We’ve partnered with Alpha Theory to provide our Earnings Distortion Scores directly into their portfolio optimization software.

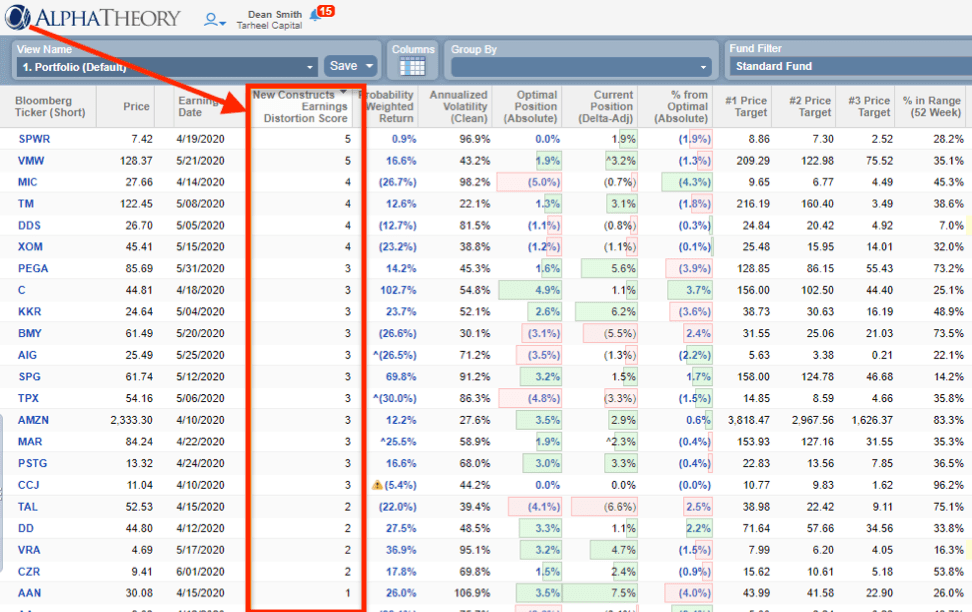

Figure 1: Earnings Distortion Scores Integrated with Alpha Theory

Sources: New Constructs, LLC and company filings.

“Alpha Theory’s goal is to constantly provide new sources of value for our clients and we believe the Earnings Distortion Score from New Constructs is great addition”, said Cameron Hight, CEO of Alpha Theory.

Earnings Distortion scores indicate the likelihood of a firm to beat or miss consensus expectations for EPS, revenue, or guidance in the next quarter. These scores are categorized into 5 tiers:

1 – Strong Beat

2 – Beat

3 – Inline

4 – Miss

5 – Strong Miss

Earnings Distortion measures the level of non-core income/expense contained within reported earnings. It is a proprietary measure featured by professors from Harvard Business School and MIT Sloan in a recent paper: Core Earnings: New Data & Evidence. The paper empirically demonstrates the superiority of our measure of core earnings[1] based on our proprietary adjustments for unusual gains/losses.

About Alpha Theory:

Alpha Theory is the premier solution used by portfolio managers to develop an efficient portfolio. Alpha Theory leverages a firm’s research and instinct to build a repeatable system for optimally sizing positions.

This article originally published on May 8, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in In Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).