A quick reminder that all members can now access our Credit Ratings and research for all companies under coverage. And, two updates:

- Clients can now download PDF reports detailing our Credit Ratings. Sample report here.

- We tweaked our Credit Rating scoring to reflect changing economic conditions.

The Value-Add of our Credit Ratings

Our Credit Ratings are different than ratings from legacy credit research firms because we use our proprietary Adjusted Fundamentals instead of unscrubbed data, which is proven to be flawed by The Journal of Financial Economics. Accordingly, our Credit Ratings more accurately measure a firm’s leverage, liquidity, interest coverage, and overall creditworthiness.

Our Credit Ratings also differ from legacy providers’ ratings as follows:

- More coverage: credit ratings for 2,750+ companies.

- Daily updates: all ratings reviewed daily based on market events and new financial data.

- Unbiased: New Constructs is 100% independent and has no conflicts of interest with research clients and is not paid by companies or bankers for credit or equity ratings.

“Better data drives better models, especially for Credit Ratings. Most investors are unaware of the problems with legacy data and ratings,” said David Trainer, CEO of New Constructs. “Our new Credit Ratings reveal the magnitude of the problems and the benefits of fixing them.”

How To Access our Credit Ratings

Members can get our Credit Ratings on the Portfolios, Ratings, and Screeners pages.

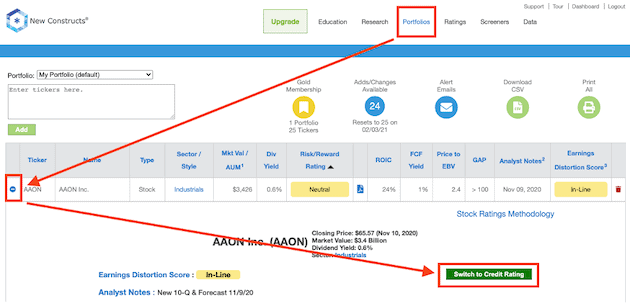

Portfolios page: expand the rating details in the first column of any stock in your Portfolio, and then click the “Switch to Credit Rating” button. See Figure 1.

Figure 1: Credit Rating for All Stocks in Your Portfolio

Sources: New Constructs, LLC

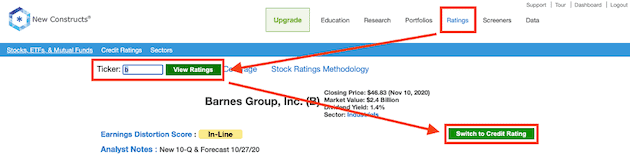

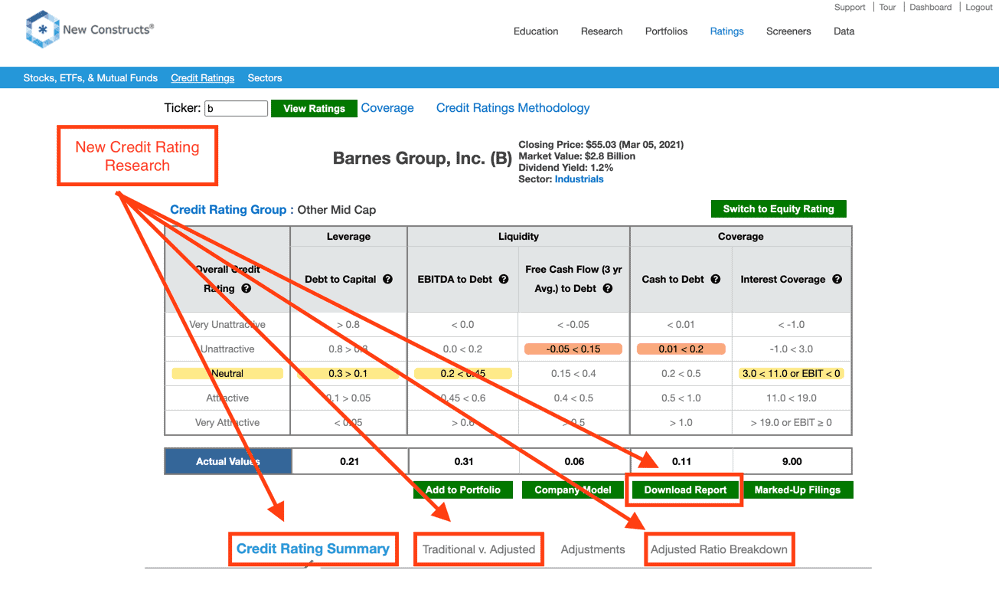

Ratings page: enter any stock ticker and click the “Switch to Credit Rating” button to view the Credit Rating. See Figure 2.

Figure 2: Credit Ratings on the Ratings Page

Sources: New Constructs, LLC

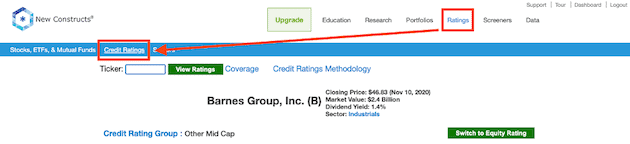

You can also click “Credit Ratings” from the blue menu bar, enter a ticker and get our Credit Rating. See Figure 3.

Figure 3: Credit Ratings on the Ratings Page Menu Bar

Sources: New Constructs, LLC

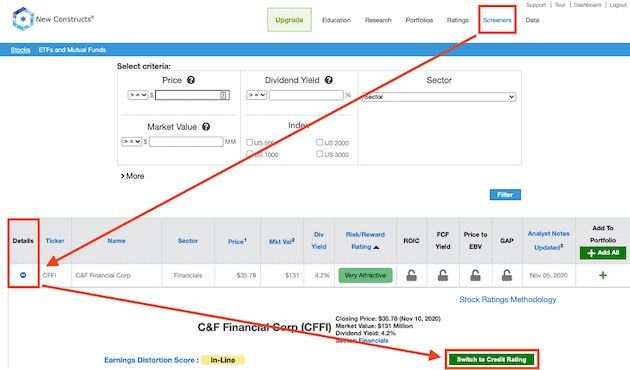

Stock Screeners page: click the “+” in the Details column and then the “Switch to Credit Rating” button to view the Credit Rating. See Figure 4.

Figure 4: Credit Ratings on the Screeners Page

Sources: New Constructs, LLC

More Credit Rating Research & Reports

We provide additional Credit Rating research:

- A 5-page report on the Credit Rating with comparisons of our Adjusted ratios to Traditional ratios,

- A Credit Rating Summary,

- Comparisons of Traditional v. Adjusted Ratios, and

- Adjusted Ratio Breakdowns to show how we calculate each ratio.

This research is available to all members on their Portfolios page, to Platinum and higher members on the Ratings page, and to Unlimited and higher members on the Screeners pages. See Figure 5.

Figure 5: More Credit Rating Research Below Credit Rating Table

Sources: New Constructs, LLC

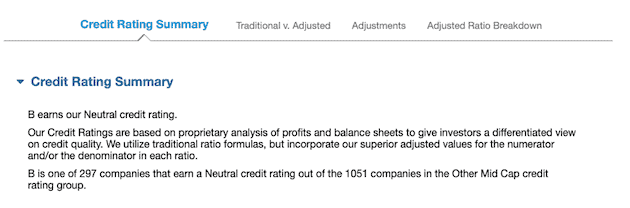

Credit Rating Summary Tab

Get a brief summary of our Overall Credit Rating and details on where each company ranks versus peers in its credit rating group. See Figure 6.

Figure 6: Credit Ratings Summary Details

Sources: New Constructs, LLC

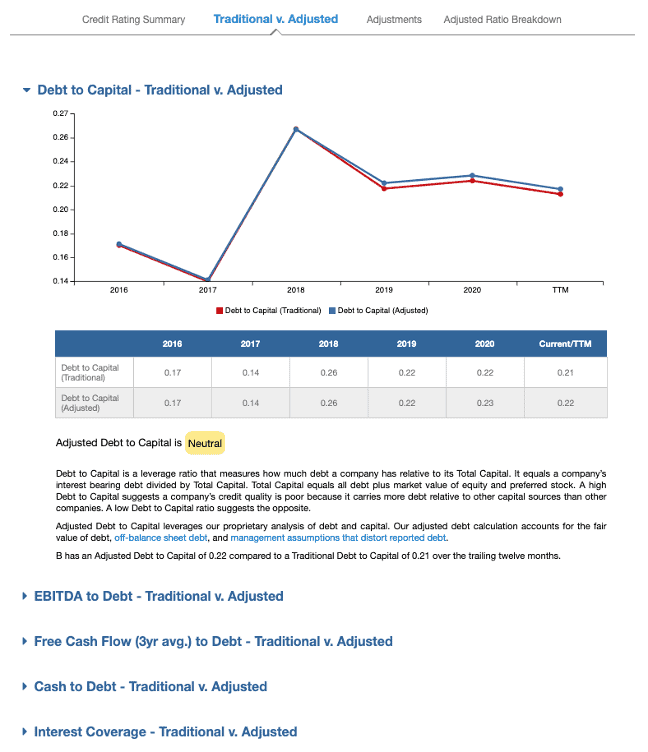

Traditional V. Adjusted Tab

We compare the traditional and adjusted versions of our five Credit Rating ratios over the last 5 years in charts, and we highlight the biggest adjustments which differentiate our adjusted ratios from traditional. See Figure 7 for a sample of this research for the Debt to Capital ratio.

Figure 7: Credit Ratings Traditional v. Adjusted Ratio Details

Sources: New Constructs, LLC

Adjustments Tab

The research here is the same as what you see for our Stock Ratings.

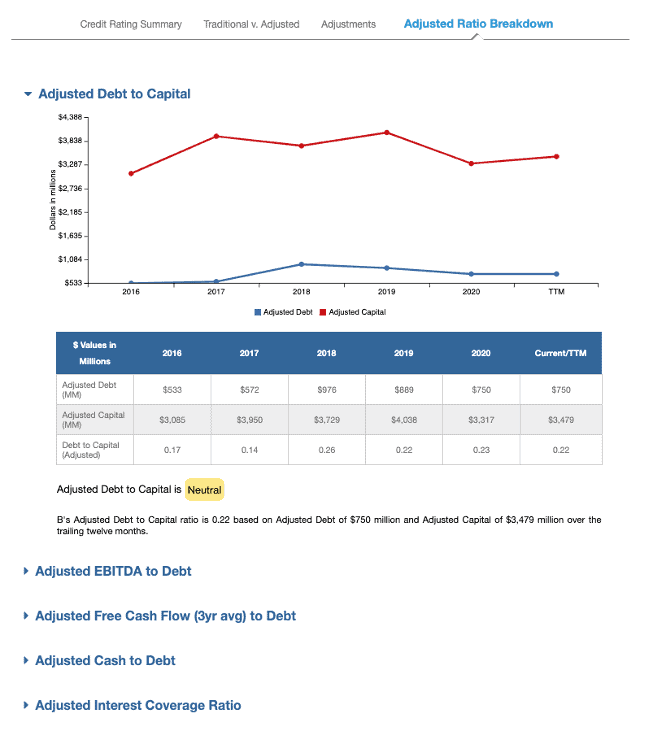

Adjusted Ratio Breakdown Tab

We present the values and a five-year chart for each of the components of the Credit Rating ratios. For example, as shown in Figure 8, we provide the values for the adjusted debt and adjusted capital, which we use to calculate the Adjusted Debt to Capital ratio. We provide the same granularity for each Credit Rating ratio.

Figure 8: Credit Ratings Adjusted Ratio Breakdown Details

Sources: New Constructs, LLC

This article originally published on March 10, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.