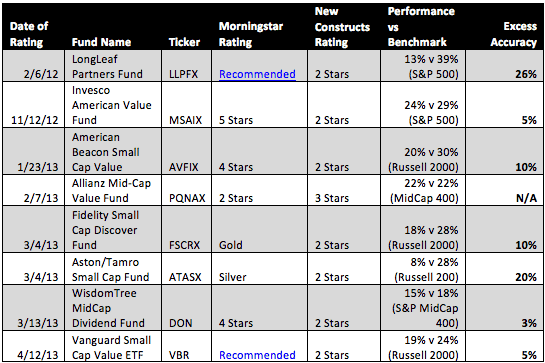

David Trainer Explains Why Greece and the Weather Don’t Matter

All the financial media seems to be concerned with these days is Greece and the possibility of "Grexit." The deep freeze that is gripping much of the eastern half of the U.S. is also grabbing headlines.

David Trainer, Founder & CEO