We closed this position on October 15, 2018. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Sears Holdings Corporation (SHLD) is in the Danger Zone this week. It is also on April’s Most Dangerous Stocks list. This Danger Zone pick combines three themes that I have discussed in recent Danger Zone posts: overvaluation due to expectations of a construction rebound, hidden liabilities undermining a company’s financial strength, and online retailing making bricks-and-mortar stores obsolete.

Let’s Look At the Valuation

The current price of ~$46/share for SHLD implies the market is expecting a dramatic reversal of fortunes for the company. To justify this share price, the company must grow revenue by 5% compounded annually for 11 years and improve its return on invested capital (ROIC) from -1% to 7%.

Contrast these expectations with SHLD’s recent history. Since 2006, its revenues have declined by an average of 2.6% annually and its ROIC has fallen from 10.6% to -1.4%. This negative trend is, if anything, only getting worse. In the last fiscal year, SHLD’s revenue declined by 4.1% and its ROIC went from -0.6% to -1.4%. Clearly, the stock is priced for a major financial turnaround.

As I wrote in last week’s Danger Zone report, investors should not expect a rebound in construction to meaningfully impact demand on construction materials and supplies.

One of the most popular bullish themes for SHLD is the potential to monetize the value of the real estate it owns. The company is selling these assets, but I do not expect those assets are nearly enough to justify the future cash flow expectations embedded in the stock price or offset the debts it owes. More on this topic is below.

It is hard to make a straight-faced argument that the company could engineer a turnaround in its business and achieve the expectations embedded in its stock price.

Red Flags: Hidden Liabilities

A number of hidden liabilities further undermine the investment quality of SHLD.

1) Underfunded pensions: The company’s pension and postretirement plans are currently underfunded by $2.75 billion, equal to 56% of SHLD’s market cap.

2) Off-balance sheet debt: The company has nearly $2.8 billion in off-balance sheet debt due to minimum payments on operating leases. This is equivalent to 57% of its market cap.

3) Deferred tax liabilities: The company has $1.3 billion in deferred tax liability, equal to 27% of market cap.

Combined, these liabilities add up to ~$6.9 billion or 140% of SHLD’s market cap.

In addition, SHLD had over $1.2 billion in accumulated asset write-downs last year, equal to 11% of the company’s net assets. Over the past several years, management has destroyed 11 cents for every dollar invested in the business, not exactly a good sign for future cash flows. Asset write-downs are a red flag for management failure.

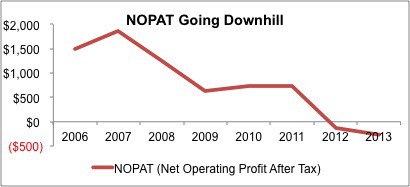

For a company with healthy profits, perhaps, these issues could be manageable. SHLD, however, has negative and declining after tax profits (NOPAT).

Figure 1: No Profits to Pay Off Liabilities

What’s Left For Equity Investors?

It is hard to see how equity investors can expect the value of SHLD to be greater than zero.

Figure 1 clearly shows that SHLD’s competitive advantage is essentially nonexistent. It got into online retail too late to really compete with the established online vendors. It lacks the scale to compete based on price with the Wal-Marts (WMT) or Home Depots (HD) of the world. At this point, SHLD’s most valuable asset appears to be the real estate its stores are built on.

After completing three asset sale transactions, equal to $886.5 million, in 2012, SHLD lists the value of its land, buildings, and improvements at $7.9 billion as of February 2, 2013.

Combining Sear’s reported debt of $3.2 billion with the $6.9 billion in hidden liabilities detailed above results in a total of $10.1 billion in debt, underfunded pensions, and deferred tax liabilities. So, the value of SHLD’s land is more than $2 billion less than what the company owes to lenders, employees or the IRS.

SHLD is a company with declining revenue and proftis, massive liabilities, and a valuation that prices out almost any potential upside. It looks more likely to go to zero than justify its current valuation.

ETFs and Mutual Funds That Allocate to SHLD – to be avoided

Investors should also avoid the following mutual funds due to their heavy allocation to SHLD and Dangerous-or-worse rating:

1) Chou America Mutual Funds: Chou Opportunity Fund (CHOEX)—9.2% allocation to SHLD and Dangerous rating.

2) Fairholme Funds, Inc: Fairholme Fund (FAIRX)—8.5% allocation to SHLD and Dangerous rating.

Sam McBride contributed to this report

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.