Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Late last year, it was announced that Warren Buffett and Berkshire Hathaway agreed to acquire the privately-held Van Tuyl Group, one of the largest auto dealer networks in the United States. Investors may be tempted to follow in Buffett’s footsteps by making a similar bet on the United States’ rebounding auto sales and low gas prices — but we don’t think the famous “rising tide lifts all boats” analogy applies here. Some dealers are better positioned to benefit from the rebound than others and some dealer stocks are just plain dangerous. The latter is what investors are getting in Sonic Automotive (SAH).

Sonic operates 118 franchisees in 13 states covering major markets in Texas, California, the Southeast, the West, and others. The company’s sales mix is 56% luxury brands, 31% import brands, and 13% domestic. BMW alone makes up 22% of the company’s sales, with other leading brands Honda and Toyota making up 15% and 10% of sales, respectively.

Where’s the Growth?

Investors in SAH have had a good run since 2011, as the company’s stock price has increased over 100% while the S&P has risen just 86%. However, this appreciation was based on misleading earnings growth.

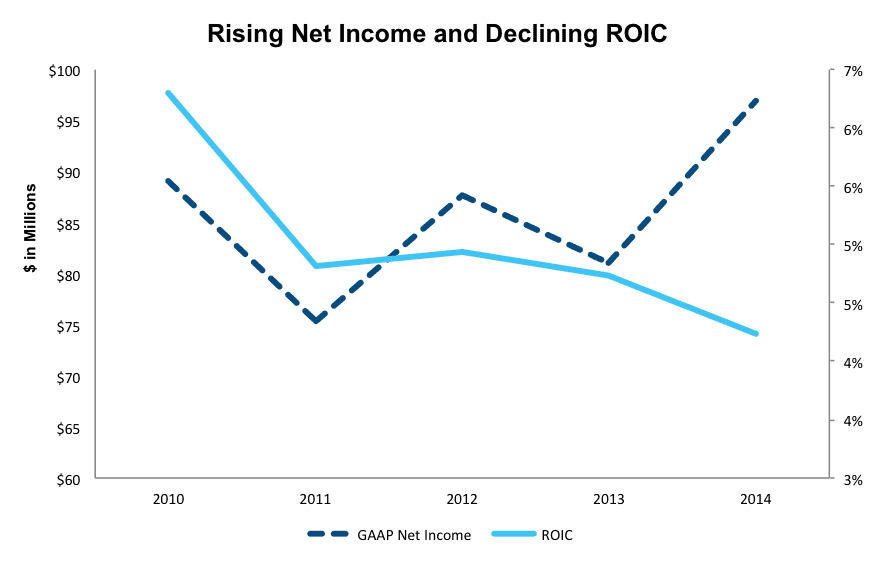

Since 2010, Sonic’s return on invested capital (ROIC) has declined from over 6% to just 4%, while GAAP net income has increased by 2% compounded annually. The rise in GAAP net income, however, is mostly due to a reduction in the interest expense the company is paying. When we remove the effect of interest expense, we can see that the company’s core business operations have become consistently less profitable over this timeframe.

Figure 1 shows this discrepancy between GAAP net income and ROIC:

Figure 1: Rising GAAP Net Income Masks Declining Profitability

Sources: New Constructs, LLC and company filings.

Last quarter, Sonic grew revenue by 5%, less than competitors Asbury Automotive (13%) and CarMax (14%), both of which have more favorable brand exposure. In 2014, half of Sonic’s dealership acquisitions were of luxury brands.

Why is this a problem? One of the key reasons that Sonic has missed out on the increased auto sales, despite its favorable revenue exposure to hot selling brands like BMW, Mercedes-Benz and Audi, is its low exposure to the “light trucks” segment that has been driving auto sales since 2014. The top selling car list last month was dominated by light trucks from Ford, GM, Dodge, and Nissan, and Sonic only has no more than 7% exposure to each of these brands.

We Made These Adjustments to Sonic’s Reported Financials

To reveal this misleading trend in Sonic’s operating profitability, we’ve made a number of adjustments to the company’s reported earnings over the years. In 2014 we:

- Removed $78 million in reported non-operating expenses, mainly due to interest expenses on Sonic’s large debt.

- Removed $31 million in implied interest expenses from Sonic’s load of operating leases.

These adjustments allow us to see that Sonic’s after-tax operating profit (NOPAT) of $168 million is much higher than its reported net income of just $97 million. This may look good on the surface, but consider that the same process led us to increase the company’s 2010 net income of $89 million to a NOPAT of $212 million. So while the company’s GAAP net income may indicate that Sonic’s profits are rising, its NOPAT (along with its ROIC above) actually shows that profits are moving in the wrong direction.

Sonic also has $476 million in off-balance sheet debt from operating leases (19% of its debt and 40% of its market cap).

The biggest adjustment we make to Sonic’s reported numbers is holding the company accountable for $655 million in accumulated asset write downs (43% of net assets). This large amount of write-downs represents a substantial amount of value destruction over the years: For every dollar on its balance sheet, Sonic has written down 43 cents. We add this full amount to Sonic’s invested capital, as it represents capital that the business once expected to generate a return on, but failed to do so.

Weakest Player in a Highly Competitive Field

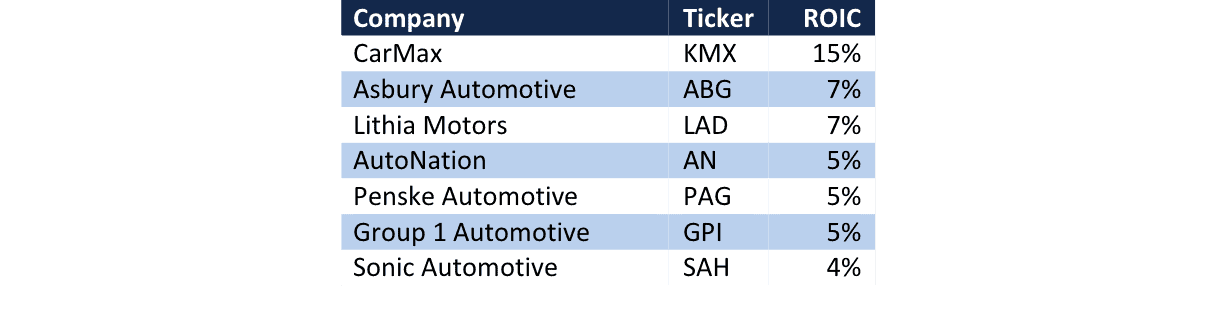

Sonic competes with other large auto dealer networks such as Asbury Automotive (ABG), Penske Automotive (PAG), Group 1 Automotive (GPI), AutoNation (AN), and Lithia Motors (LAD).

Figure 2: At the Bottom of the Industry

Sources: New Constructs, LLC and company filings.

The first thing to note is that Sonic as at the bottom of the list in terms of ROIC.

The second thing to note is just how consistently thin after-tax margins are across the industry. No company except the impressive CarMax — which only manages a 5% after-tax margin — can cross above the 3% margin. We think it’s more likely that margins will fall rather than rise, as these businesses attempt to extend this cyclical boom in auto sales by offering attractive discounts.

Valuation Ignores Current State of the Business

Sonic’s rising stock price has followed the company’s rising reported net income, but belies the company’s falling profitability. To justify its current valuation of $24/share, Sonic would need to grow NOPAT by over 5% compounded annually for the next 15 years.

Seeing has Sonic has grown profits by a total of just 7% since 2000, we think this level of solid, sustained growth is unlikely. If Sonic can instead grow profits by a still-optimistic 4% compounded annually for the next 15 years, the stock is worth $15/share, a 37% downside from current levels.

Why Sonic’s Buyback is a Poor Use of Capital

Sonic currently offers a small $0.10 annual dividend, and has around $79 million remaining in its $100 million share repurchase program. While this dividend, which amounts to just over $5 million annually, isn’t substantial, we think it’s foolish for the company to buy back stock at these record high levels.

Watch Out for These Catalysts That Could Hit SAH

We think that the cyclical boom in auto sales is coming to an end, as automakers have exhausted much of the pent-up demand from the recession. Out of the six automakers that reported their April sales last week and provided estimates ahead of time, five reported sales that came in well below estimates (with the exception of General Motors (GM)).

As delinquency rates among car loans rise to near recession-levels, scrutiny regarding the practice of subprime auto lending is increasing. This is an issue for Sonic because much of the rise in auto sales has been on the back of these subprime auto loans. If any regulation is put in place restricting the ability of companies to issue these loans, expect auto dealers to suffer, especially ones like Sonic, which derive over 25% of their revenues from used car sales.

Insiders Not Selling, but Also Not Buying

In the past six months, insiders have bought 20,000 shares and sold 20,000 shares for a net of 0 shares traded.

Short Interest Not Too High

Short interest stands at 3.3 million shares, or over 10% of float.

Dangerous Funds That Hold SAH

The following ETFs and mutual funds allocate significantly to SAH and earn our Dangerous or Very Dangerous ratings. Note that we recently featured ARKK in our list of the five riskiest ETFs.

- Cullen Small Cap Value Fund (CUSIX) — 3.5% allocation to SAH and Dangerous Rating

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo credit: Classic Film (Flickr)