Microsoft (MSFT): Very Attractive Rating — for Ask Matt Readers

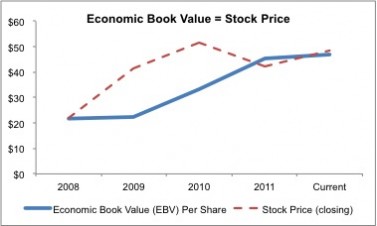

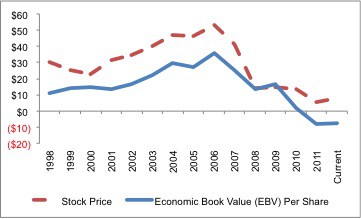

MSFT gets my best rating because the company’s ROIC, at 72%, ranks 8th in the S&P 500 while its stock price (~$31.52/share) implies the company’s profits will permanently decline by about 20%. High profitability and low valuation create excellent risk/reward in a stock. Here is my free report on MSFT.

David Trainer, Founder & CEO