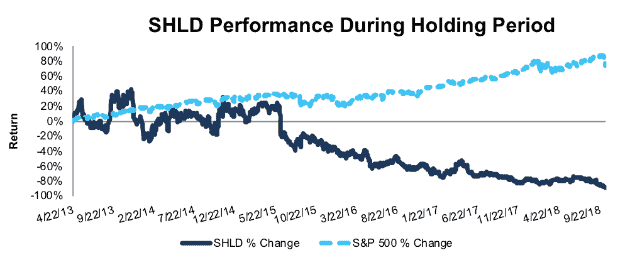

Sears Holdings Corp (SHLD: $0.31/share) – Closing Short Position – down 89% vs. S&P up 76%

Sears Holdings Corp was originally selected as a Danger Zone pick on 4/22/13. We revisited SHLD in May 2018 as the stock had fallen nearly 80% since our original report. At the time of the first Danger Zone report, the stock received a Very Unattractive rating. The stock currently earns an Unattractive rating and has a Bankruptcy Threat analyst note. Our short thesis highlighted four main issues:

- Hidden liabilities (underfunded pensions, off-balance sheet debt, and deferred tax liabilities) that lowered the reported value of the firm

- Declining revenue and after-tax operating profit (NOPAT)

- A weak competitive position relative to big-box and online retailers

- Overly optimistic expectations baked into the stock price

Sears’ struggles have been widely documented. The company struggled to compete with low price retailers (such as Walmart (WMT)) and failed to adapt to e-commerce. While the combined Sears once had 3,500 stores (after it merged with K-Mart in 2005), it now has less than 750.

Early last week, the Wall Street Journal reported Sears was hiring an advisor to prep for a bankruptcy filing. CNBC reported that the firm was near a deal that will allow it to stay open for Christmas, and Reuters reported the firm was planning to close 150 of its stores, keep 300 open under its restructuring plan, and the fate of ~250 stores remained uncertain. As of October 15, Sears officially filed bankruptcy and announced the closure of 142 stores near the end of the year. As a result, we are closing this position since the downside left in SHLD is limited.

Since our original Danger Zone report, SHLD has significantly outperformed as a short position, falling 89% (after adjusting for the spin-off of Lands’ End (LE) in 2014) compared to a 76% gain for the S&P 500.

We hope readers were able to protect their portfolios from this stock while it fell in a strongly rising market.

Figure 1: SHLD vs. S&P 500 – Price Return – Successful Danger Zone Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on October 15, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.