3Q Best & Worst ETFs & Mutual Funds – by Style – Recap

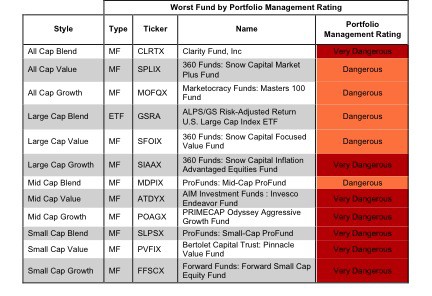

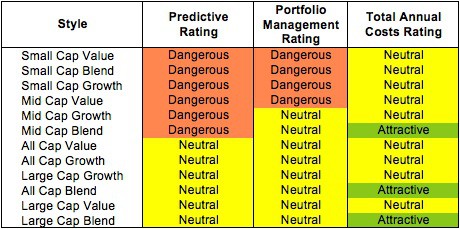

Each quarter, we provide the most comprehensive review of equity ETFs and mutual funds available. We review the Best & Worst ETFs and Mutual Funds by sector and style. This article provides quick access to all our 3Q reports on Style funds.

David Trainer, Founder & CEO