After rigorous analysis of ~7,500 mutual funds, we found a low-cost fund that successfully picks businesses with quality earnings and cheap valuations. BrandywineGlobal Dynamic U.S. Large Cap Value Fund (LMBGX) is this week’s Long Idea.

Forward-Looking Research Reveals a Very Attractive Fund

LMBGX earns our Very Attractive Predictive Fund Rating, after our analysis of its holdings reveals the fund has a higher allocation than its benchmark to highly profitable companies with low expectations for future profit growth baked into their stock prices. The fund’s benchmark is the iShares Core S&P U.S. Value ETF (IUSV).

We leverage our Robo-Analyst technology[1] to drive assessment of mutual fund portfolio quality by analyzing each fund’s individual stock holdings. This uniquely rigorous approach enables us to create forward-looking mutual fund ratings based on the strength and valuation of the underlying businesses of the stocks held in a fund.

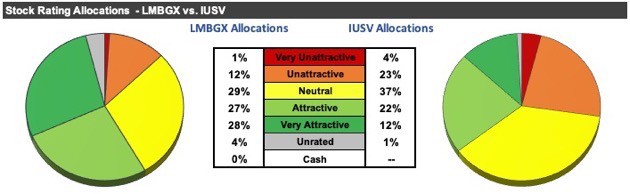

Per Figure 1, LMBGX allocates 55% of its assets to Attractive-or-better rated stocks compared to just 34% for IUSV. On the flip side, LMBGX allocates just 13% of its assets to Unattractive-or-worse rated stocks compared to 27% for IUSV.

Figure 1: LMBGX Allocates Capital to Superior Holdings

Sources: New Constructs, LLC and company filings

BrandywineGlobal Dynamic U.S. Large Cap Value’s Strategy Considers Quality and Valuation

It is not by chance that LMBGX allocates to better stocks than the benchmark. LMBGX’s investment strategy utilizes a quantitative approach to identify stocks that “have upside potential with relatively low downside risk to the Russell 1000 Value Index”. The fund ranks stocks by a multifactor score, which incorporates the following criteria:

- earnings quality

- profitability

- investor sentiment

- management’s utilization of capital

- attractive price-to-earnings ratio

- attractive price-to-book ratio

Unfortunately for investors, the fund does not give specifics as to how it measures all of the criteria involved in its score. For example, the fund does not state how it measures management’s utilization of capital. We would suggest the fund evaluate a company’s return on invested capital (ROIC), since accurately assessing a company’s ROIC is an important part of any rigorous investment process, as there is a strong correlation between improving ROIC and increasing shareholder value. Though we don’t know exactly how LMBGX evaluates management’s utilization of capital, the fund’s ROIC is higher than its benchmark.

The fund’s methodology doesn’t just look for good companies, but also considers valuation to identify good stocks. The fund’s managers rely on price-to-earnings (P/E) and price-to-book (P/B) ratios, which can mislead investors. We think the methodology could be improved by incorporating price-to-economic book value (PEBV), free cash flow (FCF) yield, and a reverse discounted cash flow (DCF) model to more accurately understand the expectations embedded within a stock’s current price. Despite using inferior metrics, the fund is successful in identifying stocks with expectations for future growth that are much lower than the benchmark.

Quality Stocks Drive Very Attractive Risk/Reward Rating

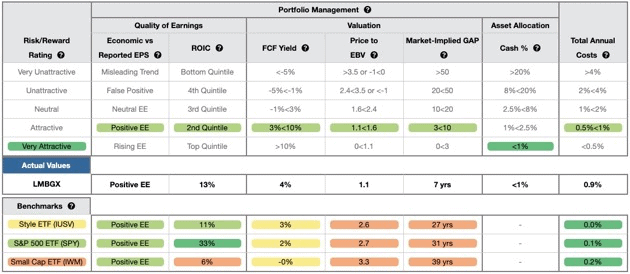

Figure 2 contains our detailed rating for LMBGX, which includes each of the criteria we use to rate all mutual funds under coverage. These criteria are the same for our Stock Rating Methodology, because the performance of a mutual fund’s holdings equals the performance of the mutual fund after fees.

Figure 2: BrandywineGlobal Dynamic U.S. Large Cap Value Fund Breakdown

Sources: New Constructs, LLC and company filings

LMBGX’s holdings are superior to IUSV (click here for our report on IUSV) in four of the five criteria that make up our holdings/Portfolio Management analysis. Specifically:

- LMBGX’s ROIC is 13% and greater than the 11% earned by IUSV holdings

- LMBGX’s free cash flow (FCF) yield of 4% is higher than IUSV’s 3%

- the price-to-economic book value (PEBV) ratio for LMBGX is 1.1, which is much less than the 2.6 for IUSV

- our discounted cash flow analysis reveals an average market implied growth appreciation period (GAP) of just seven years for LMBGX’s holdings compared to 27 years for IUSV

The stocks held by LMBGX generate higher-quality cash flows and have lower valuations than IUSV. Market expectations for stocks held by LMBGX imply profits will only grow by 10% (measured by PEBV ratio) while the expectations embedded in IUSV’s holdings imply profits will grow by 126%.

A Closer Look at LMBGX’s Quality Holdings

Out of the 104 of LMBGX’s holdings under coverage:

- 100% have a positive ROIC

- 80% have a positive free cash flow yield

- 81% have a PEBV ratio of 1.3 or less

- 81% have a GAP of 10 years or less

- only 13% receive a Risk/Reward rating below Neutral

Given its ability to identify quality companies with low valuations, it’s no wonder that 11% of the mutual fund’s assets are allocated to stocks we’ve featured as Long Ideas. Figure 3 shows the 11 LMBGX holdings that are open Long Ideas.

Figure 3: Open Long Ideas That LMBGX Holds

| Company | Ticker | % of Assets |

| JPMorgan Chase & Company | JPM | 3% |

| Allstate Corp (The) | ALL | 2% |

| Oracle Corporation | ORCL | 2% |

| Johnson & Johnson | JNJ | 1% |

| Walmart Inc. | WMT | 1% |

| Verizon Communications, Inc. | VZ | 1% |

| Amgen Inc. | AMGN | 1% |

| SYSCO Corporation | SYY | 1% |

| The Walt Disney Company | DIS | 1% |

| Universal Health Services, Inc. | UHS | <1% |

| Discover Financial Services | DFS | <1% |

| Total | 11% |

Sources: New Constructs, LLC

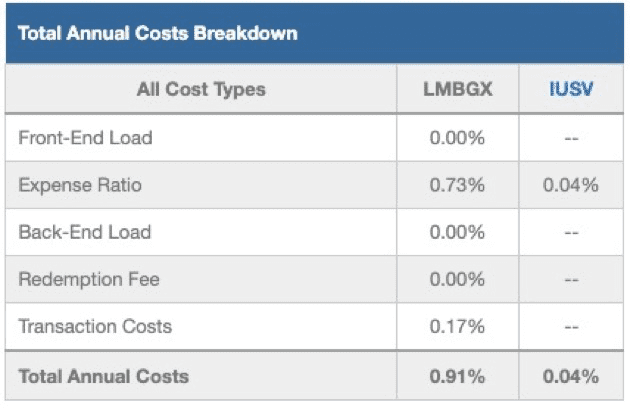

Quality Stock Selection at Below Average Cost

LMBGX’s 0.91% total annual costs (TAC) are well below the 1.59% simple average and 1.22% weighted average of the 948 other All Cap Value mutual funds under coverage. Figure 4 shows our breakdown of LMBGX’s total annual costs, which is available for all of the 6,600+ funds and 900+ ETFs under coverage.

Figure 4: LMBGX Total Annual Costs Breakdown

Sources: New Constructs, LLC and company filings

The Importance of Sector and Holdings Based Fund Analysis

We offer clients in-depth reports for all the 7,500+ ETFs and mutual funds under coverage. Click below for a free copy of LMBGX’s standard mutual fund report.

Simply buying a mutual fund or ETF based on past performance does not necessarily lead to outperformance. Only through holdings-based analysis can one determine if a mutual fund is allocating to stocks with businesses with high earnings quality and low valuations, as LMBGX does.

Most investors don’t realize they can already get the sophisticated fundamental research that enables investors to overcome inaccuracies, omissions, and biases in legacy fundamental datasets. Our Robo-Analyst technology analyzes the holdings of all mutual funds and ETFs under coverage to avoid “the danger within.” Our diligence on holdings allows us to cut through the noise and find mutual funds, like BrandywineGlobal Dynamic U.S. Large Cap Value Fund (LMBGX) , with a portfolio that suggests future performance will be strong.

Build An Even Better Fund For Yourself

As we showed in The Paradigm Shift to Self-Directed Portfolio Construction, new technologies enable investors to create their own fund without any fees while also enabling better, more sophisticated weighting methodologies. If we reallocate the fund’s holdings according to economic earnings, our customized fund allocates:

- 74% of assets to Attractive-or-better rated stocks (compared to 55% for LMBGX)

- <1% of assets to Unattractive-or-worse rated stocks (compared to 13% for LMBGX)

See a detailed view of the quality of stock allocations in our customized fund versus LMBGX’s actual allocation here.

This article originally published on January 19, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our Robo-Analyst technology provides superior fundamental data, as proven in The Journal of Financial Economics, and a novel source of alpha.