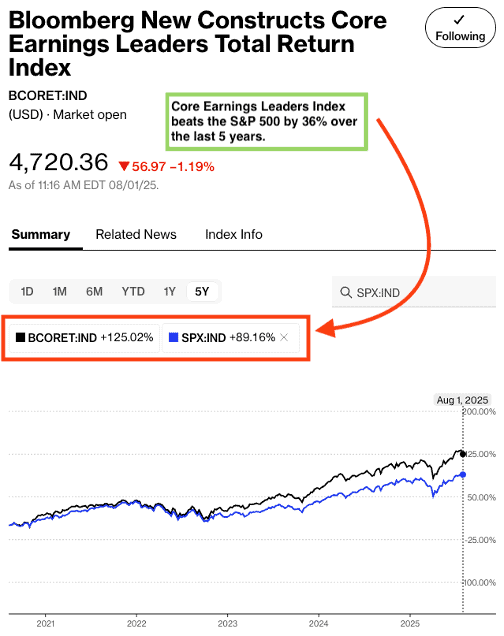

The Bloomberg New Constructs Core Earnings Leaders Index, which allocates based on Earnings Capture and Core Earnings, beat the S&P 500 by over 36% over the past five years. The Index (ticker: BCORET:IND) was up 125% while the S&P 500 was up 89%.

Figure 3: Bloomberg New Constructs Core Earnings Leaders Index Outperforms S&P 500: Last 5 Years

Sources: Bloomberg as of August 1, 2025

Note: Past performance is no guarantee of future results.

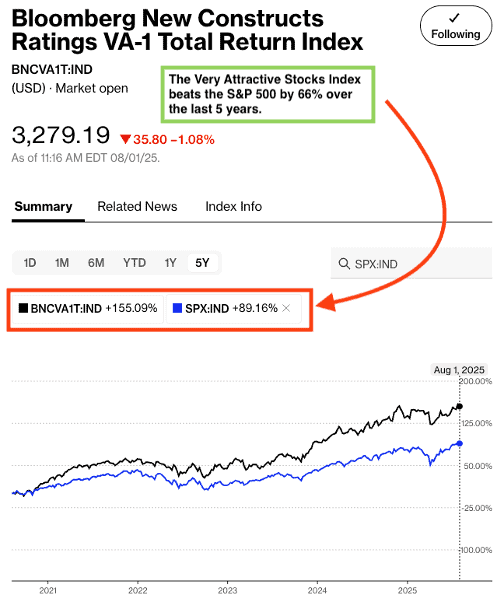

The “Very Attractive Stocks” Index, which allocates to stocks that get a Very Attractive rating by our AI Agent for Investing, beat the S&P 500 by 66% over the last five years. Bloomberg’s official name for the index is Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND). Figure 4 shows it was up 155% while the S&P 500 was up 89%.

Figure 4: Very Attractive-Rated Stocks Strongly Outperform the S&P 500: Last Five Years

Sources: Bloomberg as of August 1, 2025

Note: Past performance is no guarantee of future results.

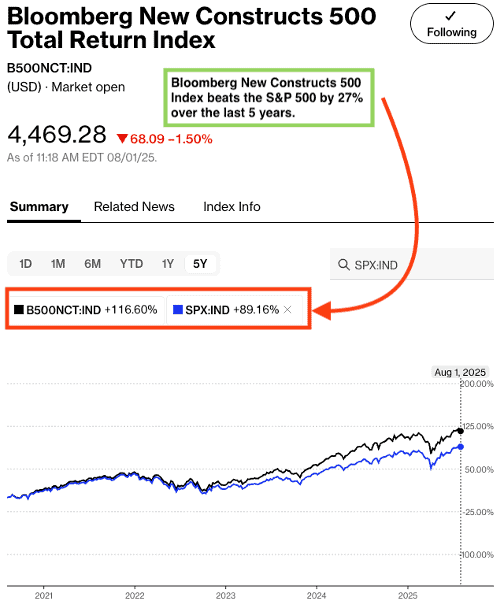

Our “Core-Earnings Weighted S&P 500” Index, which weights the largest 500 U.S. companies by Core Earnings instead of market cap, beat the S&P 500 by 27% over the past five years. Bloomberg’s official name for the index is Bloomberg New Constructs 500 Total Return Index (ticker: B500NCT:IND). Figure 5 shows it was up 117% while the S&P 500 was up 89%.

Figure 5: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500: Last Five Years

Sources: Bloomberg as of August 1, 2025

Note: Past performance is no guarantee of future results.

Note that these indices are not available to the public. The only way to build strategies that achieve this kind of outperformance based on superior fundamental data is to be a New Constructs member.

This article was originally published on August 7, 2025.

Disclosure: David Trainer owns DHI. Hakan Salt owns JPM. David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[2] Stocks are in the Focus List Model Portfolios for different periods of time as we open and close positions during the year. When measuring outperformance of the Focus List Model Portfolios, we compare each stock’s return to the S&P 500’s return for the time each is in the Focus List Model Portfolios. This approach provides more of an apples-to-apples comparison of how each stock performed vs. the S&P 500.