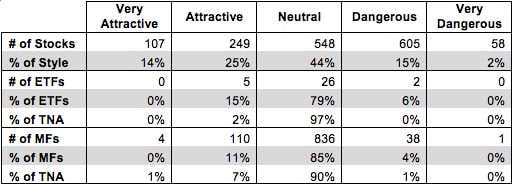

The Large-cap Blend style ranks first out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 33 ETFs and 989 mutual funds in the Large-cap Blend style as of April 26, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

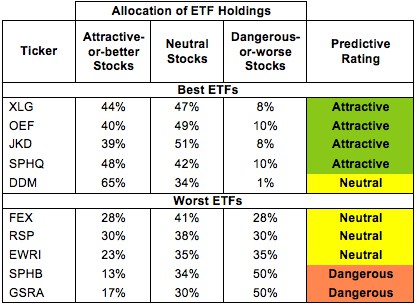

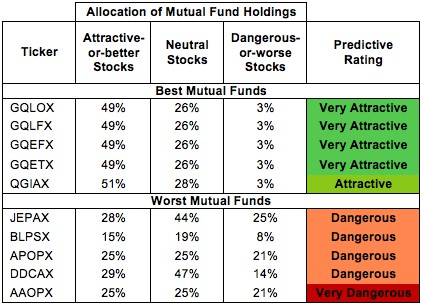

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. Not all Large-cap Blend style ETFs and mutual funds are created the same. The number of holdings varies widely (from 16 to 994), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Large-cap Blend style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

My fund rating methodology is detailed here.

Investors seeking exposure to the Large-cap Blend style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Get my ratings on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

First Trust Mega Cap AlphaDEX Funds (FMK) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

Guggenheim Russell Top 50 ETF (XLG) is my top-rated Large-cap Blend ETF and GMO Trust: GMO Quality Fund (GQLOX) is my top-rated Large-cap Blend mutual fund. XLG earns my Attractive rating and GQLOX earns my Very Attractive rating. For those who cannot afford the high initial minimum of GQLOX, GQETX provides the same holdings with only slightly higher total annual costs.

ALPS/GS Risk-Adjusted Return U.S. Large Cap Index ETF (GSRA) is my worst-rated Large-cap Blend ETF and Cavanal Hill Opportunistic Fund (AAOPX) is my worst-rated Large-cap Blend mutual fund. GSRA earns my Dangerous rating and AAOPX earns my Very Dangerous rating.

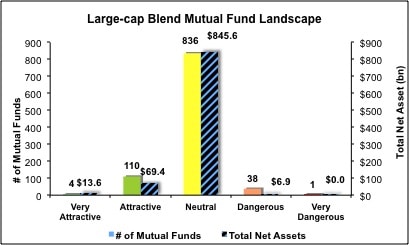

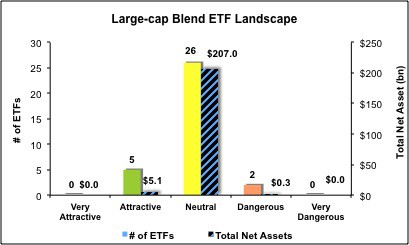

Figure 3 shows that 356 out of the 1,567 stocks (over 39% of the market value) in Large-cap Blend ETFs and mutual funds get an Attractive-or-better rating. However, only 5 out of 33 Large-cap Blend ETFs (less than 2% of total net assets) and 114 out of 989 Large-cap Blend mutual funds (less than 8% of total net assets) get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Large-cap Blend ETFs hold poor quality stocks.

There are plenty of good stocks to choose, yet more mutual fund managers and ETF providers choose the bad ones. Any fees paid for Large-cap Blend funds are more than the managers or the providers deserve.

Figure 3: Large-cap Blend Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Large-cap Blend ETFs and mutual funds, as two ETFs and 39 mutual funds get a Dangerous-or-worse rating. The majority of Large-cap Blend ETFs and mutual funds earn a Neutral rating, so investors have to do their due diligence to ensure they are getting the cream of the crop.

Caterpillar Inc. (CAT) is one of my favorite stocks held by Large-cap Blend ETFs and mutual funds and earns my Very Attractive rating. Analysts have been bearish on CAT recently due to lower global growth especially in mining. As commodity prices have fallen, mining companies have been spending less on capital—i.e Caterpillar products—recently. Despite this trend, the fundamentals of CAT are strong. It posted a top quintile return on invested capital (ROIC) of 15% in 2012 while growing after-tax profit (NOPAT) by 20%. Investors need to look past the declining EPS and earnings estimates. At its current valuation of ~$84.51/share, CAT has a price to economic book value ratio of 0.8. This low valuation implies that NOPAT will permanently decline by 20%. Such a pessimistic outlook is unwarranted for a company with CAT’s track record of profit growth The company’s recently announced $1 billion share repurchase program shows that management is confident in the company. Investors should be too. For more on CAT, see my interview on CNBC Asia.

Genworth Financial (GNW) is one of my least favorite stocks held by Large-cap Blend ETFs and mutual funds and earns my Dangerous rating. This company has not earned positive economic earnings for as far back as our model goes, 2004. The recovery in the housing market is expected to aid GNW’s bottom line, but the company is too far from economic profitability for that alone to make the difference. To justify its current share price of ~$9.99, GNW would have to grow NOPAT by 11% compounded annually for 11 years. For a company with no track record of profitability, betting on such growth is quite a risk. Heavy exposure to GNW helps to explain how an ETF like PowerShares S&P 500 High Beta Portfolio (SPHB) earns its Dangerous rating.

Figures 4 and 5 show the rating landscape of all Large-cap Blend ETFs and mutual funds.

My Style Rankings for ETFs and Mutual Funds report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with reports on all 33 ETFs and 989 mutual funds in the Large-cap Blend style.

Sam McBide contributed to this report.

Disclosure: David Trainer and Sam McBride own CAT. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style or theme.

1 Response to "Best & Worst ETFs and Mutual Funds May 2013: Large-cap Blend Style"

David Trainer-

I have one question: Do you short stocks?

The problem with your opinions, is that you’re influencing markets by what you say and write.

M.