Subscribers got access to this report one month early. You can get access to all our actionable reports before they are made available to the public, along with Most Attractive, Most Dangerous Stocks or Best & Worst ETFs & Mutual Funds newsletters for as little as $9.99/month.

Why We Believe Bob Evans Farms is Ready to Fall Off a Cliff

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and Marketwatch.com.

Bob Evans Farms (BOBE: $43/share) is in the Danger Zone this week. The Ohio-based company has two segments: restaurants (72% of revenue) and BEF (packaged) Foods (28% of revenue). Bob Evans’ profits and revenue have been in decline since 2010, and management’s 2012 turnaround plan has been unsuccessful. The company is running out of cash while facing more and more competition, including direct competition from the Cracker Barrel (CBRL) chain and the rising popularity of fast-casual restaurants such as Dunkin Donuts, (DNKN), Starbucks (SBUX), and Panera (PNRA).

Companies in trouble have symptoms. To interpret the symptoms you first must know what they are. The outline that follows will provide a starting point.

Symptom #1: Profitability Trending in the Wrong Direction

Restaurant sales have declined by 5% since 2010 while BEF Foods sales have increased by 18%.

Bob Evans’ operating profit (NOPAT) has also been in decline since 2010. Excluding Mimi’s Cafe, which was sold in 2013, we see that the company’s NOPAT fell by approximately 20% compounded annually between 2010-2014. Bob Evans’ return on invested capital (ROIC) fell from 8% to under 4% over this timeframe.

Symptom #2: Little Cash, Lots of Debt and Write-Downs

Bob Evans is running out of resources to fund its dividend and turnaround efforts. The company has under $4 million in cash and $463 million in debt, almost half of its total assets.

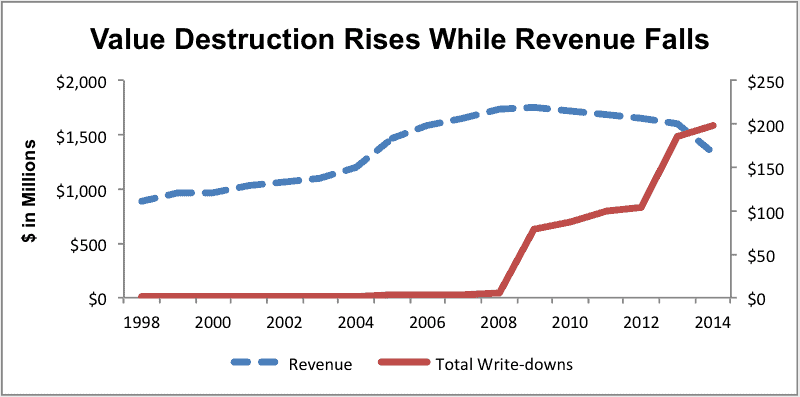

Most investors probably do not know that the current turnaround efforts are doing more damage than good. Figure 1 shows accumulated asset write-downs accelerating concurrent with an acceleration in revenue decline. Write-downs, at this level, unequivocally signal that management is failing investors. With total asset write-downs of $198 million, Bob Evans has written down 42 cents for every dollar on its balance sheet. These write-downs, which began to climb in 2009, consist mostly of closing restaurants and goodwill impairment.

Figure 1: Bad Trends for Investors

Sources: New Constructs, LLC and company filings.

Between 2012 and 2014, Bob Evans’ spent $225,000 per store on a chain-wide remodeling initiative in an attempt to reverse this revenue decline. Nevertheless, same-store sales have continued to fall. In fiscal 1Q15, with the remodeling initiative completed, same-store sales declined 2% year over year. Even more concerning is that the restaurants that finished remodeling in 2012 saw their same store sales decline 3% year over year in 3Q14.

Symptom #3: Last Place in Two Competitive industries

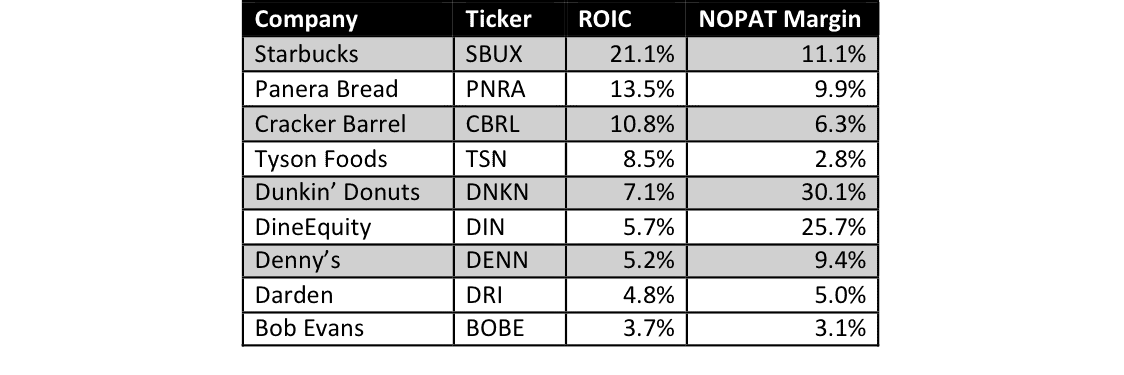

In its restaurant segment, Bob Evans competes mainly with Cracker Barrel (CBRL), Denny’s (DENN) and DineEquity (DIN), which owns Applebee’s and IHOP restaurants. Bob Evans’ packaged foods business, which sells primarily sausage and frozen breakfast products, competes with companies like Tyson Foods (TSN).

Figure 2 shows that Bob Evans lags all of its competitors in terms of ROIC and NOPAT margin. With its $1 billion market cap Bob Evans is also the second-smallest company on this list, bigger only than Denny’s. Note the presence of Bob Evans’ three fast-casual competitors near the top of the list for both ROIC and NOPAT margins.

Figure 2: Lagging in Terms of Profitability

Sources: New Constructs, LLC and company filings.

The casual dining industry at large faces strong headwinds. Cracker Barrel has seen its profits grow by just 4% compounded annually since 2010, and same store sales slipped by almost 1% in the most recent quarter. Other competitors have not been so lucky: since 2009, DineEquity has seen its profits decline by 11% compounded annually, and Denny’s profits have declined by 10% compounded annually over the same period.

Consumers are increasingly taking their business to fast-casual restaurants such as Starbucks (SBUX) and Panera (PNRA). The fast-casual industry saw aggregate sales grow by 11% in 2013.

The one bright spot is Bob Evans’ BEF Foods segment, which has seen solid sales increases year over year. Bob Evans has around a 17% market share in sausage, behind only Hillshire’s 28%. However, BEF Foods accounts for just 18% of Bob Evans’ profits and its yearly gains have been offset by the restaurant segment’s sustained decline.

Symptom #4: Turmoil in the Boardroom

BOBE has been in the news this year as a result of increasing activist investor activity. Hedge fund manager Thomas Sandell has stated that Bob Evans’ longstanding Board of Directors has become complacent and is responsible for the company’s weak results.

Sandell recently secured four board seats on the company’s 12-member board, which gives his fund some leverage to enact its proposed changes. These changes include spinning off or selling the BEF foods segment and selling some of Bob Evans’ company property and real estate.

Sandell alleges the spin-off and real estate sales could generate up to $1.1 billion. He plans to use around 75% of these proceeds for a share repurchase program. Sandell’s plan looks good on paper, but it faces an uphill battle. The remaining eight entrenched Bob Evans board members are extremely reluctant to sell the BEF Foods division as they have invested over $100 million in the segment over the past two years.

Darden Restaurants (DRI), which has also been battling activist investors since last December, is a mirror image of the case of Bob Evans. Unfortunately, the image is not pretty. The activists in DRI proposed similar spin-off and real estate sale plans for the business as Sandell has for BOBE. Darden sold its Red Lobster business for $2.1 billion in March and is using the cash to pay off around 40% of its debt and implement a share repurchase plan of $500 million. These efforts have not distracted investors from Darden’s declining same store sales, and the stock is down 7% since March. As seen in Figure 2, Bob Evans is already in worse operating condition than Darden, which makes it less likely to recover from its unprofitable ways.

Symptom #5: Stock Worth Versus Stock Price Creates Out of Touch Valuation

Despite Bob Evans’ struggles and the casual dining industry’s steady decline, the company is tremendously overvalued. BOBE’s current price of ~$43/share implies that the company will grow NOPAT by 17% compounded annually for 16 years.

This stock is so overvalued that even in the best-case scenario for Sandell, it is still dangerous. Let us assume that Sandell sells both BOBE’s real estate and BEF Foods, and that he gets the total $1.1 billion he estimates for both, which equates $47 per share.

We think it is naïve to expect Sandell to use more than half of the cash for share repurchases because Bob Evans has substantial debt and other senior liabilities of over $536 million or about $23/share. Spending all the proceeds on share repurchases would raise alarms with all stakeholders, especially bondholders, considering the company is free cash flow negative.

Let’s assume Sandell is able to spend $564 million or $24/share on buying back stock. In which case, we need only to measure the expectations implied in $19 per share (current price $43/share minus $24/share).

To justify $19/share, BOBE must grow its profits by 16% compounded annually for the next 8 years. This expectation seems awfully optimistic for a restaurant chain with steadily declining sales. If we assume a 9% compounded annual NOPAT growth rate for 9 years, the stock is worth just $11/share, a 39% downside from $18. This situation is lose-lose. Sandell cannot save shareholders.

Gridlock and hostility in the boardroom are likely to block Sandell’s plan and any other major efforts to overhaul the company’s declining restaurant business. Consequently, the decline in restaurant sales could accelerate. We’ve seen this play out before with JC Penney (JCP), which saw its sales slide to 1987 levels after Bill Ackman’s turnaround efforts clashed with an unfriendly boardroom.

The BEF Foods segment could also fail to grow as anticipated owing to competitive pressure from recently consolidated food giants Tyson and Hillshire.

In the short term, Bob Evans is experiencing too much upheaval to be a reliable bet. In the long term, BOBE is highly overvalued, especially for a company in a slow to no-growth industry. With such formidable competition and such a poor history of capital allocation decisions, investors would be wise to stay away from this company in the middle of a “turnaround.”

Symptom #6: Insiders Are Dumping Their Shares

Over the past 6 months, insiders have sold a net of 156,987 shares, or 18% of their shares. Only 811 shares were purchased by insiders over this timeframe. Insiders do not seem confident about the company’s future.

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector or theme.

Photo: Bill McChesney (Flickr)