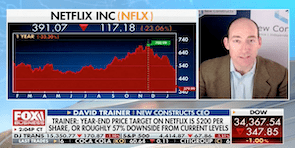

Configured for Continued Profit Growth

Our “See Through the Dip” thesis has proven true as the firm’s operations and economic earnings recover from the COVID-19-induced “dip”.

Matt Shuler, Investment Analyst II