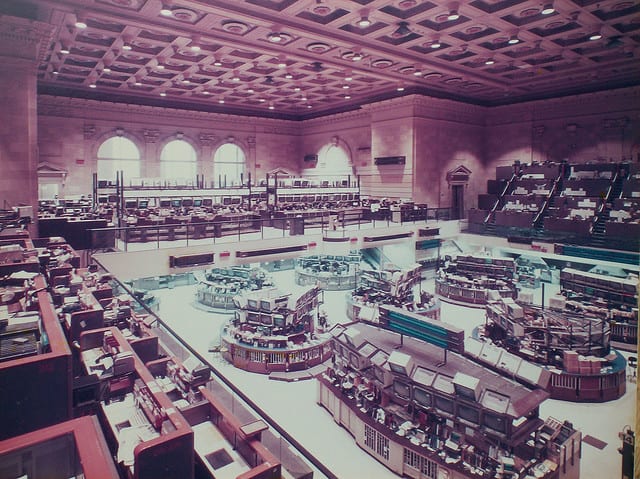

Why One Investment Style Falls Below the Rest

This week, ETFs and mutual funds in the Small Cap Blend investment style are in the Danger Zone. The Small Cap Blend style ranks last out of the 12 styles as detailed in our 2Q15 Style Ratings report.

Andre Rouillard