Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

This week, ETFs and mutual funds in the Small Cap Blend investment style are in the Danger Zone. The Small Cap Blend style ranks last out of the 12 styles as detailed in our 2Q15 Style Ratings report.

Of the 710 Small Cap Blend ETFs and mutual funds under our coverage, 497, or 70%, earn a Dangerous-or-worse rating. Less than 2% of these funds receive Attractive ratings. Zero ETFs or mutual funds receive our Very Attractive rating.

Poor Portfolio Management

The primary reason for Small Cap Blend funds’ poor ratings is their poor stock picking. We rate each fund under our coverage with a Portfolio Management rating. The Portfolio Management rating measures the quality of a fund’s holdings.

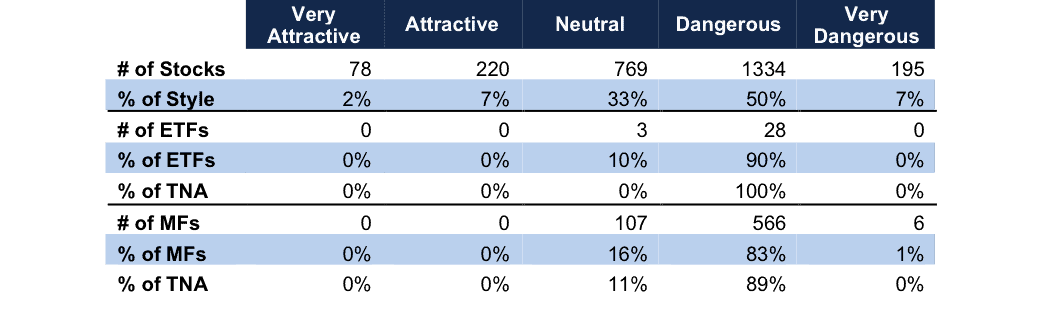

Figure 1 juxtaposes the ratings of stocks in the Small Cap Blend style with the portfolio management ratings of mutual funds and ETFs in the style. 1067 out of the 2596 stocks held by Small Cap Blend funds earn a Neutral-or-better rating. These Neutral-or-better-rated stocks make up 42% of the market cap in the Small Cap Blend style.

Figure 1: Portfolio Management Rating of Funds vs. Quality of Stocks

Sources: New Constructs, LLC and company filings.

Despite the high proportion of Neutral-or-better Small Cap Blend stocks, just 10% of ETFs and 16% of mutual funds in the style even manage to earn a Neutral Portfolio Management rating. No ETFs or mutual funds earn an Attractive Portfolio Management rating.

Even more disheartening is that the three ETFs that do earn a Neutral Portfolio Management rating contain less than 1% of the assets invested across all Small Cap Blend ETFs. Similarly, just 11% of all Small Cap Blend mutual fund assets are in mutual funds that earn a Neutral Portfolio Management rating.

Even though the advice “past performance is not a guarantee of future returns” gets repeated again and again, investors still gravitate towards funds with a strong history of performance. Unfortunately, that means investors in the Small Cap Blend style are missing out on funds with superior holdings simply because said funds don’t yet have established track records.

High Costs Only Worsen an Investment

The second reason for so many poor funds in the Small Cap Blend style is the high costs across the board. The Small Cap Blend Style is one of the most expensive of all 12 styles, with average total annual costs of 2.09%, ranking behind only the Small Cap Value and Small Cap Growth styles.

Normally investors do a good job of avoiding funds with high costs. However, in this case, investors are ignoring the high costs associated with the Russell U.S. Small Cap Equity Fund (RLACX). RLACX is one of our least favorite mutual funds in the Small Cap Blend style and charges total annual costs of 4.40%. Despite its poor holdings and high costs, RLACX has over $2.3 billion in assets. While the fund’s expense ratio of 1.25% might look attractive, its high front-end load costs of 5.75% and transaction costs of 0.79% loom large.

Many investors don’t take these costs into account when investing in a fund, but these additional costs erode 36% of their return over a 10-year period. To make matters worse, RLACX charges investors these high costs while 48% of its portfolio consists of Dangerous-or-worse rated stocks.

A Bad Stock in a Bad Fund

Granite Construction (GVA) is RLACX’s top holding and earns our Dangerous rating. Over the past 10 years, Granite’s after-tax profit (NOPAT) has declined by just over 4% compounded annually. It seems Granite’s moat has disappeared as well, as its pretax margin has declined from 8% in 2008, to just 3% in 2014. Over the same timeframe, its return on invested capital (ROIC) has declined from 22% to just 4%, which ranks in the bottom quintile of all companies we cover. The company has also been bleeding cash and has a cumulative free cash flow of -$72 million over the past four years.

In addition to not being a growth stock, GVA is no value stock either. To justify its current price of $36/share, Granite must increase its pretax margins to 5% and grow profits by 21% compounded annually over the next 9 years. This expectation seems extremely unlikely given Granite’s long-term declining profits and value destruction.

If the company can grow profits by a still-optimistic 13% compounded annually for the next 10 years, the stock is worth $26/share, a 27% downside. This is the kind of downside risk embedded in RLACX’s top holding and we haven’t even looked at the rest of its portfolio yet. Investors don’t deserve to pay such high fees for such poor stock picking.

Quality Can Be Found in the Small Cap Blend Style

When it comes to overall rating, which combines our Portfolio Management and total annual cost ratings from above, there are a few Attractive rated funds in the Small Cap Blend investment style. These funds combine quality stocks with relatively low total annual costs. The top three funds, excluding those with less than $100 million in assets are as follows:

- Virtus Quality SmallCap Fund (PXQSX) – receives our Attractive rating by charging only 1.3% in total annual costs and allocating over 21% of assets to Attractive-or-better-rated stocks.

- Royce Small Cap Value Fund (RVVRX) – despite what its name would imply, RVVRX allocates more towards a mix of small cap stocks, not only value stocks. It receives our Attractive rating by charging only 1.3% in total annual costs and allocating over 21% of assets to Attractive-or-better-rated stocks.

- Janus Perkins Small Cap Value Fund (JDSNX) – much like RVVRX, despite what its name implies JDSNX’s portfolio more closely resembles a Small Cap Blend fund. JDSNX receives our Attractive rating by charging only 1% in total annual costs while allocating 52% of assets to Neutral-or-better rated-stocks.

While these three funds might earn our Attractive rating, they are few and far between. Fund managers need to do a better job allocating to quality stocks. At the same time, investors need to be more diligent about which funds they purchase in the Small Cap Blend style.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.