The Consumer Discretionary sector ranks seventh out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 17 ETFs and 23 mutual funds in the Consumer Discretionary sector as of January 28th, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

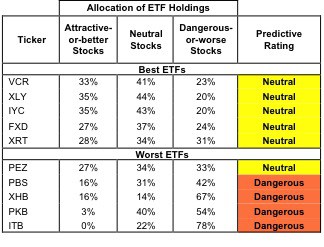

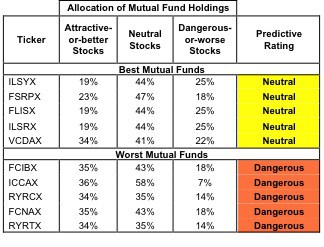

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector. Not all Consumer Discretionary sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 372), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Consumer Discretionary sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any Consumer Discretionary ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Get my ratings on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

Six ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

ICON Funds: ICON Consumer Discretionary Fund (ICCCX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Vanguard Consumer Discretion ETF (VCR) is my top-rated Consumer Discretionary ETF and AIM Sector Funds: Invesco Leisure Fund (ILSYX) is my top-rated Consumer Discretionary mutual fund. Both earn my Neutral rating.

iShares Dow Jones U.S. Home Construction Index Fund (ITB) is my worst-rated Consumer Discretionary ETF and Rydex Series Funds: Retailing Fund (RYRTX) is my worst-rated Consumer Discretionary mutual fund. Both earn my Dangerous rating.

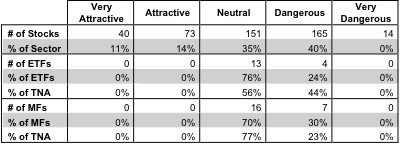

Figure 3 shows that 113 out of the 443 stocks (over 25% of the total net assets) in the sector get an Attractive-or-better rating. However, none of the 17 ETFs and none of the 23 mutual funds in the Consumer Discretionary sector get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Consumer Discretionary ETFs hold poor quality stocks.

Figure 3: Consumer Discretionary Sector Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Consumer Discretionary ETFs and mutual funds, as no ETFs or mutual funds in the Consumer Discretionary sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Focus on individual stocks instead.

Garmin Ltd. (GRMN) is one of my favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Very Attractive rating. Garmin’s return on invested capital (ROIC) of 43% and a 14% free cash flow yield are signs of high economic profitability. The rise of GPS in cell phones causes some uncertainty over Garmin’s future, but it has expanded its product line into other areas and shows no signs of a major decline in profitability. The current share price of ~$38.5 predicts a permanent 20% decline in Garmin’s after-tax cash flows (NOPAT). Even in a changing industry, that’s an overly bleak forecast for a company that has performed as well as Garmin.

MGM Resorts International (MGM) is one of my least favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Very Dangerous rating. It was also my Danger Zone pick on 11/12/13. MGM’s 2% ROIC falls short of its 9% weighted average cost of capital (WACC), which means the company generates negative economic earnings. Its current share price of ~$13 implies the company will grow NOPAT at 15% compounded annually for about 15 years. Those are high expectations for any company, much less one without a track record of economic profitability.

464 stocks of the 3000+ I cover are classified as Consumer Discretionary stocks, while Consumer Discretionary ETFs and mutual funds hold 443 stocks.

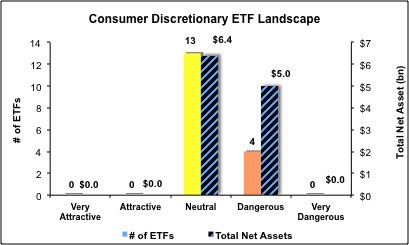

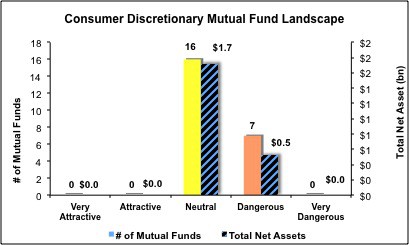

Figures 4 and 5 show the rating landscape of all Consumer Discretionary ETFs and mutual funds.

Our Sector Rankings for ETFs and Mutual Funds report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with reports on all 17 ETFs and 23 mutual funds in the Consumer Discretionary sector.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector or theme.