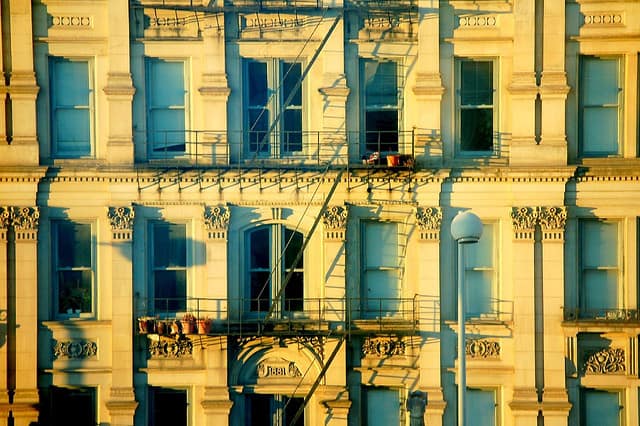

This Longtime American Retailer Deserves Your Attention

Some believe the best implementation of ecommerce solutions will ultimately win the retail battle. Others believe online stores, such as Amazon, have simply accelerated the inevitable extinction of the brick and mortar store. However, this week we’re taking a look into a brick and mortar company that also has a strong online presence and shows signs of improvement.

Kyle Guske II, Senior Investment Analyst, MBA