We published an update on this Danger Zone pick on August 16, 2021. A copy of the associated Earnings Update report is here.

Since its high-flying IPO at $46, this stock has soared to $135. With such strong momentum and triple-digit year-over-year revenue growth, traders may push this stock higher. However, the fundamentals reveal this stock is more style than substance. Fiduciaries should avoid Beyond Meat Inc. (BYND: $135/share).

While Beyond Meat’s stock performance is attractive to many momentum traders, investors with fiduciary responsibilities should consider the deteriorating fundamentals, weak prospects to compete at the scale of its competition, and the unrealistic increase in profits implied by the current valuation.

This report helps investors of all types see just how extreme the risk in BYND is based on:

- Slowing revenue growth

- More competition

- The lack of competitive advantages that nearly all competitors possess

- Doing the math: stock price implies huge increase in revenue/profits

Growth Will Slow Down, but Competitors Won’t

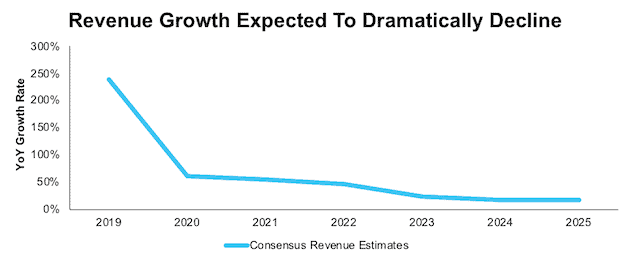

Beyond Meat’s massive revenue growth cannot last forever. The larger the firm gets, the more difficult it becomes to achieve large year-over-year (YoY) growth rates. Case in point, revenue grew 239% YoY in 2019, 141% YoY in 1Q20, and 69% YoY in 2Q20. Consensus estimates expect revenue will grow 61% YoY in 2020, and just 17% YoY by 2025, per Figure 1.

Going forward, Beyond Meat will find it even more difficult to grow revenue and profits as competitors flood the market.

Figure 1: Consensus Revenue Growth Estimates: 2020-2025

Sources: New Constructs, LLC and company filings.

2020-2025 revenue growth rates based on consensus estimates

Competition is Plentiful and Has Competitive Advantages

Attracted by Beyond Meat’s impressive growth rates and soaring market value, multiple competitors are entering the alternative meat industry. Tyson Foods (TSN), the largest meat producer in the U.S., sold its stake in Beyond Meat in April 2019 and just a few months later announced the launch of its plant-based protein brand, Raised & Rooted. Some of the largest consumer food brands have followed suit.

Below is a short list of some of Beyond Meat’s alternative meat competitors:

- Incogmeato by Morningstar Farms, owned by Kellogg Co. (K)

- Simply Plant-Based Meatless Burger, a SYSCO Corp. (SYY) exclusive product

- Simple Truth plant-based meat, owned by The Kroger Co. (KR)

- Sweet Earth Brand, owned by Nestle (NSRGY)

- Gardein, owned by ConAgra Foods (CAG)

- Happy Little Plants, owned by Hormel (HRL)

- Boca Foods, owned by Kraft Heinz (KHC)

- Impossible Foods, privately owned

- Lightlife Foods, owned by Maple Leaf Foods

This list is not exhaustive and doesn’t include any of the traditional meat products that continue to garner a large share of consumer dollars.

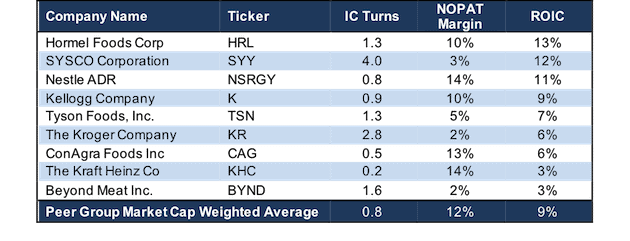

Beyond Meat’s profitability ranks at the bottom of this peer group. Per Figure 2, Beyond Meat’s NOPAT margin and return on invested capital (ROIC) are below each of the competitors listed above, and well below the market-cap-weighted average of all the Food Processing firms under coverage.

Low margins in an increasingly competitive industry leave Beyond Meat with less flexibility to compete on price or invest in marketing and R&D. Furthermore, many of the firms in Figure 2 have other key advantages – multi-year relationships and existing distribution networks with grocery stores and quick-serve restaurants such as Tyson, or in the case of Kroger, direct control of distribution and the end-consumer relationship.

Figure 2: Beyond Meat’s Profitability vs. Competitors

Sources: New Constructs, LLC and company filings

Serious Uphill Battle for Beyond Meat to Improve Profitability

Several of Beyond Meat’s competitors, including Hormel, Nestle, Kellogg, Tyson, Kroger, ConAgra, and Kraft Heinz, enjoy key competitive advantages:

- Shelf space – large amounts of space, which can be very difficult to acquire, especially from firms like Kroger who directly control shelf space allocation

- Production and distribution scale

- Marketing and advertising capacity – existing businesses generate lots of cash flow that enables these firms to spend much more on marketing and advertising than Beyond Meat

- Strong brand – decades-long relationships with consumers across multiple brands that engender the trust that enables quicker adoption of newer products

These advantages are very important and very difficult, if not impossible, for new entrants like Beyond Meat to match or overcome in the near term, if ever.

For example, without any existing shelf space, and only recently announcing an e-commerce platform, Beyond Meat must spend more on not only convincing consumers to try their products, but also on retailers to display their products. This additional expense, one that is much lower for many competitors (as they already have profitable business lines to offset any marketing of new products), makes it even more difficult for Beyond Meat to improve its profitability in such a competitive market.

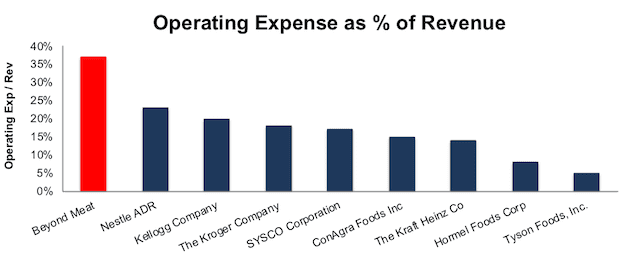

As Kroger invests further in its Simple Truth brand, we’d expect the firm to allocate more shelf space to its own in-house brands, rather than a competitor such as Beyond Meat. This competitive disadvantage only makes Beyond Meat’s path to sustainable profitability that much more difficult. Figure 3 shows Beyond Meat spends 37% of its revenue on operating expenses (SG&A, R&D, and restructuring costs), which is well above peers. Such high spending is not only unsustainable, but it also means Beyond Meat’s product must be more expensive than competitors’ products for the firm to turn a profit.

Figure 3: Operating Expense as % of Revenue: Beyond Meat vs. Competitors

Sources: New Constructs, LLC and company filings

While Beyond Meat’s SG&A (which includes marketing and advertising expenses) represents a large percentage of the firm’s TTM revenue, the firm’s total dollars spent on SG&A pales in comparison to larger competitors.

For instance, over the TTM, ConAgra spent 15 times more on SG&A than Beyond Meat. While comprising only 5% of its total revenue, Tyson outspent Beyond Meat’s SG&A by 20 times over the TTM. Considering these competitors are already supplying plant-based protein products, Beyond Meat faces an increasingly uphill battle to reach the size it needs to match the cost efficiencies of larger competitors like these two established firms.

The superior scale of Beyond Meat’s peers will also challenge what the firm believes to be a critical competitive advantage – its innovation. Beyond Meat will face difficulty maintaining an innovative edge over its peers, who already spend much more on research and development (R&D). Beyond Meat’s R&D in 2019 was just $21 million compared to $56 million for ConAgra and $97 million for Tyson over the same time.

These expenses, and the need to maintain them to support Beyond Meat’s already declining growth, illustrate that the firm is not approaching economies of scale anytime soon.

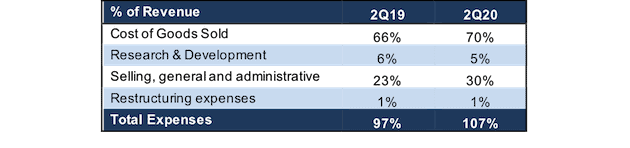

Per Figure 4, Beyond Meat’s operating expenses as a percent of revenue have actually increased over the past twelve months from 97% in 2Q19 to 107% in 2Q20.

Figure 4: Expenses as % of Revenue: Beyond Meat 2Q19 vs. 2Q20

Sources: New Constructs, LLC and company filings

Given that most plant-based protein products are now aiming for the same goal – imitating the taste and texture of meat – it stands to reason that as the plant-based protein market matures, differentiation between products will diminish as all products begin to taste more and more like meat.

As the industry becomes more commoditized, economies of scale will be even more important for firms seeking profitability, which doesn’t bode well for smaller firms such as Beyond Meat.

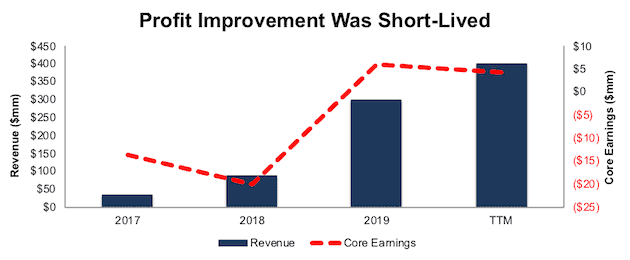

Recent Improvement in Profitability Was Short-Lived

Per Figure 5, Beyond Meat saw significant improvement in profitability in 2018, but the improvement was short lived. Though the firm’s revenue has improved from $298 million in 2019 to $401 million over the trailing-twelve-months, Beyond Meat’s core earnings[1] have fallen from $6 million to $4 million over the same time.

Figure 5: Beyond Meat’s Revenue & Core Earnings Since 2017

Sources: New Constructs, LLC, and company filings

Furthermore, Beyond Meat has a history of significant free cash flow (FCF) burn that is unlikely to change anytime soon. Over the past two years, the firm has burned a cumulative $179 million (2% of market cap) in FCF. Over the TTM period, FCF is -$164 million. At the end of 2Q20, Beyond Meat had $222 million of cash and cash equivalents on its balance sheet. At its TTM FCF burn rate, the firm has enough cash to operate for just over 16 months before needing additional capital.

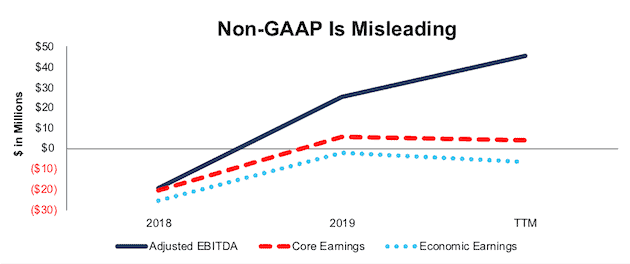

Non-GAAP Metrics Mislead Investors

Beyond Meat would rather investors focus on flawed non-GAAP metrics such as adjusted EBITDA, which allow management to remove real costs of the business and to paint a rosier view of profits.

Among the items Beyond Meat excludes when calculating its adjusted EBITDA are equity-based compensation, restructuring expenses, and a vague line item labeled “other”.

Over the TTM, Beyond Meat removed $23.7 million (6% of revenue) in share-based compensation and $7.5 million in restructuring expenses (2% of revenue) when calculating adjusted EBITDA. Over 2Q20, Beyond Meat removed $1.5 million (1% of revenue) in “other” expenses when calculating adjusted EBITDA.

Per Figure 6, Beyond Meat’s TTM adjusted EBITDA of $45 million is well above core earnings of $4 million. Economic earnings, which account for the unusual items on the income statement and changes to the balance sheet, are negative $6 million and declining over the TTM, even as adjusted EBITDA is positive and rising.

Figure 6: Beyond Meat’s Adjusted EBITDA Misleads on Profitability

Sources: New Constructs, LLC and company filings.

Doing the Math: Valuation Implies Significant Disruption of the Entire Meat Industry

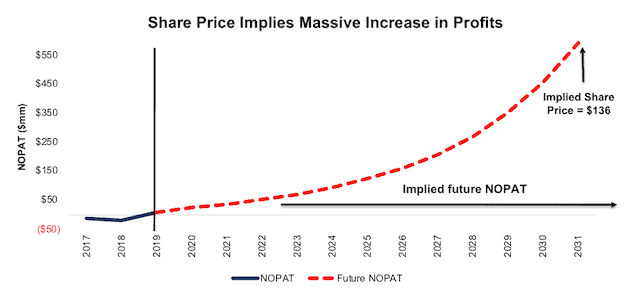

With low margins and little control over the majority of distribution, we think shares can fall sharply from current levels. When we use our reverse discounted cash flow (DCF) model to analyze the expectations implied by the stock price, BYND appears significantly overvalued.

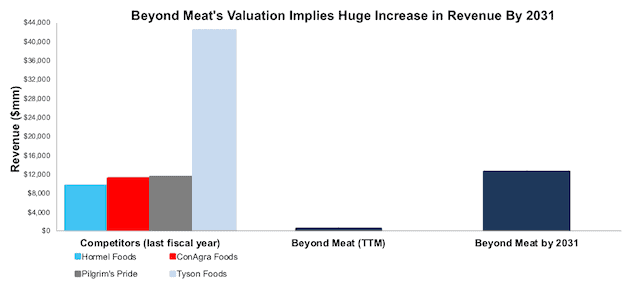

To justify its current price of $135/share, Beyond Meat must immediately improve its NOPAT margin to 5% (same as Tyson and more than double its current margin of 2%). In this scenario, Beyond Meat grows revenue by 37% compounded annually (which results in NOPAT growing 42% compounded annually) for the next 12 years. See the math behind this reverse DCF scenario. Figure 7 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 7: Current Valuation Implies Drastic Profit Growth

Sources: New Constructs, LLC and company filings.

In this scenario, Beyond Meat would earn ~$12.5 billion (slightly more than MarketsandMarkets’ 2019 estimated global plant-based meat market size of $12.1 billion) in revenue in 2031, compared to $401 million TTM. For comparison, this scenario implies Beyond Meat would generate more sales than incumbent competitors such as Pilgrim’s Pride (PPC), ConAgra Foods (CAG), and Hormel Foods (HRL) in their last fiscal years.

Furthermore, Beyond Meat’s current valuation implies it will generate sales equal to 29% of Tyson’s 2019 revenue – a level that places it as the sixth largest meat and poultry processor in the world in 2019. See Figure 8 for details.

Figure 8: Current Valuation Implies Massive Revenue Growth

Sources: New Constructs, LLC and company filings.

Significant Downside in a More Realistic Scenario

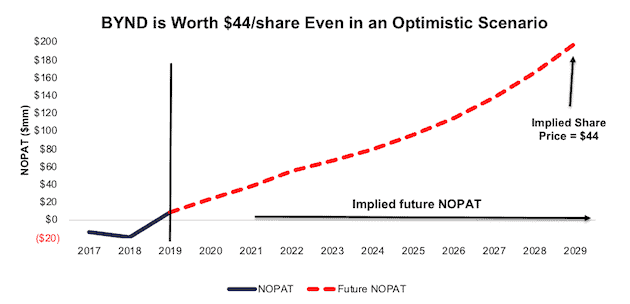

If Beyond Meat can improve its NOPAT margin to 5% (equal to Tyson’s TTM margin) and grow revenue at 61% in 2020, 55% in 2021, and 47% in 2022 (consensus estimates) and by 20% compounded annually thereafter, the stock has significant downside risk. In this scenario, Beyond Meat grows NOPAT by 36% compounded annually over the next decade and the stock is worth just $44/share – a 67% downside to the current price. See the math behind this reverse DCF scenario.

Figure 9 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 9: BYND Has Large Downside Risk: DCF Valuation Scenario

Sources: New Constructs, LLC and company filings.

Each of the above scenarios also assumes Beyond Meat is able to grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, Beyond Meat’s invested capital has increased by an average of $84 million (28% of 2019 revenue) over the past two years.

Acquisition Would Be Unwise

Often the largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and buys Beyond Meat at the current, or higher, share price despite the stock being overvalued. While we think a plethora of competitors have already developed a competing product, its plausible that a competitor could decide to buy Beyond Meat rather than continue building its own plant-based protein brand. However, given the low margins and overvalued stock price, we think it would be unwise for a larger firm to acquire Beyond Meat at current levels.

Even though the firm doesn’t necessarily hold logistical or technological advantages over its competitors, we think it helps to quantify what, if any, acquisition hopes are priced into the stock.

Walking Through the Acquisition Math

First, investors need to know that Beyond Meat has a large liability that makes it more expensive than the accounting numbers would initially suggest.

- $572 million in outstanding employee stock options (7% of market cap)

After adjusting for this liability, we can model multiple purchase price scenarios. For this analysis, we chose Kraft Heinz as a potential acquirer of Beyond Meat since it doesn’t have a pea-protein based product like Beyond Meat’s and has a history of acquisitions. While we chose Kraft Heinz, analysts can use just about any company to do the same analysis. The key variables are the weighted average cost of capital (WACC) and ROIC for assessing different hurdle rates for a deal to create value.

Even in the most optimistic of scenarios, Beyond Meat is worth less than its current share price.

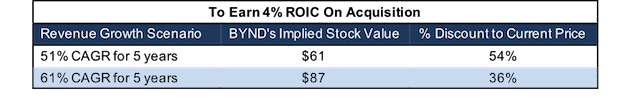

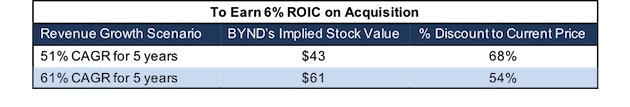

Figures 10 and 11 show what we think Kraft Heinz should pay for Beyond Meat to ensure it does not destroy shareholder value. There are limits on how much Kraft Heinz should pay for Beyond Meat to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In the first scenario, the estimated revenue growth rate is 61% in year one, 55% in year two, and 47% in year three, or equal to consensus. We assume revenue grows 47% in years four and five, the same as year three. In the second scenario, we use 61% growth (2020 consensus estimate) for all years to illustrate a best-case scenario where we assume Beyond Meat could grow revenue faster within the larger distribution network, resources, and customer base of Kraft Heinz.

We conservatively assume that Kraft Heinz can grow Beyond Meat’s revenue and NOPAT without spending any working capital or fixed assets beyond the original purchase price. We also assume Beyond Meat achieves an 8% NOPAT margin, which equals the average of Beyond Meat’s and Kraft Heinz’s TTM NOPAT margins. For reference, Beyond Meat’s TTM NOPAT margin is 2% and the TTM NOPAT margin of one of the largest food producers in the world, Tyson Foods, is 5%.

Figure 10: Implied Acquisition Prices for Value-Neutral Deal

Sources: New Constructs, LLC and company filings

Figure 10 shows the implied values for BYND assuming Kraft Heinz wants to achieve an ROIC on the acquisition that equals its WACC of 4.4%. This scenario represents the minimum level of performance required not to destroy value. The bottom line is that even if Beyond Meat can grow revenue by 51% compounded annually for five years at an 8% NOPAT margin, the firm is worth much less than $135/share. It’s worth noting that any deal that only achieves a 4.4% ROIC would not be accretive to shareholder value, as the return on the deal would equal Kraft Heinz’s WACC.

Figure 11: Implied Acquisition Prices to Create Value

Sources: New Constructs, LLC and company filings

Figure 11 shows the implied values for Beyond Meat assuming Kraft Heinz wants to achieve an ROIC on the acquisition that equals 6%. Acquisitions completed at these prices would be truly accretive to Kraft Heinz’s shareholders. The implied stock values in this scenario are significantly below Beyond Meat’s current price. Without significant increases over the margins and revenue growth assumed in this scenario, an acquisition of Beyond Meat at its current price destroys significant shareholder value.

Catalyst: Others’ Success Could Come at Beyond Meat’s Expense

Shares have fallen 10% since news on June 25, 2020 that McDonald’s was discontinuing testing of a plant-based burger it dubbed the PLT made with a Beyond Meat patty in several Canadian markets. While the market hasn’t liked this news, both the CEO’s of Beyond Meat and McDonald’s have stated that there is no change in the relationship between the two companies. If, however, McDonald’s chooses to not continue on with the PLT or finds another supplier for its plant-based protein items, BYND could fall even further.

Success of any of Beyond Meat’s competitors could also further threaten future profit growth for Beyond Meat. For example, Kellogg’s delayed the launch of its first round of Incogmeato products due to the COVID-19 pandemic. However, Kellogg’s appears it is ready to launch Incogmeato and recently partnered with Postmates to deliver free Incogmeato samples to residents of Denver and Dallas. Should Kellogg continue to push the marketing of Incogmeato and swiftly gain customers, investors may kiss the ultra-high expectations baked into BYND goodbye.

Further, consensus estimates for Beyond Meat’s 2020 earnings are now $0.07/share. Looking ahead to 2021, consensus earnings estimates are a much higher $0.47/share. With such high expectations, nearly any negative news could place Beyond Meat’s future earnings in doubt and cause shares to fall.

What Noise Traders Miss With BYND

These days, fewer investors pay attention to fundamentals and the red flags buried in financial filings. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing BYND:

- Increased competition

- Slowing revenue growth rates

- Competitors have significant advantages

- Valuation implies massive improvement in profitability with sustained revenue growth rates

Executive Compensation Adds Additional Risk

As an emerging growth company, Beyond Meat has opted to comply with the executive compensation disclosure rules applicable to “smaller reporting companies”, which require less stringent disclosures regarding compensation.

Despite less transparency, we know that Beyond Meat’s executive compensation plan consists of a cash bonus, option grants, and restricted share units (RSUs).

Performance goals for cash bonuses could be determined by achievement of GAAP or non-GAAP financial measures and may be adjusted by the compensation committee for any reason. We’ve previously shown how linking executive compensation to faulty metrics such as adjusted EBITDA can lead to the destruction of shareholder value.

Option grants and RSUs directly align executives’ interests with the price of the company’s shares and not necessarily with creating shareholder value.

We would prefer Beyond Meat align executives’ interests with shareholders’ interests and link executive compensation with improving ROIC, which is directly correlated with creating shareholder value.

Insider Trading and Short Interest Indicate Market Skepticism

Over the past twelve months, insiders have purchased 700 thousand shares and sold 4 million shares for a net effect of 3.3 million shares sold. These sales represent 5% of shares outstanding.

There are currently 7 million shares sold short, which equates to 9% of shares outstanding and just over one day to cover. The number of shares sold short has increased by 10% since last month. With insiders quick to sell their shares and a large and growing short interest forming, it seems that others in the market are also unwilling to bet on the future hurdles Beyond Meat must clear.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Beyond Meat’s 10-Q and 10-K:

Income Statement: we made $33 million of adjustments, with a net effect of removing $21 million in non-operating income (5% of revenue). You can see all the adjustments made to Beyond Meat’s income statement here.

Balance Sheet: we made $290 million of adjustments to calculate invested capital with a net decrease of $228 million. One of the most notable adjustments was $11 million in operating leases. This adjustment represented 3% of reported net assets. You can see all the adjustments made to Beyond Meat’s balance sheet here.

Valuation: we made $757 million of adjustments with a net effect of decreasing shareholder value by $513 million. Apart from total debt which includes the operating leases noted above, the most notable adjustment to shareholder value was $572 million in outstanding employee stock options. This adjustment represents 7% of Beyond Meat’s market cap. See all adjustments to Beyond Meat’s valuation here.

Unattractive Fund That Holds BYND

The following fund receives our Unattractive rating and allocates significantly to BYND.

- Domini Sustainable Solutions Fund (LIFEX) – 3.4% allocation and Unattractive rating

This article originally published on September 2, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).