Stock Pick of the Week

The best stocks in a particular industry aren’t always the most popular or well-known companies. Whether because of their size, name brand, or what have you, large companies often dominate the headlines and the ticker tape. However, if you peer beneath the surface, you can uncover the true value plays in a particular industry.

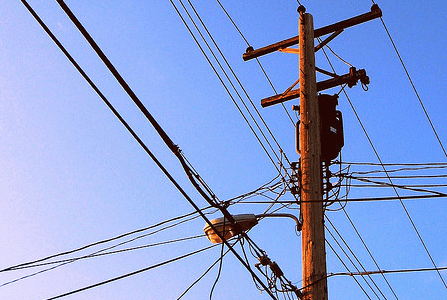

This week we’re highlighting a company that operates behind the scenes but provides services paramount to the success of global telecom companies. Without this company, large telecom providers would be forced to undertake large capital expenditure plans or risk not offering service in select locales. It is this type of company that flies below the radar and offers excellent value for investors. This stock also lands on our Most Attractive List for April. Our stock pick of the week is Inteliquent Inc. (IQNT).

What Is Inteliquent?

Inteliquent offers telecommunications services on a wholesale basis — specifically, an IP-network, which enables the delivery of telecom data. It offers services including local calling, long distance, international voice, and toll-free services. Prior to 2014, Inteliquent offered data transmission as well, but that unit was sold in mid-2013. Inteliquent’s transmission services allow other carriers to deliver voice traffic where they don’t possess their own network.

Why Invest Now?

Inteliquent has done an excellent job of growing its business over the past three years, and after an unwarranted drop in share price in early 2015, the stock is now extremely undervalued. Voice revenue grew by 10% year over year in 2014. On the back of this excellent revenue growth, Inteliquent’s 2014 after-tax profit (NOPAT) grew 13% year over year. Over the past three years, Inteliquent has grown NOPAT by an impressive 28% compounded annually.

Inteliquent has also been cutting costs while continuing its revenue growth. This is apparent in the company’s increased return on invested capital (ROIC). Inteliquent’s ROIC was a top-quintile 28% in 2014, up from only 11% in 2012. This excellent ROIC growth can be attributed to management’s effective allocation of the capital flowing into the business.

Inteliquent also has a free cash flow yield of 9% and positive economic earnings. The company currently pays out an excellent dividend yielding 3.8%, furthering the attractiveness of this stock.

Revenue Concentration an Issue?

Inteliquent has a high concentration of sales consisting of four customers, with two of them representing 60% of revenues in 2014. Although this may appear high, telecom giants AT&T (T), Verizon (VZ) are Inteliquent’s two largest customers with percentages of about 35% and 25% of total revenues, respectively. In a sector dominated by these two companies, the high concentrations are to be expected and since Inteliquent’s services provide AT&T and Verizon voice transmission to locations otherwise not serviced by the two, Inteliquent appears to have positioned itself well.

These Adjustments Reveal Inteliquent’s Operating Profitability and Valuation

We make several key adjustments to the earnings and balance sheets of companies to uncover the recurring cash flows of each company’s core business and the value left for shareholders. We made the following major adjustments to Inteliquent’s earnings in 2014:

- Removed $1 million non-operating expenses included in operating earnings.

- Removed $5 million in taxes due to non-operating expenses lowering operating earnings.

These two adjustments to Inteliquent’s earnings have the effect of raising its operating profit by over $7 million, or 19% above its net income.

When considering Inteliquent’s valuation, we also add $22 million in off-balance sheet debt (4% of market cap) to Inteliquent’s total debt. This adjustment represents all of Inteliquent’s debt, as the company has no other reported short-term or long-term debt.

Price Decline Has Created a Buying Opportunity

After releasing full year results that exceeded top and bottom line expectations, Inteliquent’s stock price dropped 14%. This large price decline is unwarranted given the operations of the business. Inteliquent’s stock has since recovered since this drop, but has not returned to its pre-earnings report levels. This lag creates a nice buying opportunity.

At ~$16/share, Inteliquent has a price to economic book value (PEBV) ratio of just 1.0. This ratio implies that the market expects the company’s profits to never materially increase from current levels. This expectation is out of touch with reality. Such low expectations, coupled with the company’s strong fundamentals, allows Inteliquent to earn our Very Attractive rating.

If Inteliquent can grow NOPAT by just 6% compounded annually for the next eight years, the company is worth $20/share today — a 25% upside from current levels. This profit growth is low based on the company’s track record and investors have every reason to expect even greater upside from IQNT.

Disclosure: David Trainer owns IQNT. David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Photo credit: Jenni Konrad (Flickr)