Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Dunkin Brands Group (DNKN: ~$51/share), owner of the Dunkin Donuts and Baskin-Robbins chains, is in the Danger Zone. DNKN’s illusory growth in accounting earnings has driven the stock up nearly 40% while the S&P 500 is up only about 20% over the past year. Our diligence reveals that while reported earnings are up, DNKN’s economic earnings are in decline. Future growth expectations are overblown as well because the company’s plans to expand outside of the Northeast pit it against formidable, entrenched competitors like Starbucks (SBUX) and McDonald’s (MCD) as well as other aggressive growers such as Krispy Kreme (KKD) and Tim Hortons (THI).

Earnings Growth is Misleading

On a GAAP basis, DNKN grew its earnings by 36% in 2013 and 214% in 2012. However, these numbers are misleading, as they include a number of unusual non-operating expenses that drove down reported earnings in both 2011 and 2012.

In 2011, major non-recurring expenses included a $15 million sponsor termination fee, a $34 million loss on debt termination, and a $20 million impairment charge on a South Korean joint venture.

In 2012, major non-recurring expenses included a $21 million charge due to a lawsuit brought about by former franchise owners and $5 million in secondary offering costs. In addition, the Baskin-Robbins International segment had a one-time delay in revenue recognition that impacted revenue by $6 million.

When we remove these unusual items, we see that DNKN’s true after-tax operating profit (NOPAT) in 2011 and 2012 were higher than reported. Therefore, the growth in 2013 is much smaller than it appears on the surface. In 2012, DNKN grew NOPAT by 30%, and in 2013 DNKN grew NOPAT by just 7%. That’s not a bad growth rate, but it pales in comparison to the double-digit growth that bulls are touting and the stock valuation reflects.

Digging further into DNKN’s balance sheet, we see that economic earnings declined by over 380% in 2013. This decline comes from the fact that the company’s balance sheet is growing faster than cash flows. In other words, the company is seeing incremental returns on capital that are much lower than current returns and its return on invested capital (ROIC) has fallen below its weighted average cost of capital (WACC). This decline is a bad sign when the company’s profitability is already worse than many of its competitors.

With ROICs of 15% and 22%, McDonald’s (MCD) and Starbucks (SBUX) have ROICs that are double and triple DNKN’s ROIC. Smaller competitors like Panera (PNRA) at 12% and Einstein Bros (BAGL) at 9% also have higher ROICs.

Such a low ROIC means that DNKN is in no position to expand. Its current franchises are not profitable enough to justify growth. If the company is not able to generate higher returns from its small base of business, then why should we expect it to generate anything but lower returns when it expands into markets with competitors that have higher ROICs?

Expansion Means More Competition And Even Lower Profits

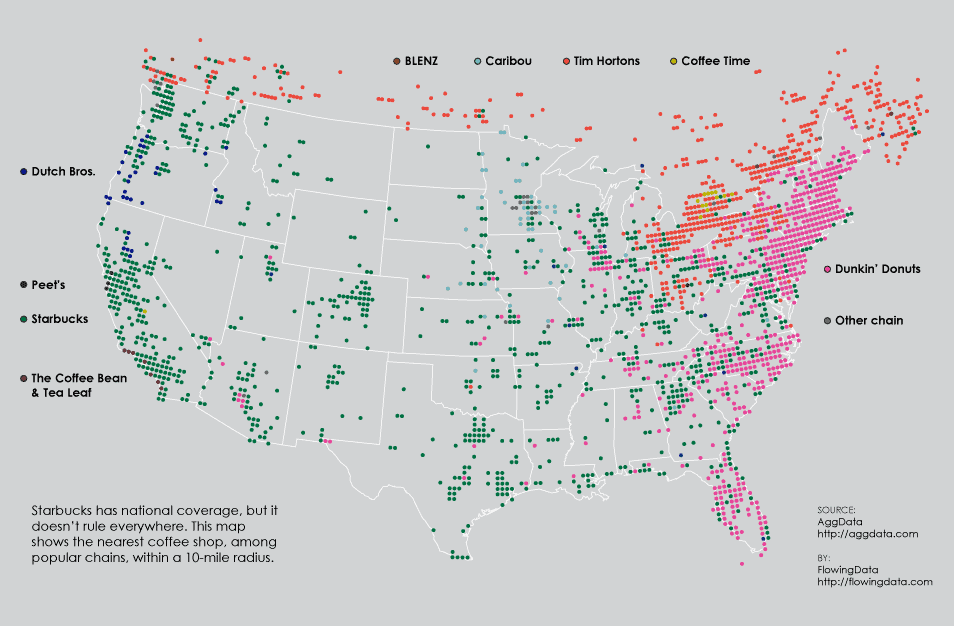

While Dunkin Donuts slogan for years has been “America Runs on Dunkin”, it is really just the east coast that is running on Dunkin. Figure 1 shows just how concentrated Dunkin Donuts is in New England and the Atlantic coast.

Figure 1: Map of Coffee Chains in the U.S. – Dunkin Donuts In Pink

The giant mass of pink on the right side of that map represents Dunkin Donuts. Given that 81% of DNKN’s profits came from its domestic Dunkin Donuts segment in 2013, it’s clear that, for all its international presence, DNKN still depends largely on one region in the U.S.

DNKN is trying to expand aggressively into the western part of the U.S. However, profit growth in this region seems unlikely as the company faces competition from incumbents like Starbucks and McDonalds (MCD), which have already worked to saturate these markets and have higher ROICs and much better brand recognition than DNKN. The idea that DNKN can compete with or take market share from higher ROIC companies like SBUX and MCD seems absurd to me.

One of our analysts visited a new Dunkin Donuts location here in Nashville a few times and found it to be almost or entirely empty each time. A Krispy Kreme two blocks away on one side and a Starbucks and McDonald’s on the other side surround that Dunkin Donuts.

Smaller competitors have the same expansion plans as DNKN. Canadian favorite Tim Hortons plans to build over 300 new U.S. franchises in the next few years. Krispy Kreme, which has shown impressive growth since bottoming out in 2006, has plans to open nearly 100 new stores worldwide this year, almost double its total from 2013. Einstein Bros is even stepping up its expansion, with 80 new stores planned this year.

Don’t forget about competition from home coffee brewers, led by Keurig Green Mountain (GMCR) or all the gas stations, which also serve coffee and donuts.

DNKN’s expansion plans face serious challenges and could lead to major write-offs in the future as they build out stores that never turn a profit. .

Best Case Scenario Already Priced In

This stock has two major problems.

First, while 2013’s 7% NOPAT growth is not terrible, it is far below the growth expectations embedded in the stock. The current valuation of ~$51/share implies that the company will grow NOPAT by 15% compounded annually for 12 years.

If the company continues on the 7% NOPAT growth rate for 15 years, it has a fair value of just $19/share. Moderate 7% profit growth means major downside for investors.

The second problem for the stock is that the misallocation of capital for expansion will further undermine the profitability, i.e. ROIC, of the company. Taking the profits from already struggling stores and plowing them into less successful stores means the company’s ROIC will decline further. This decline may be masked by top line revenue and earnings growth in the near-term, but, ultimately, it leads to a lower ROIC and a less profitable company, which means a lower stock price.

Our research on DNKN’s ROIC highlights the need for investors to perform due diligence for prior years as well as the present one. Our adjustments for 2013 aren’t all that significant, but adjustments to previous years put DNKN’s 2013 results in an entirely different perspective.

Insider Selling

For a company that is supposedly in a growth stage, DNKN’s executives are cashing out at a surprising rate. Over the past six months, insiders have sold 540 thousand shares, or 8% of their holdings. That amount of selling suggests that the stock may have run out of steam after an 80% increase since its IPO in 2011.

DNKN is not a bad company, but at ~$51/share it is a bad stock, and insiders seem to agree. Double digit profit growth for over a decade is not a realistic expectation for a quick service restaurant in a crowded field. DNKN’s reported earnings growth may look tempting, but investors should resist the urge to take a bite.

Avoid This Fund

In addition to avoiding DNKN, investors should also steer clear of funds that allocate heavily to DNKN. Only one fund, Starboard Investment Trust: Goodwind SMID Cap Discovery Fund (GAMAX) allocates more than 3% to DNKN. With a 3.6% allocation and our Very Dangerous rating, investors should steer clear of GAMAX.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Update: David Trainer has taken a short position in DNKN

Feature Photo Credit: Jeepers Media (Flickr)