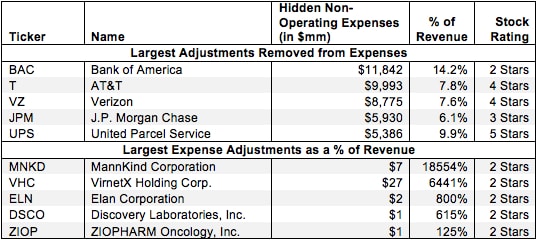

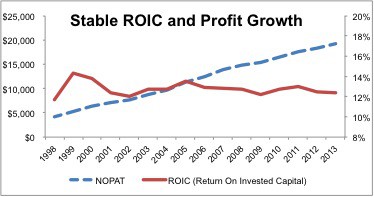

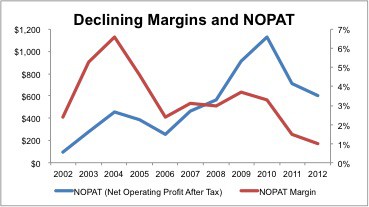

Adjusting NOPAT for Non-Operating Expenses Hidden in Operating Earnings

Non-operating expenses are unusual charges that don’t appear on the income statement because they are bundled in other line items. Without careful footnotes research, investors would never know that these non-recurring expenses distort GAAP numbers by lowering operating earnings.

David Trainer, Founder & CEO